Overnight – Stocks drift lower as investor optimism dwindles

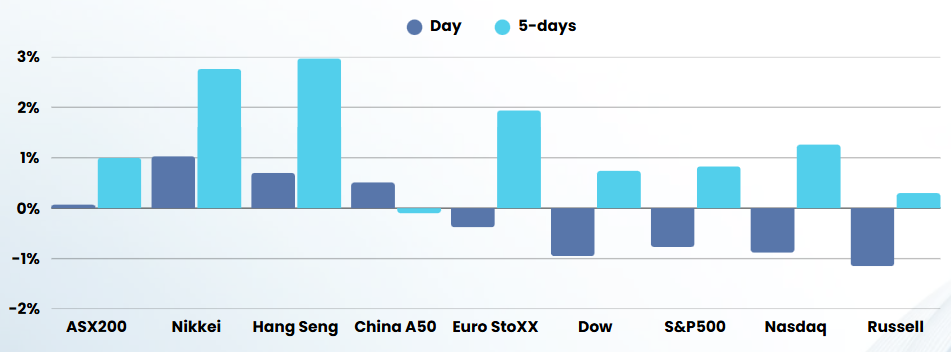

Stocks drifted lower overnight as investors mulled the lack of updates on U.S.-China trade progress and awaited the Federal Reserve rate decision due tomorrow morning.

Markets had briefly recovered early session losses on hopes of a major announcement on trade after Trump touted he would have “very, very big announcement to make,” ahead of his administration’s trip to the Middle East. But the reprieve was short lived after Trump said the big announcement may “not necessarily” be on any trade-related development.

President Donald Trump said China wanted to negotiate a trade deal to end the current trade war, but stopped short of signalling urgency to resolve the conflict, saying the U.S. and China would meet at the “right time”. This would be making investors nervous, with dwindling inventory in the US and a 30 day lead time to reboot supply chains.

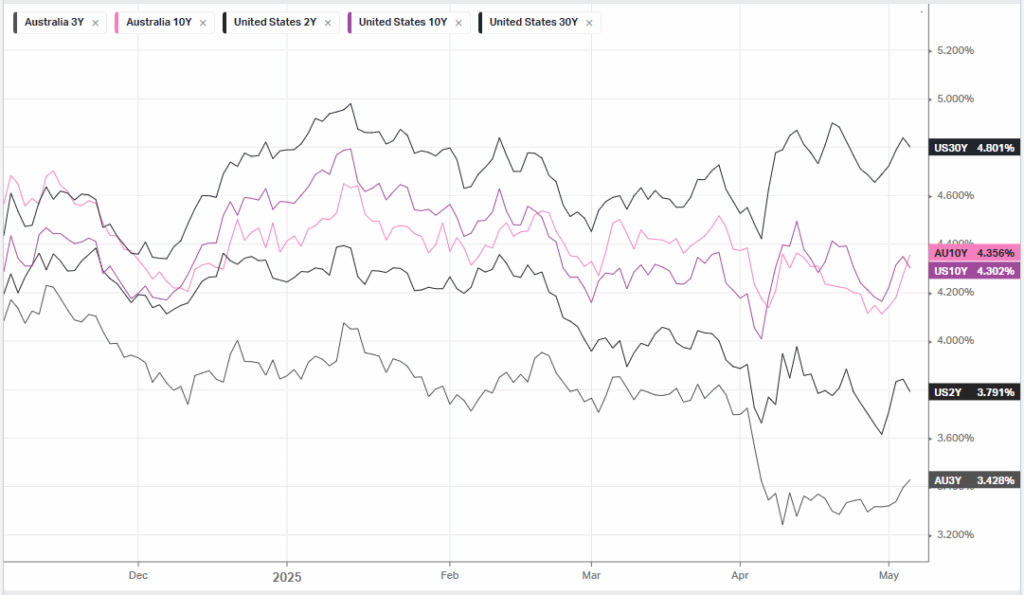

Also on investors minds is the Federal reserve meeting and rate decision looming large. The Fed kicked off the two day meeting overnight with a rate decision due tomorrow morning at 430am AEST. The central bank expected to hold interest rates steady and the decision is largely seen as a forgone conclusion, so the focus will be on comments from Powell to get insights into the Fed’s future rate path.

Fed Chair Jerome Powell recently signalled that the policymakers are in a wait-and-see mode amid tariff concerns. This comes despite overt pressure from President Trump and Treasury Secretary Scott Bessent to cut policy rates.

