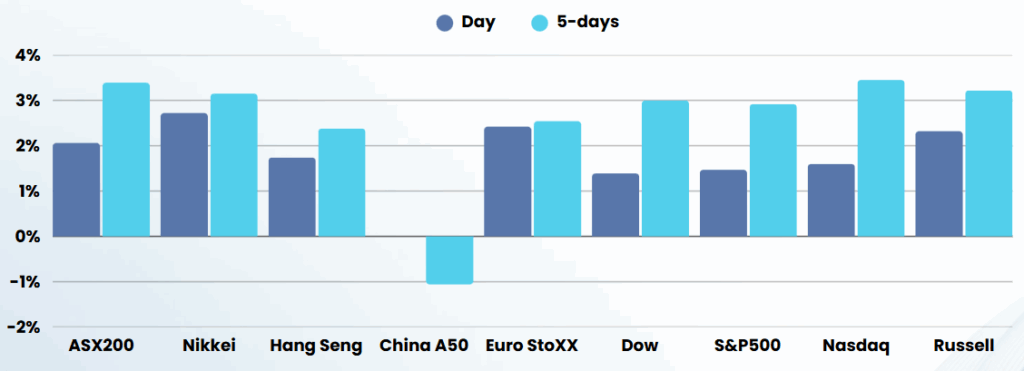

Overnight – Stocks see best 9-day streak in 20 years, led by tech and trade optimism

Stocks closed higher for a ninth-straight day Friday, notching its longest winning streak in more than 20 years as a strong jobs growth as well as on hopes of a lessening of tensions between China and the U.S. over trade.

The U.S. labour market demonstrated strength in April, with nonfarm payrolls increasing by 177,000-exceeding expectations despite ongoing concerns about the Trump administration’s volatile trade policies. The unemployment rate stayed at 4.2%, and average hourly earnings rose by 0.2%, a slight slowdown from March. While employers remain hesitant to lay off workers after pandemic-era labour shortages, warning signs are emerging, such as a recent contraction in GDP and declining job openings, suggesting that the full impact of tariffs and economic uncertainty may not yet be reflected in the jobs data. The continual high readings, with a downward revision in the following months is fishy, with every month lower than expectation in the following months revision, but higher than expected in the headline month.

China’s commerce ministry announced it is considering trade negotiations with the U.S., emphasizing that talks must be sincere and contingent on the removal of unilateral tariffs. This response follows recent U.S. indications of willingness to negotiate, amid heightened market fears that escalating trade tensions could trigger a global recession. The prospect of renewed dialogue has brought some hope to global markets, which have been unsettled by the risk of a broader trade war.

The economy contracted last quarter for the first time in three years, swamped by a flood of imports as businesses tried to avoid duties from President Donald Trump’s tariffs.

Company Earnings

- Apple – fell more than 3% after the company said it sees about $900 million in costs for the upcoming quarter due to tariffs. Apple posted fiscal second-quarter results that topped Wall Street estimates on better-than-expected iPhone sales, but tariff concerns dented optimism.

- Amazon – stock ended just below the flatline after the e-commerce giant reported softer guidance for the current quarter and underwhelming growth in its key cloud computing segment.

- Airbnb – stock rose 1% despite the short-term rental company issuing a weak outlook for the second quarter, blaming economic uncertainties for softer travel demand in the U.S.

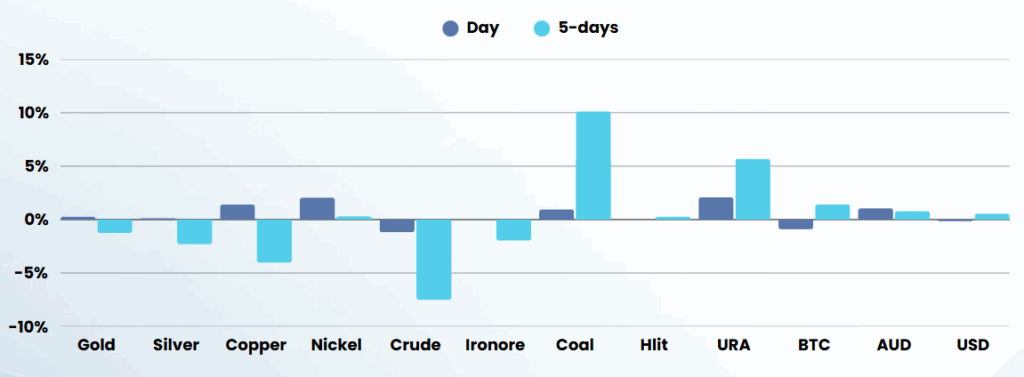

- Exxon Mobil – stock closed marginally higher after the oil major beat expectations for first-quarter profit as higher oil and gas production from Guyana and the Permian basin helped boost earnings.

ASX SPI 8280 (+0.38%)

The ASX is in for a positive start to the week, although the looming bank earnings, Fed meeting and hyper-extended rally in the US, could mean enthusiasm for buying is capped

The avalanche of Labors win over the weekend could bring some positivity with one political party unlikely to have to do constant “deals” to get things done