Overnight – Investors re-think optimism as Trump and Elon “feud” escalates

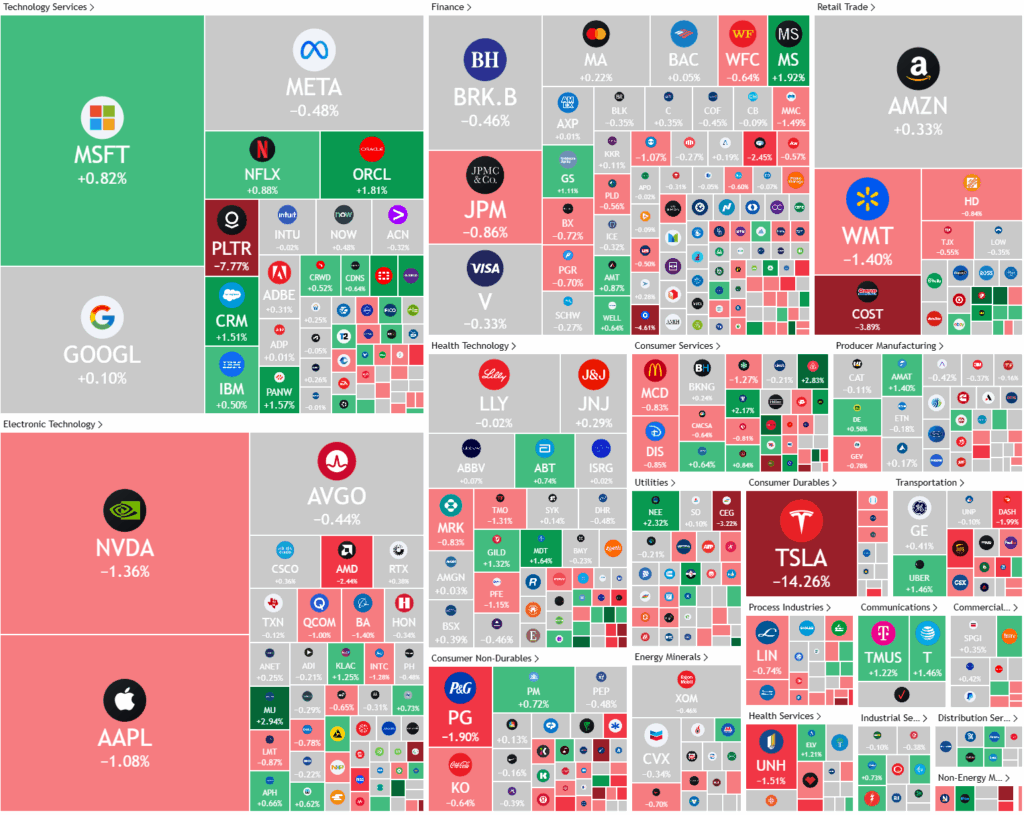

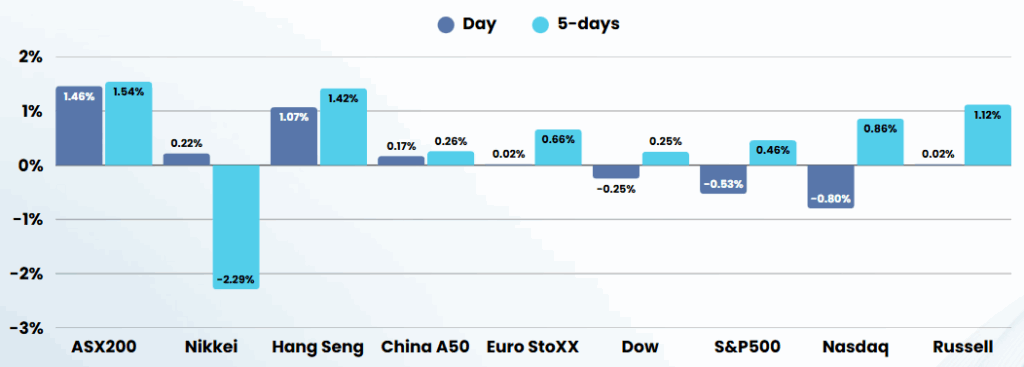

Stocks headed lower overnight as investors weighed up whether it’s smart to be optimistic about the US President after very public fallout between the President and Elon Musk and a “positive” US-China call on trade that either side refused to release details about