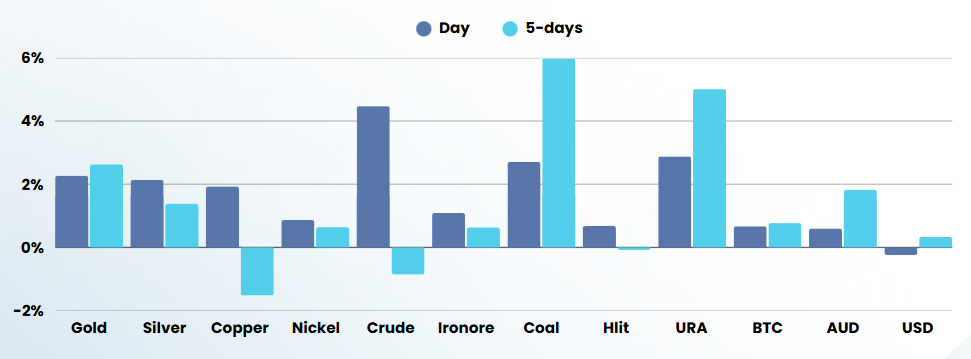

In economic data, a reading of activity in the key U.S. services sector, which accounts for more than two-thirds of the economy’s output, was stronger than anticipated, signalling that businesses may be able to shrug off headwinds from the tariffs. Still, a metric of prices paid by services companies rose, adding to worries that the duties could fuel inflationary pressures. US goods and services deficit widened in March following an uptick in imports as businesses raced to lock in prices before the implementation of elevated tariffs. Adjusted for seasonality but not price changes, the trade gap rose by 14.0% to $140.5 billion from a downwardly-revised $123.2 billion in February, according to data from the Commerce Department’s Bureau of Economic Analysis on Tuesday.

Futures gained 1.5% on the breaking news that “US Tres Sec and top trade official Greer said they would be meeting with China officials in Switzerland next week” The US officials were already scheduled to be in Geneva to meet with Swiss officials

Company Earnings

- Ford – stock rose more than 2% even as the auto giant slashed its full-year guidance, noting uncertainty around the outlook due to Trump’s tariffs.

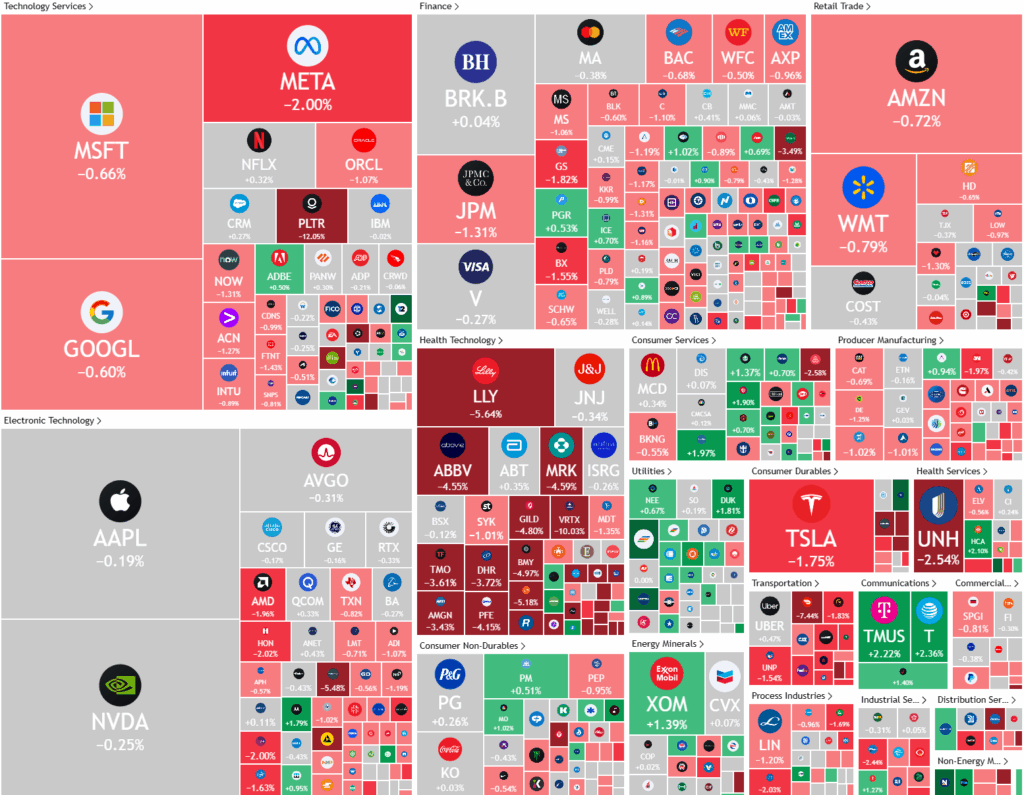

- Palantir – stock slumped about 12% after the artificial intelligence-focused data firm reported quarterly numbers that disappointed heightened market expectation, even as it lifted its annual sales guidance.

- DoorDash – stock fell more than 7% after the food delivery company’s first-quarter revenue fell short of estimates, while also confirming it has made a formal offer to acquire U.K. rival Deliveroo

- Mattel – stock added more than 2% despite the toymaker pausing its 2025 full-year guidance due to tariff uncertainty. The paused on guidance came as the company reported quarterly results that were better than feared.

ASX SPI 8138 (-0.37%)

The local market is likely to open strong on the China/US meeting announcement. While this is positive, we are still of the view that returning to cash is the smart play.

Focus on some individual names at the Macquarie Conference could see some movement in prices