Overnight – Stocks bounce as investors rush to “Buy the Dip”

Stocks rebounded from Friday’s big sell off, as investors rushed to buy the dip on growing expectations for a rate cut.

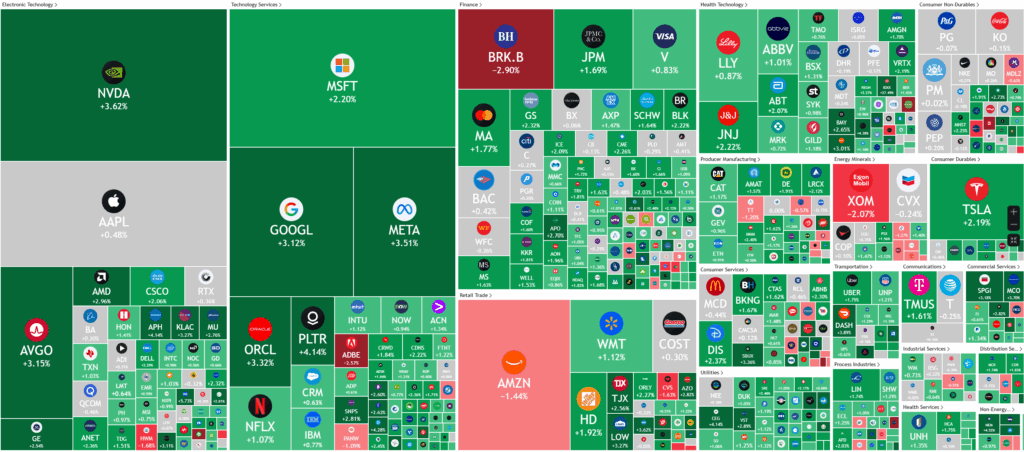

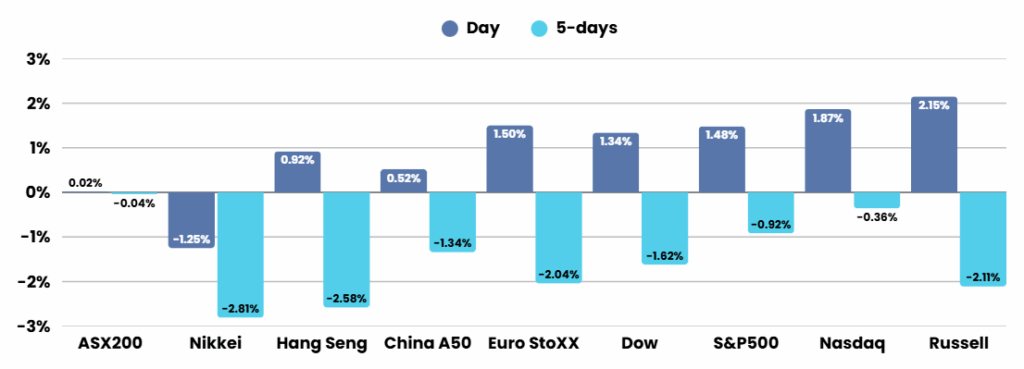

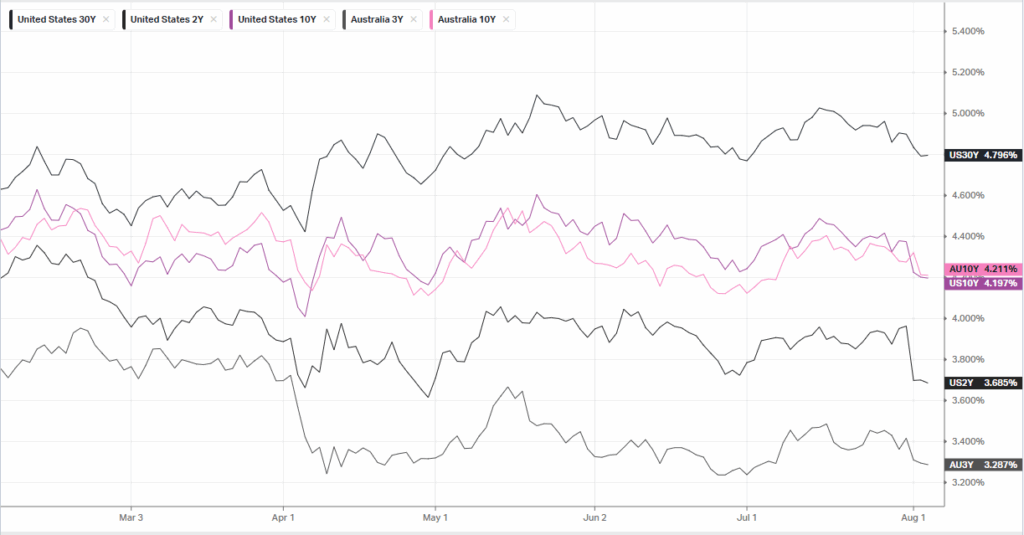

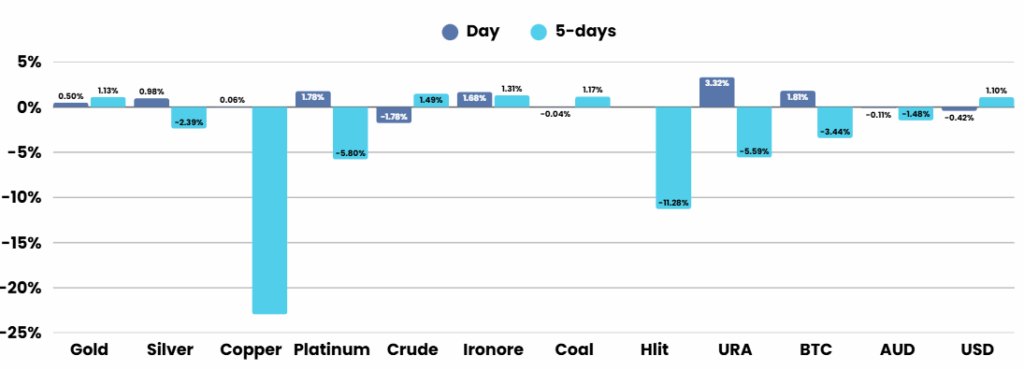

U.S. stock markets rebounded strongly on Monday after a steep sell-off last Friday, with the S&P 500 rising 1.5%, the Dow Jones gaining 1.3%, and the NASDAQ climbing 2%. The rally was underpinned by renewed expectations for an earlier Federal Reserve rate cut, following weak economic data and a soft jobs report showing nonfarm payrolls increased by just 73,000 in July—well below forecasts—with heavy downward revisions to previous months’ job numbers. This jobs data, alongside President Trump’s dismissal of the statistics bureau chief and the imposition of sweeping tariffs on imports from nearly 70 countries, created uncertainty around the health and transparency of U.S. economic data and trade prospects, but also boosted hopes for Fed action as the probability of a September rate cut surged past 80%.

Despite near-term caution given these economic signals, some strategists remain bullish on U.S. equities. Morgan Stanley’s Mike Wilson reaffirmed his positive outlook for the stock market, highlighting a sharp rebound in corporate earnings per share (EPS) revisions and labeling recent market events in April as the clear end of the bear market that began in 2024. Wilson sees pullbacks as buying opportunities and expects sustained strength for equities over the next 12 months, even if short-term consolidation occurs amid interest rate uncertainties.

