Overnight – Nvidia continues to singlehandedly support US Stock Indices

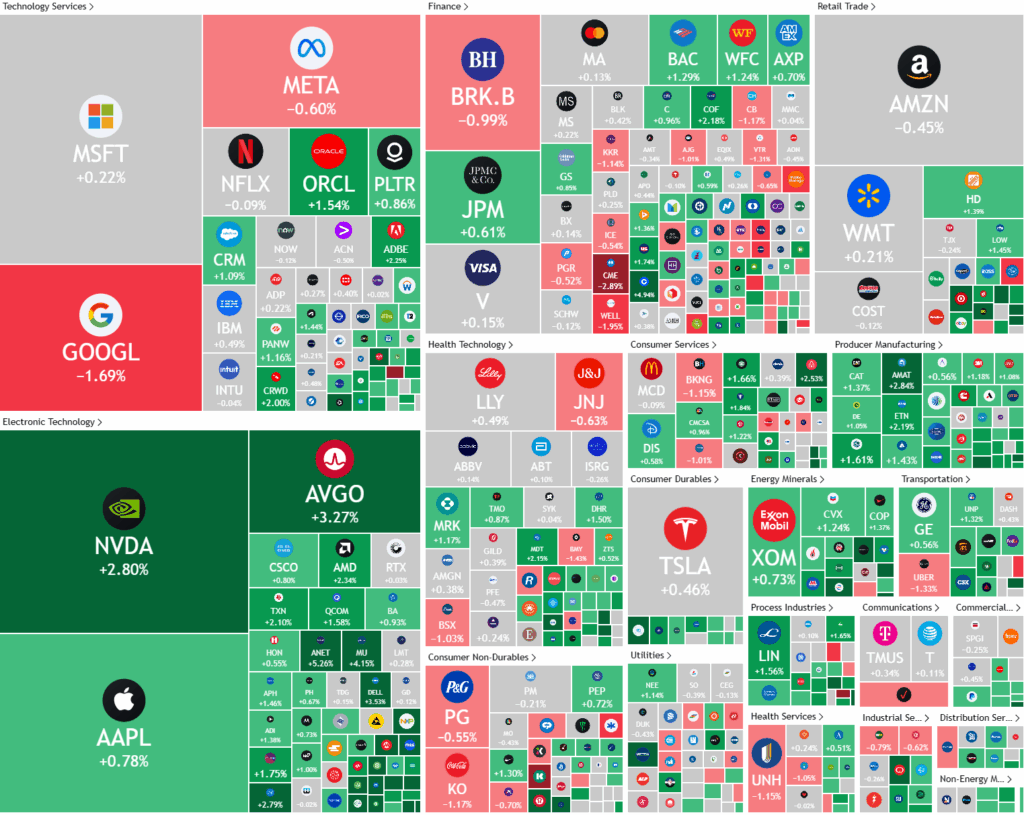

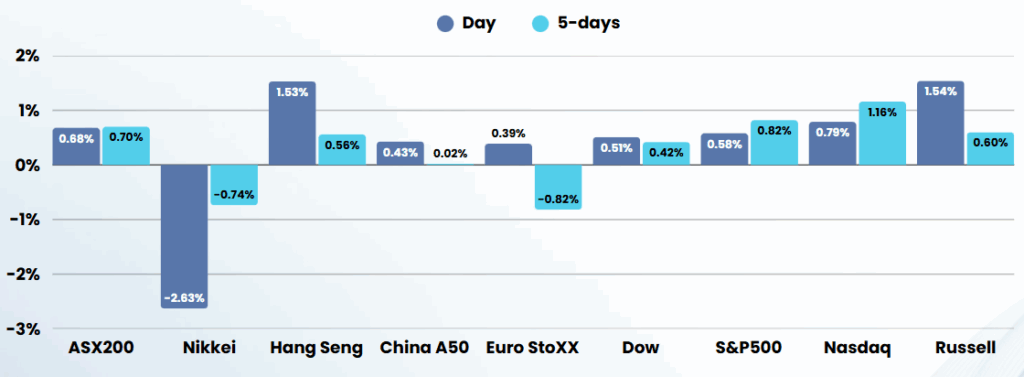

US Indexes were yet again underpinned by a surge in semiconductor stocks, namely Nvidia, on AI enthusiasm as investors awaited further update on trade deals after the White House confirmed that countries should submit their best trade offers by Wednesday.

Semiconductor stocks surged as investors remained enthusiastic about artificial intelligence, with NVIDIA rising over 2% and approaching new highs following a strong earnings report that highlighted robust AI demand despite export restrictions to China. Broadcom, another AI leader, is set to report earnings this week, and analysts expect continued strength in its AI-related revenues and further benefits from its VMware integration, reflecting the sector’s momentum and investor optimism.

On the policy front, the White House pushed for a Wednesday deadline for countries to submit their best trade offers as it seeks to finalize several bespoke trade agreements before the current pause on reciprocal tariffs expires in July. While some progress has been made, with only a UK deal announced so far, the administration is under pressure to secure more agreements amid ongoing negotiations with major partners like the EU, Japan, and India.

Meanwhile, economic data showed resilience: U.S. job openings exceeded expectations at 7.4 million, and Ford reported a 16% jump in May auto sales, driven by strong demand for trucks and SUVs. In corporate earnings, Dollar General and Signet Jewelers both raised full-year guidance after beating estimates, while Nio’s stock fell on a wider-than-expected loss. Notably, Constellation Energy shares soared after Meta Platforms signed a 20-year deal to purchase nuclear power, underscoring the growing intersection of tech, energy, and AI infrastructure needs

ASX SPI 8507 (+0.27%)

The ASX may consolidate today, however the largely semi-conductor driven rally in the US gives very little catalyst for the ASX to extend the upside. We remain cautious and recommend selling around these levels in global equities, with very little upside left, but plenty of downside

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.