Overnight – Stocks higher as Trump convinces Apple to make parts locally

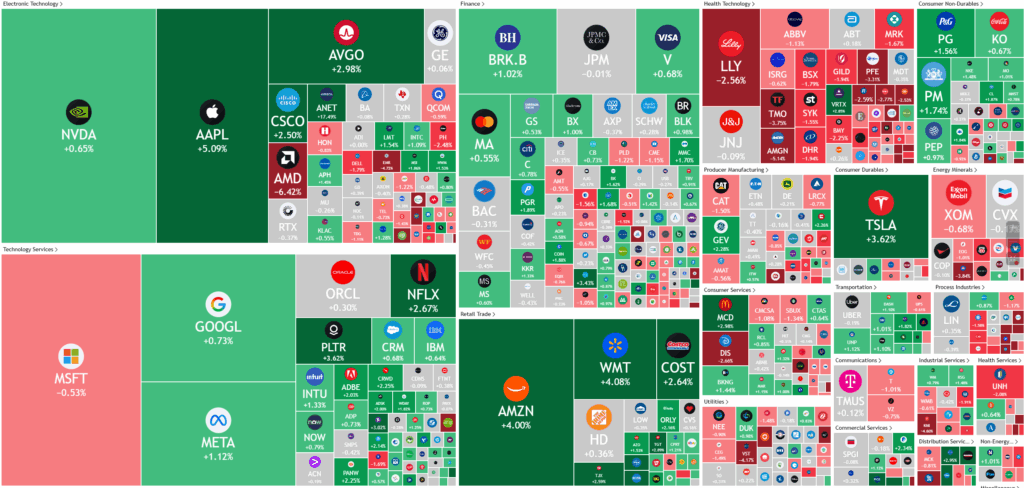

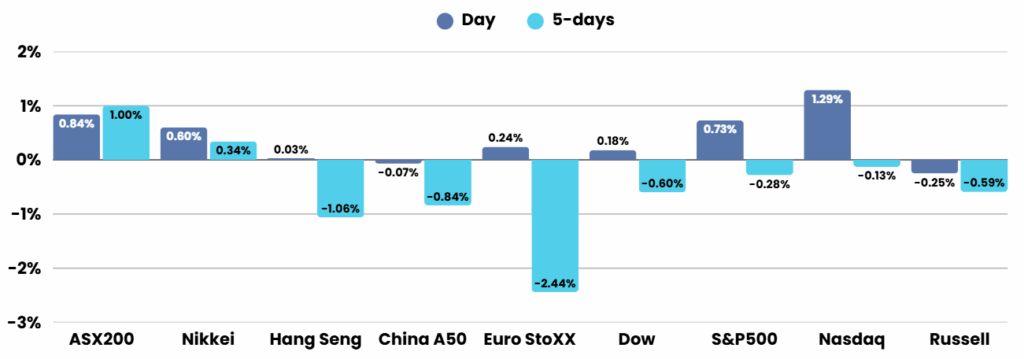

Stocks floated higher overnight as Trump/Apple announcement fuelled a tech rally and investors cheered mostly bullish quarterly results.

Apple led major tech stocks higher, surging more than 5% as it prepared to announce a new $100 billion investment in U.S. manufacturing, bringing its total commitments in the sector to $600 billion. This announcement, scheduled with President Donald Trump at the White House, underscored Apple’s confidence in domestic production. Trump announced after the bell with Tim Cook, that 100% tariffs would be put in place on Semiconductors, unless the company is building a manufacturing facility or producing in the US, then they will be exempt from tariffs. If a company announces to avoid tariffs and doesn’t follow through, they will be retrospectively hit with the 100% levy.