Big technology stocks continued to lead market gains, driven by optimism surrounding artificial intelligence. Shares of NVIDIA, Microsoft, and Meta Platforms all moved higher, with Microsoft and Meta extending gains after strong quarterly reports. Investors are keenly watching a packed earnings calendar this week, with results due from more than 150 companies including Advanced Micro Devices (AMD), Caterpillar, Walt Disney, McDonald’s, and Uber Technologies. Meanwhile, Berkshire Hathaway saw its shares slide after disclosing a major write-down on its Kraft Heinz stake, and Tesla shares climbed as the company approved a substantial stock award for CEO Elon Musk based on a special board committee’s recommendation.

Corporate Earnings

- Palantir +7% – delivered a breakout Q2 2025, generating $1.004 billion in revenue—a 48% year-over-year surge—driven by explosive U.S. commercial growth (up 93% YoY), a robust AI strategy, and major government wins including a $100 million U.S. Army contract and entry into a potential $10 billion consolidation deal. Profits soared with GAAP net income reaching $326.7 million and a Rule of 40 score climbing to 94%, prompting management to raise 2025 revenue guidance to $4.142–$4.150 billion. The company’s AI Platform continues to differentiate Palantir, reflected in a 39% rise in customers.

- Hims & Hers Health -10% – Telehealth provider delivered a staggering 255.8% one-year stock return, fueled by 2024 revenue jumping 69.3% to $1.48 billion and a dramatic swing to profitability, with net income of $126 million. 313.6% jump in Q1 2025 diluted EPS and an 83.5% Rule of 40 score—the company is now seen as a hyper-growth standout in digital health.

ASX SPI 8701 (+0.99%)

It should be a good day for the ASX on top of the index holding its ground yesterday. With little on the economic, earnings or geopolitical front, its likely we will continue to head higher over the coming days*

*Trump disclaimer – Always expect the unexpected

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.