Overnight – S&P500 notches new record on Vietnam Trade deal

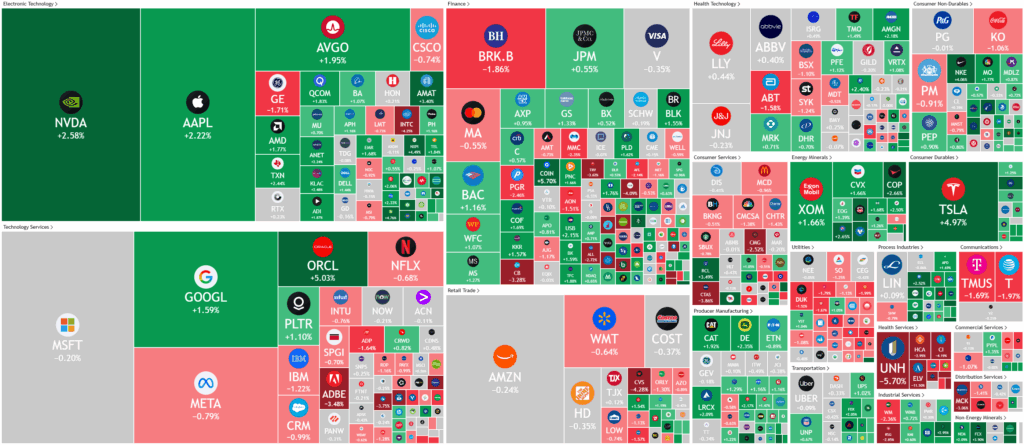

Stocks reached a new record overnight, driven by a rebound in technology stocks and renewed optimism over trade agreements.

President Trump announced a trade deal with Vietnam, adding to recent agreements with China and potential progress with India, all ahead of a critical July 9 deadline when paused reciprocal tariffs are set to resume. Trump made it clear that he would not extend this deadline, signaling a shift toward securing quick, phased trade agreements to maintain momentum and market confidence.

Despite the positive market sentiment, economic data revealed some underlying challenges. U.S. private payrolls fell by 33,000 in June, marking the first decline in over two years and missing expectations for job growth. This drop was mostly seen in professional and business services, education, and health care, while other sectors like leisure and manufacturing showed modest gains. The labor market’s weakness, combined with ongoing trade policy uncertainty, has prompted the Federal Reserve to maintain a cautious, data-driven approach, with analysts speculating that interest rate cuts could be considered if job data continues to soften.

On the policy front, the Senate narrowly approved Trump’s sweeping fiscal bill, which now moves to the House for final approval before the July 4 deadline. The legislation extends Trump’s 2017 tax cuts, introduces new reductions, and increases spending on defense and border security, raising concerns about its impact on the federal debt. Meanwhile, Tesla shares recovered after a sharp drop due to renewed tensions between Trump and Elon Musk, and Microsoft announced its largest round of layoffs since 2023, affecting about 4% of its workforce as the company adjusts to economic conditions and invests in AI infrastructure.

ASX SPI 8587 (-0.11%)

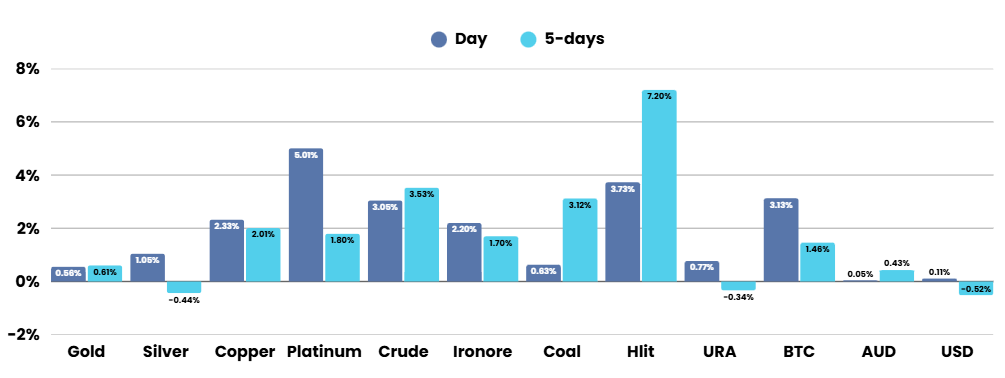

Today is likely to be quiet on the local market with the trends from yesterday likely to continue with materials catching a bid tone on optimism on China. Investors may be nervous about tonight’s US Employment numbers with the first negative ADP number in 2 years landing overnight, bringing the possibility of some “risk off” in the session

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.