Overnight – Stocks ignore the geopolitics and the economy to reverse early losses

Stocks shrugged off rising tensions between China and the U.S. that threatens to spark a global trade war between the largest two economies.

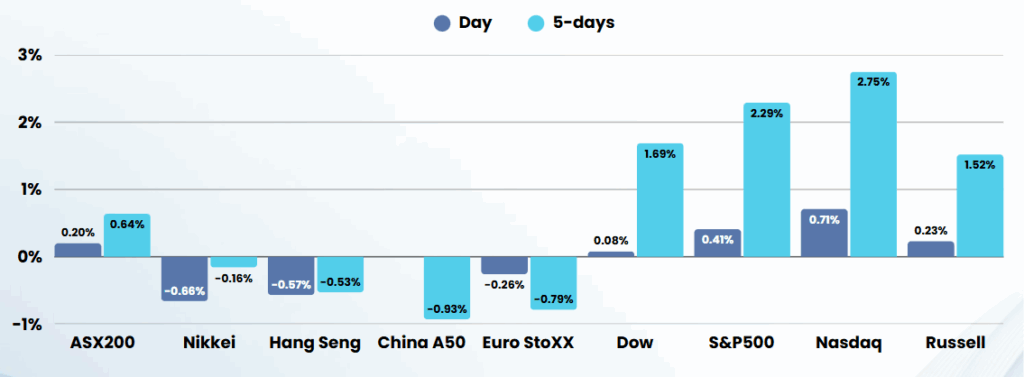

Stocks reversed course after a strong May, during which the S&P 500 posted a gain of over 6%, its best monthly performance since November 2023. This rally was driven by optimism surrounding a temporary truce in the U.S.-China trade war, as both nations agreed in mid-May to pause triple-digit tariffs for 90 days and China pledged to lift export restrictions on critical metals needed by U.S. industries. However, the positive momentum was interrupted as trade tensions flared anew, with President Trump accusing China of breaching the Geneva agreement and announcing a doubling of steel tariffs to 50%, effective June 4. In response, China rejected the accusations as “groundless” and vowed to take “forceful measures” to protect its interests, further escalating uncertainty in global markets.

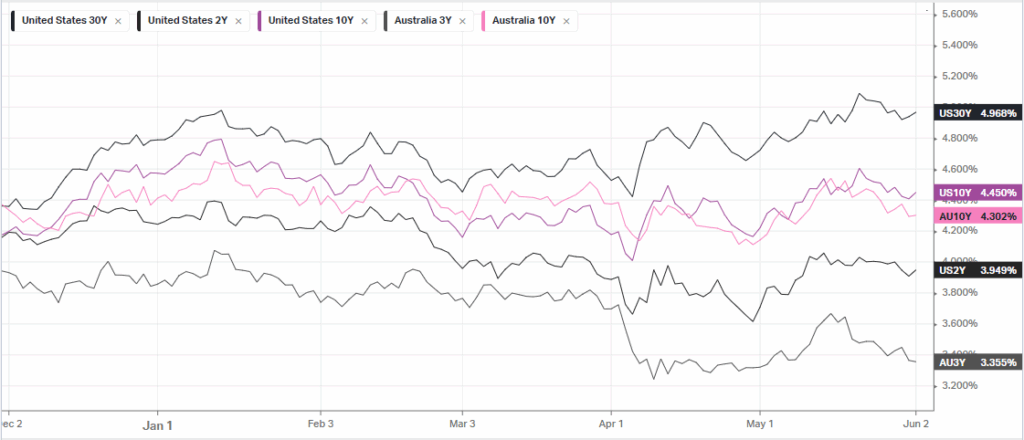

Amid these renewed trade hostilities, investors turned their attention to upcoming economic data and Federal Reserve commentary for guidance. While Fed Chair Jerome Powell refrained from providing new policy signals, other officials indicated that the central bank could still cut rates later in the year if inflation continues to ease and the labor market remains resilient. Fed Governor Christopher Waller and Chicago Fed President Austan Goolsbee both suggested that the inflationary impact of tariffs may be temporary and, provided underlying inflation trends remain favorable, “good news” rate cuts could be warranted. Meanwhile, the May nonfarm payrolls report is expected to show a slowdown in job creation compared to April, adding to the cautious outlook.

