Overnight – Trumps fresh Tariff blitz and Tesla lead market lower

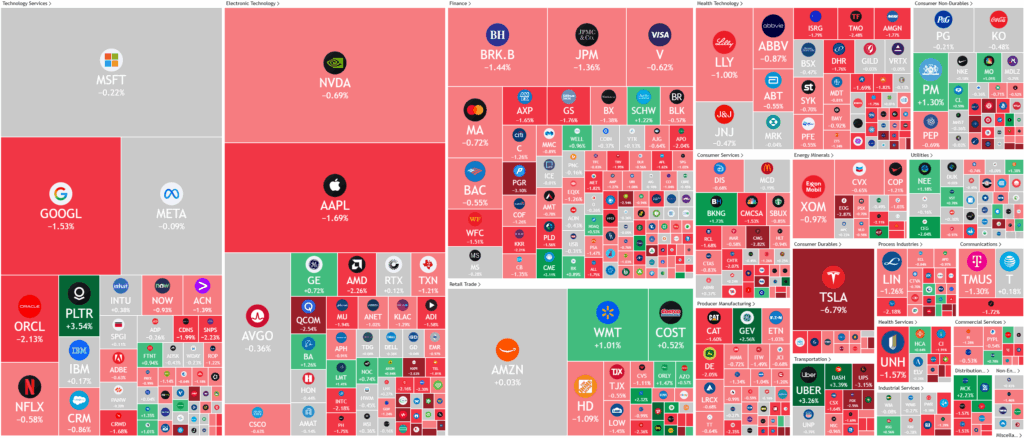

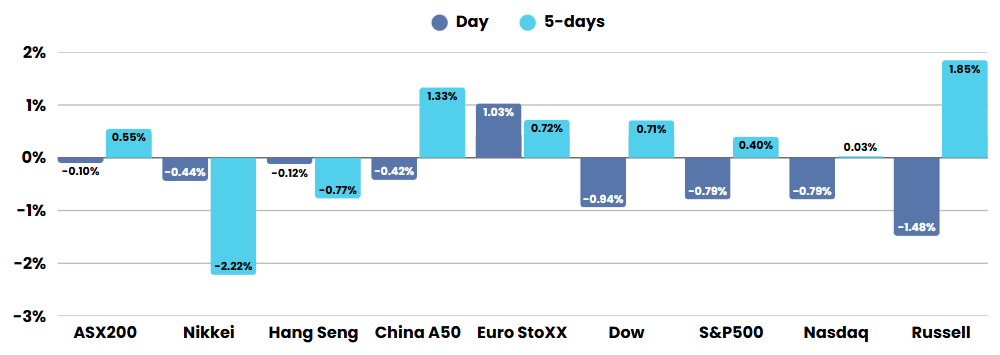

Stocks closed sharply lower overnight led by disappointment from Tesla shareholders in Elon Musk getting political again and President Donald Trump’s fresh slew of tariffs including a 25% levy on Japan goods.

