Overnight – Stocks run out of steam as US ports continue to empty

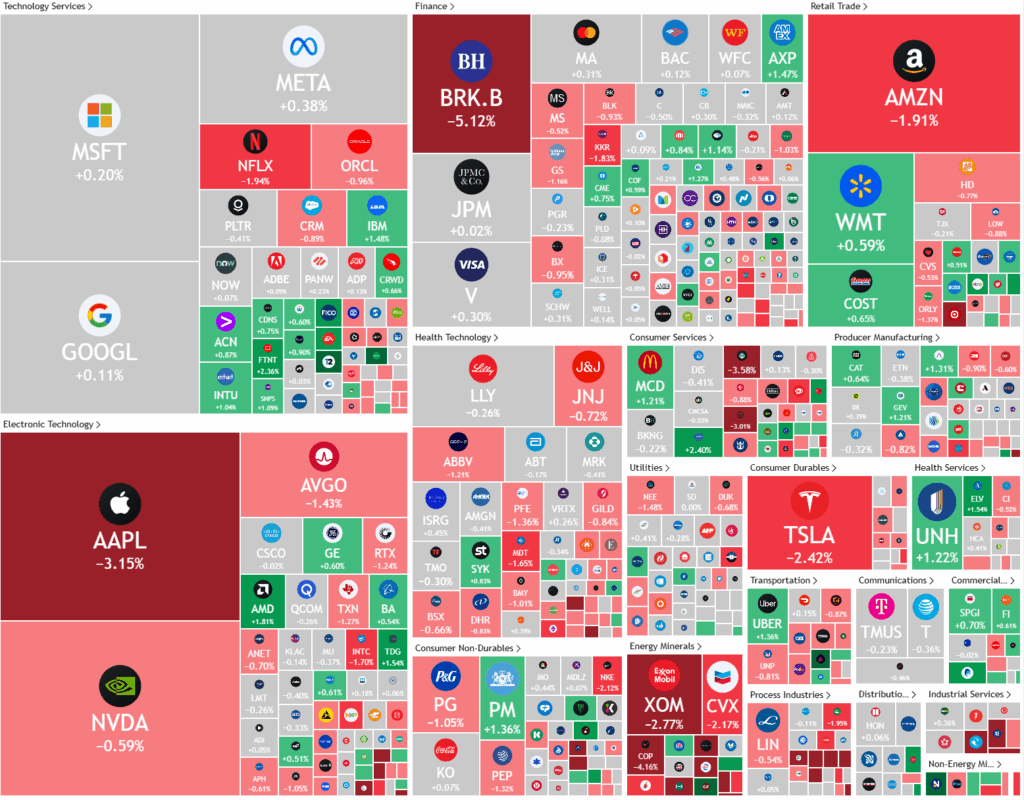

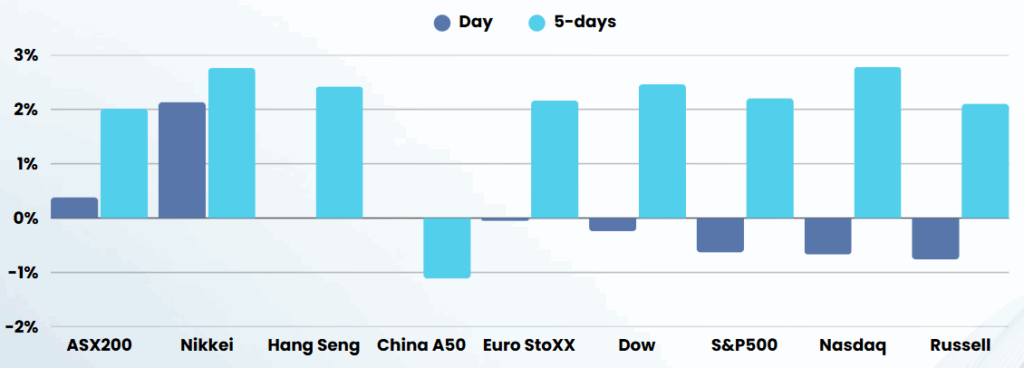

Stocks snapped a nine-day winning streak, driven by a fall in energy and caution as traders awaited an update on trade deals as US ports empty and investors await the Fed decision due later this week.