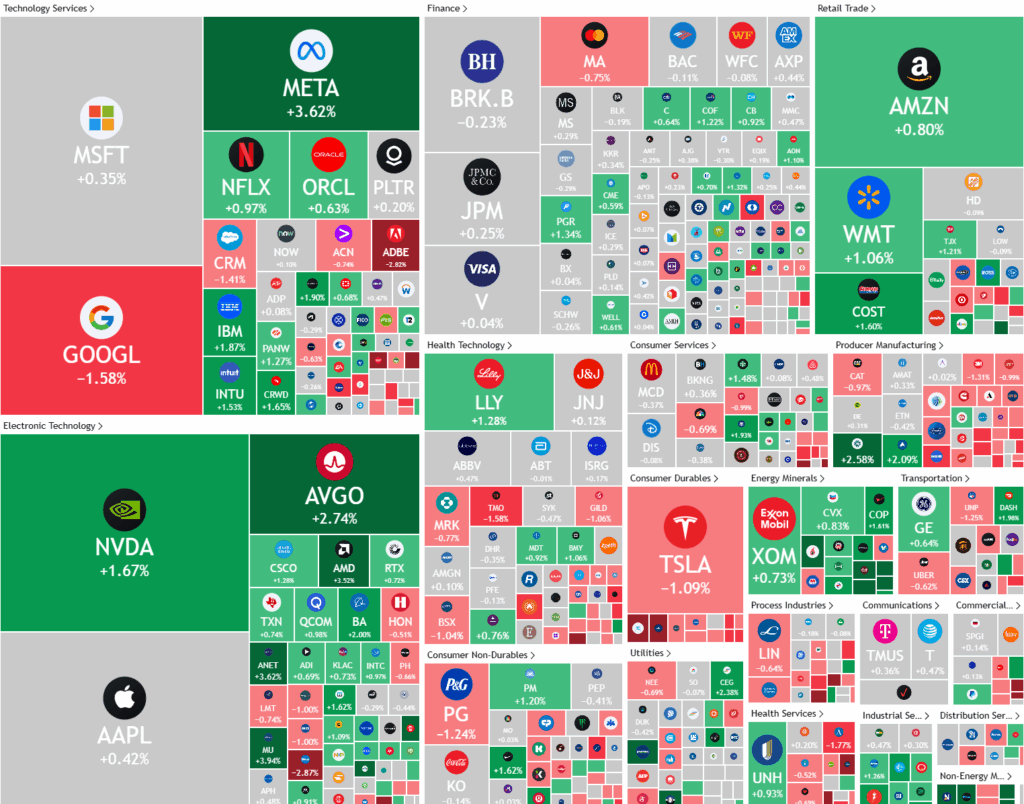

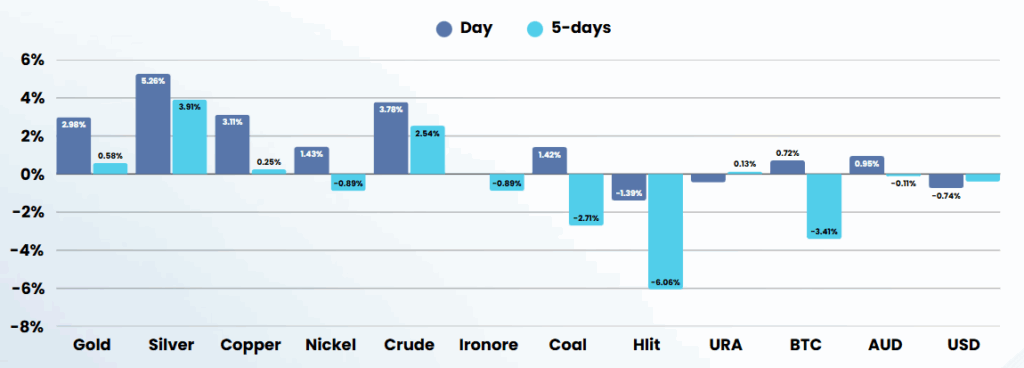

On the corporate front, chip stocks pared losses despite reports that the Trump administration may further tighten restrictions on Chinese tech firms. Conversely, U.S. steel and aluminum stocks surged in anticipation of higher tariffs, benefiting companies like Cleveland-Cliffs and Nucor. Energy shares also gained as OPEC+ announced a third consecutive monthly oil production increase of 411,000 barrels per day for July, aiming to restore market share and stabilize prices amid robust fundamentals and low inventories. Overall, while May’s market gains reflected optimism over easing trade tensions, the resurgence of tariff threats and global policy uncertainty have left investors bracing for more volatility in the weeks ahead.

ASX SPI 8503 (+0.81%)

The ASX is likely pulled higher by the materials & energy sector as global commodities headed higher.

Company Specific

- Telstra will become the first local telecoms provider to allow customers to send and receive text messages in areas without mobile service, under its partnership with Elon Musk’s SpaceX and his Starlink satellites.

- Wesfarmers owned Officeworks has poached an executive at Kmart and Target to succeed its outgoing managing director Sarah Hunter.

- Treasury Wine Estates has downgraded earnings guidance owing to lower expected shipments. The Penfolds owner also said one of its United States-based distributors will cease operations in California from September.

- IDP Education says global policy uncertainty has hurt its enrolment pipeline, with student placements expected to drop by up to 30 per cent. That prompted the international education provider to downgrade its earnings guidance.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.