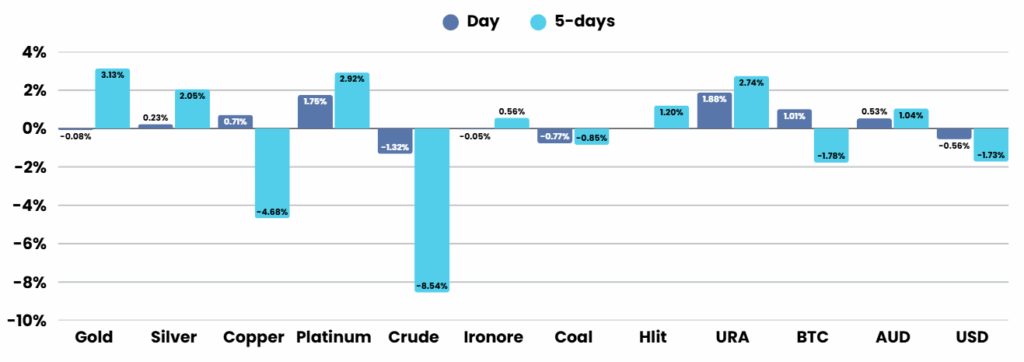

The broader earnings season continued on a strong note, with over 80% of reporting firms beating expectations. Notably, McDonald’s surpassed global sales forecasts thanks to budget-friendly deals and promotions, while Disney’s conventional TV and sports revenue lagged despite robust growth in theme parks and streaming. Meanwhile, Advanced Micro Devices disappointed with soft data center results compared to Nvidia, and Snap’s shares fell steeply amid rising competition from AI-driven peers.

Despite pockets of strength, a sense of caution lingered in the market. Spotify outperformed by forecasting better-than-expected third-quarter revenue, driven by AI enhancements and platform upgrades, and Capri Holdings posted a smaller decline in revenue thanks to steady demand for luxury goods. However, Rivian Automotive’s deeper-than-expected quarterly loss, attributed to ongoing supply chain disruptions, dampened sentiment. Broader blue-chip indexes remained under pressure due to concerns about the Trump administration’s unpredictable trade policies and their impact on U.S. economic activity.

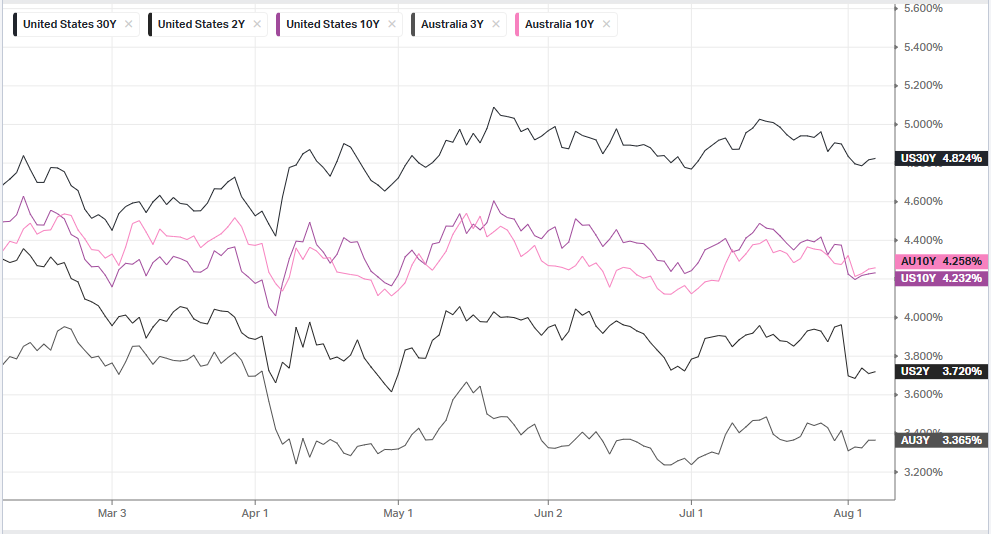

Economic data added to investor anxiety, with the Institute for Supply Management’s non-manufacturing index falling to 50.1 in July—a level barely above contraction as service industries drive most U.S. growth. Companies also faced the sharpest rise in input costs in almost three years, intensifying fears of stagflation—a mix of weak growth and elevated inflation. This backdrop of economic fragility raised expectations that the Federal Reserve might cut rates in September, especially after recent weak payroll numbers and dovish comments from Fed officials. Investors turned their attention to upcoming statements by key Fed policymakers, seeking clues about the future path of U.S. interest rates.

Corporate Earnings

- Spotify Technology +3.6% – stock soared after the e-commerce company forecast third-quarter revenue above market estimates, as its AI features and platform upgrades boosted demand for its e-commerce services despite tariff-related uncertainty pressuring retail businesses.

- Snap -17% – shares plummeted as the social media company reported a weak quarter as mounting competition underscored the company’s struggle to keep pace with AI-driven peers.

- Walt Disney -2.66% – has lifted its annual adjusted earnings per share guidance, as the media conglomerate’s ESPN sports broadcasting empire said it would launch a new direct-to-consumer streaming service on August 21.

ASX SPI 8779 (-0.30%)

We should see another positive day, with investors likely buoyed by earnings so far in AU. Watch for commodity moves around lunchtime to see if the materials sector can add to recent momentum

AMP and Light & Wonder are set to report results on Thursday. The June trade balance is scheduled for 11.30am.

*Trump disclaimer – Always expect the unexpected

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.