Overnight –Stocks slump on soft US employment data

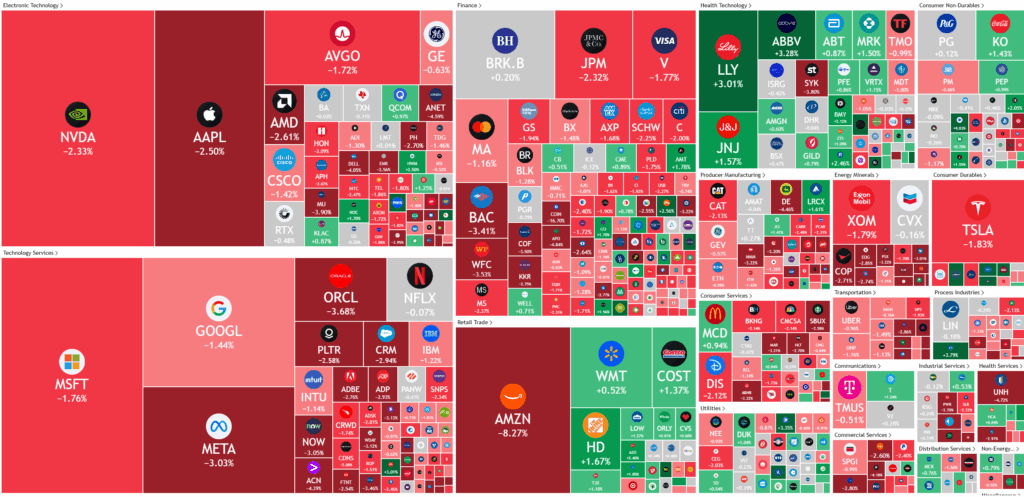

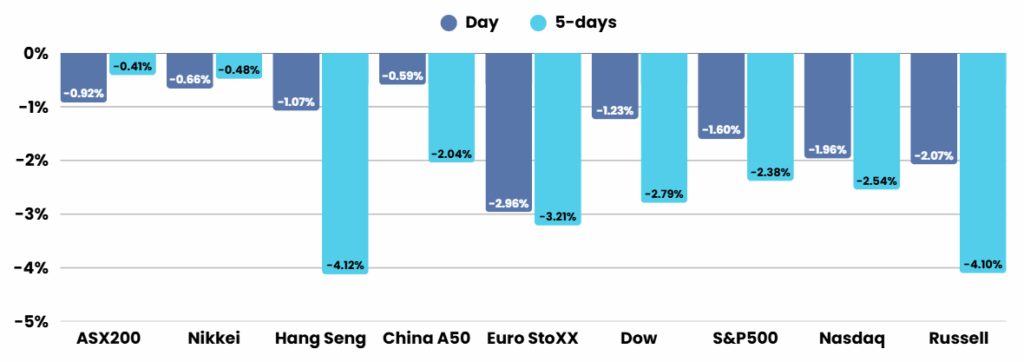

Stocks fell sharply Friday after a much weaker-than-expected jobs report triggered fears about an economic slowdown just as Amazon-led weakness in tech hit investor sentiment.

The Labor Department reported that only 73,000 new jobs were added in July, far below the forecast, with significant revisions to prior months cutting hundreds of thousands of previously reported gains. The unemployment rate rose to 4.2%. Economists noted that health care and social assistance sectors accounted for the bulk of new hiring, while federal and business services shed jobs, further highlighting economic fragility.