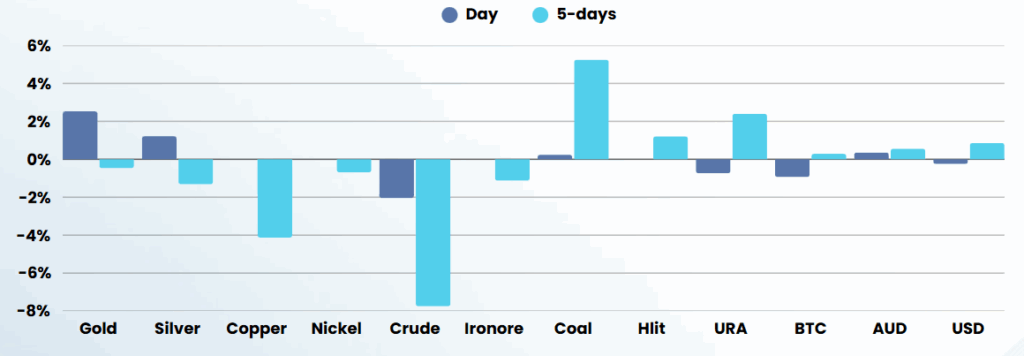

Shares of major oil companies like Exxon Mobil and Chevron dropped as oil prices fell sharply following OPEC+’s decision to accelerate production increases. The alliance, led by Saudi Arabia, announced a 411,000 barrel-per-day hike for June, marking the third consecutive monthly increase and bringing the total boost since April to nearly one million barrels per day. This move, aimed partly at disciplining members who have exceeded quotas, has pushed oil prices to their lowest levels since 2021, intensifying concerns about a potential price war and the impact of weak global demand amid ongoing recession fears.

Meanwhile, President Donald Trump signaled that new trade deals could be announced soon, as the U.S. continues negotiations with several countries, including China. Trump emphasized his priority for “fair” agreements, especially with China, where reciprocal tariffs have reached historic highs-145% on Chinese goods and 125% on U.S. exports. While optimism has grown with China’s recent openness to talks, both sides remain far apart, and Trump has warned that tariffs could be reinstated if no deals are reached. These developments, coupled with Trump’s broader economic and foreign policy announcements, are contributing to heightened uncertainty in global markets

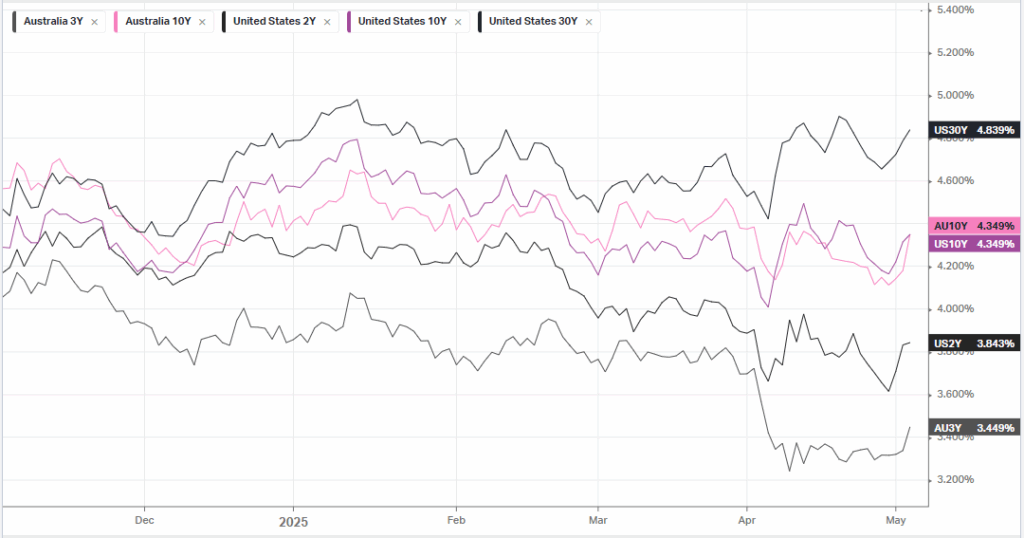

Looking ahead The U.S. Federal Reserve is widely expected to keep its benchmark interest rate unchanged at 4.25%-4.50% during its upcoming meeting, despite ongoing pressure from President Trump to cut rates. The central bank remains in a “wait-and-see” mode, assessing the economic impact of Trump’s recent tariffs, which have introduced significant uncertainty and contributed to a first-quarter contraction in GDP. The Fed faces a dilemma as tariffs are expected to push up inflation while also threatening employment, complicating its dual mandate to maintain price stability and support the labor market. Investors will closely watch Fed Chair Jerome Powell’s statements for clues about the timing and pace of future rate cuts, especially as global central banks and markets react to evolving trade policies and economic data

Company Earnings

- Berkshire Hathaway – fell 5% after the investment conglomerate posted a 14% drop in first-quarter operating earnings versus the prior year to $9.64 billion, due in large part to insurance losses linked to devastating wildfires in California.

- Skechers USA – jumped more than 24% after the footwear company agreed to be taken private by 3G Capital in $63-per-share deal.

- Tyson Foods– fell nearly 8% after the reporting quarterly revenue that fell short of analyst estimates as rising meat prices dented demand from spending-wary consumers.

ASX SPI 8152 (-0.29%)

The ASX is unlikely to be very active today as investors take a breather. Focus on some individual names at the Macquarie Conference could see some movement in prices

- Macquarie’s 27th annual Australian conference kicks off. Australian data coming out today includes household spending and dwelling prices for March.