Tesla shares plunged over 14% as tensions between CEO Elon Musk and former President Donald Trump escalated. The fallout began when Trump expressed disappointment with Musk following the Tesla chief’s public criticism of Trump’s legislative initiatives, prompting Musk to retort that Trump would have lost without his support. The previously close political alignment between Musk and Trump had been seen as beneficial for Tesla, but the recent public spat has negatively impacted investor sentiment.

In other major developments, President Trump and Chinese President Xi Jinping held a constructive 90-minute phone call focused on trade, particularly rare earth exports. Both leaders agreed to resume trade negotiations, with high-level U.S. officials set to meet their Chinese counterparts. The call was described as positive, with Trump emphasizing that the discussion was limited to trade issues, and invitations for state visits were exchanged, signalling a potential thaw in U.S.-China economic relations.

Meanwhile, US labour market data showed signs of cooling, as jobless claims rose to 247,000 last week, above expectations and the previous week’s revised figure. This increase, along with other reports indicating fewer private-sector job additions and more layoffs, suggests growing uncertainty tied to Trump’s tariff policies. The European Central Bank responded to global economic headwinds by cutting interest rates for the eighth time since last June. On the corporate front, Broadcom was set to headline earnings reports, with investors watching closely for insights into AI chip demand amid economic uncertainty, while Five Below and MongoDB stocks surged on strong quarterly results and positive forecasts.

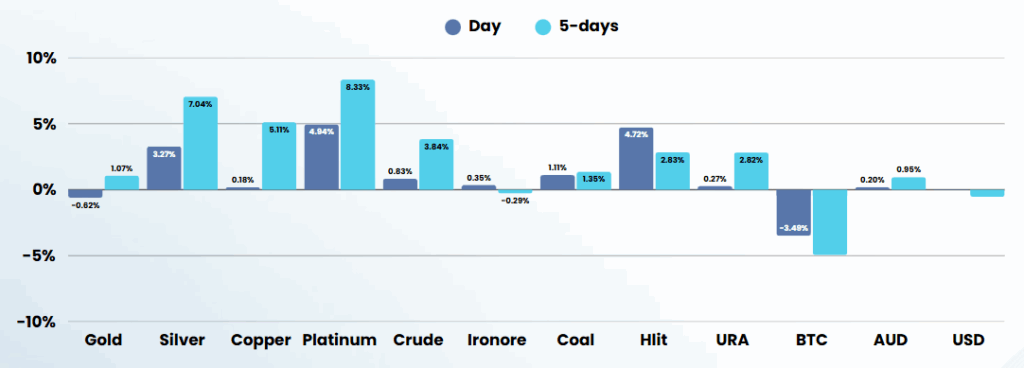

Precious metals surged as Silver has surged past $35 per ounce, its highest in over 13 years, fueled by strong industrial demand and a persistent supply deficit. But Silver was eclipsed by Platinum, rising 5%, to its highest level since Russia invaded Ukraine in 2022 and 16% from multi-decade highs

ASX SPI 8540 (-0.02%)

The ASX is likely to drift lower into the long-weekend as the Trump-Elon spat, the lack of details on the Trump/Xi trade conversation and tonight’s US employment numbers all weighing on investors’ minds, with 3 days of market risk.

At the current levels, optimism is priced into both the AU and US equity markets, sitting just 4% from record highs. With so much still unresolved from “Liberation Day” we see the risk/reward strongly weighted to the downside for the broader market and investors should be focused on single stock opportunities only

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.