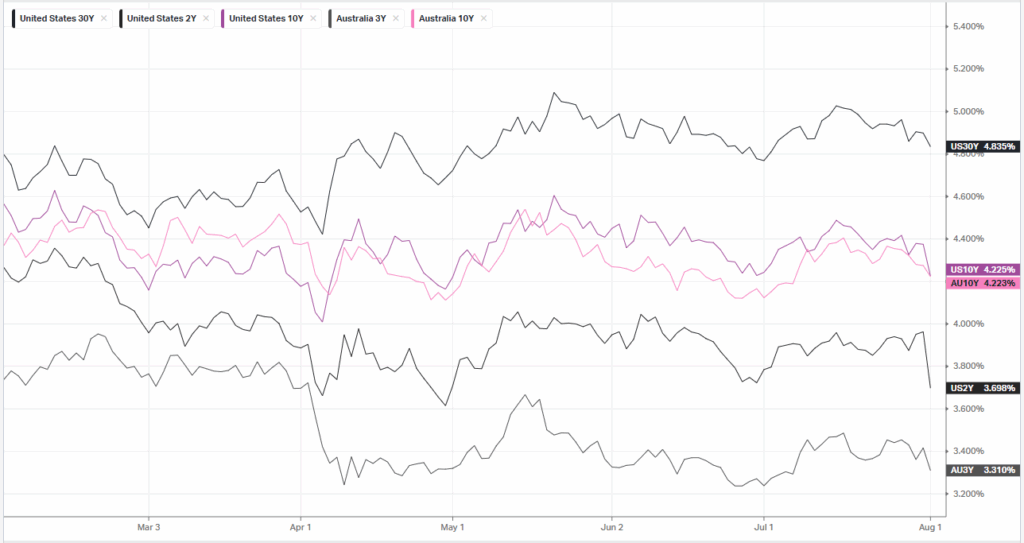

Amid this economic backdrop, President Donald Trump fired Commissioner of Labor Statistics Erika McEntarfer, accusing her—without evidence—of manipulating job figures for political purposes. The dismissal came shortly after the dismal jobs release and follows a pattern of Trump expressing distrust toward official economic data, particularly when unfavourable. The controversy over labour statistics coincided with the Federal Reserve’s decision earlier in the week to hold interest rates steady for a fifth consecutive meeting. However, analysts now widely speculate that the latest Labour market weakness may prompt the Fed to consider a rate cut at their next meeting, especially as inflation remains stubbornly above the 2% target and the impact of Trump’s new and expanded tariffs starts to be felt across trade-exposed industries.

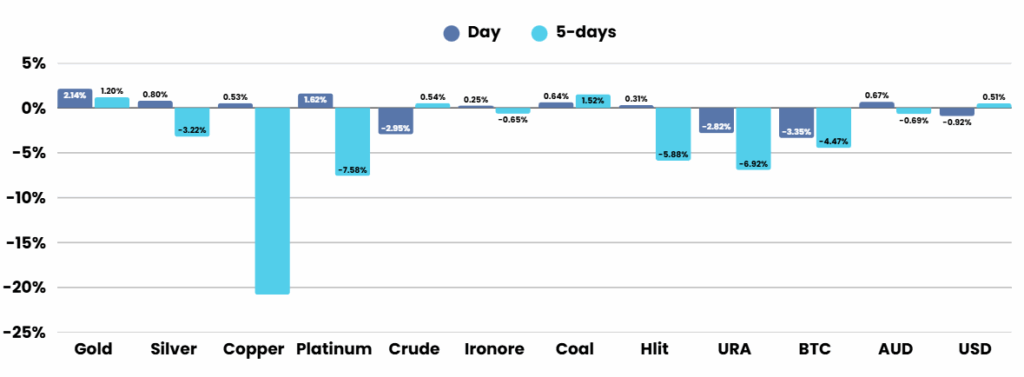

Corporate earnings also contributed to market unease, with Amazon shares dropping after it provided cautious guidance for operating income in the upcoming quarter, despite AWS revenue rising 17.5% to $30.9 billion. Investor concern revolves around AWS possibly losing ground to rivals in the pivotal artificial intelligence cloud market. In contrast, Apple’s earnings beat expectations thanks to a rebound in Chinese demand, though Wall Street remains wary of Apple’s slow progress in AI innovation. Other highlights included a sell-off in Coinbase stock following a trading slowdown, and a surge in Reddit’s shares after strong revenue guidance linked to AI-powered advertising tools. While most sectors saw heightened volatility, the overarching narrative was one of economic and market uncertainty, driven by weak job data, political turmoil, and mixed corporate performances

Corporate Earnings

- Coinbase Global -16% – stock slumped after the crypto exchange reported a drop in second-quarter adjusted profit due to a slowdown in trading.

- Reddit +17.5% – stock soared after the social media company forecast third-quarter revenue above expectations, betting on growing digital advertising driven by its artificial intelligence-powered marketing tools.

- Exxon Mobil -1.56% and Chevron -0.16% – both fell even as higher oil and gas production at the energy majors helped them overcome lower crude prices.

ASX SPI 8587 (-0.37%)

The ASX will likely follow the US lower, however probably not to the same extent as the US market sits at MUCH frothier valuations and the catalyst for the down move was very US-centric

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.