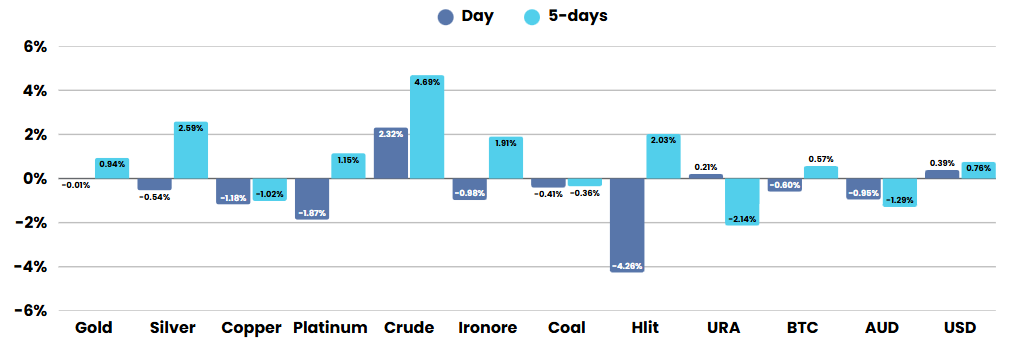

Trumps move reignited fears of a worldwide trade war that could the put the global economy in the crosshairs. Trump’s move targets long-standing U.S. trade deficits with Japan ($68.5 billion) and South Korea ($66 billion), and he threatened to escalate tariffs further if those countries retaliate. Additional tariffs were also announced on countries such as Myanmar, Laos, South Africa, Malaysia, and Kazakhstan. The administration’s actions come as the expiration of a previous pause on reciprocal tariffs draws near, with only preliminary trade deals reached with the United Kingdom and Vietnam, and a truce with China. Treasury Secretary Scott Bessent indicated more trade announcements are expected within 48 hours, as negotiations intensify ahead of a Wednesday deadline to finalize pacts.

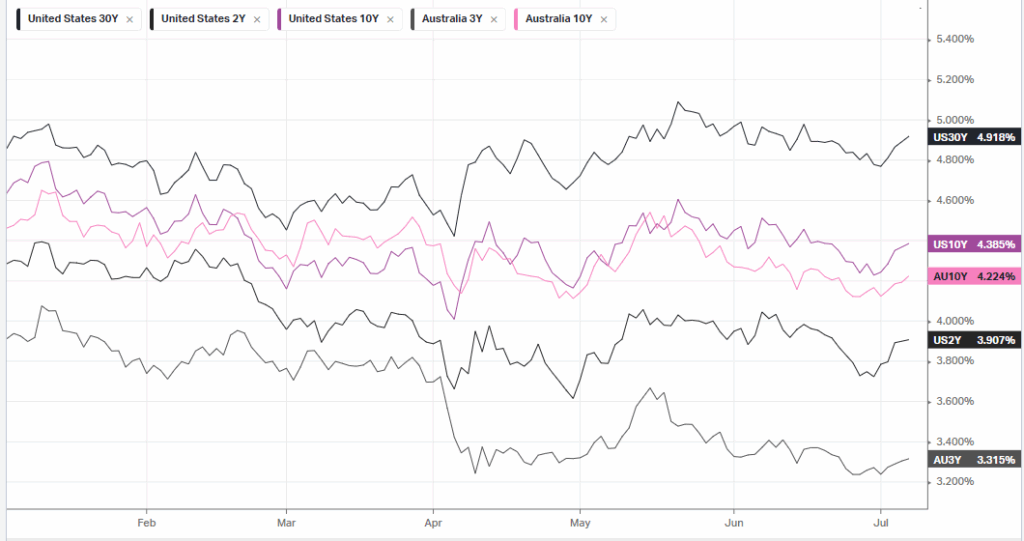

Investor sentiment remains unsettled, not only due to the uncertainty over the eventual scale of the tariffs—Trump has suggested rates could reach as high as 60% or 70%—but also because of threats to impose extra levies on BRICS nations for what he described as anti-American practices. The market is also awaiting the release of the latest Federal Reserve policy meeting minutes on Wednesday, which could offer clues about future interest rate decisions. The Fed recently kept rates steady at 4.25% to 4.5%, citing the need for more clarity on the economic impact of the new tariffs.

In corporate news, Tesla shares tumbled nearly 7%, wiping out $68 billion in market value, after CEO Elon Musk announced the formation of a new political party, raising concerns about his focus amid declining sales and ongoing disputes with President Trump. KalVista Pharmaceuticals surged after its new oral treatment for hereditary angioedema received FDA approval. Correctional facility operators Geo Group and CoreCivic gained following increased funding for immigrant detention in Trump’s latest tax-and-spending bill. Meanwhile, Stellantis shares fell as the U.S. National Highway Traffic Safety Administration opened a recall investigation into approximately 1.2 million Ram trucks over transmission issues.

ASX SPI 8526 (-0.54%)

The ASX will follow the US lower as trade war fears will make investors sensitive at record highs. The RBA finishes its 2 day meeting today, widely expected that policymakers will vote for a 25 basis point cut.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.