WANT TO INVEST IN US STOCKS?

GET AUSSIE BASED HELP, ON GLOBAL STOCKS WITH GLOBAL ALPHA

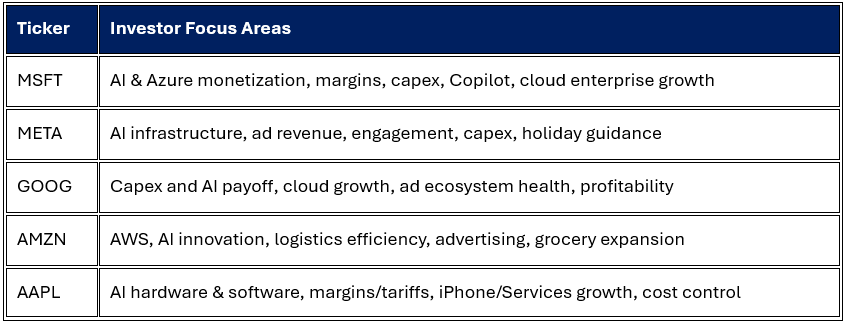

What the market was expecting

Investors are generally looking for confirmation that heavy AI investments are starting to convert into profitable growth, with particular attention given to margin management and whether these companies can sustain or accelerate growth amid intense global competition and operational shifts

The Results

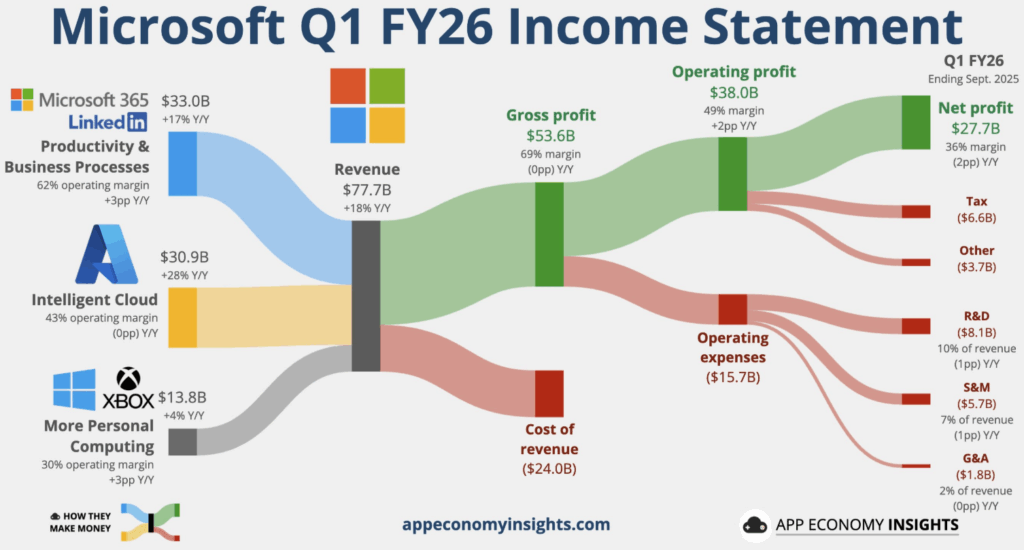

Microsoft -2.5% – Microsoft reported strong fiscal first-quarter results with earnings per share of $4.13, topping estimates of $3.66, and revenue of $77.7 billion, up 18% year over year. Azure’s cloud business surged 40%, surpassing forecasts, and the Intelligent Cloud unit’s revenue climbed 28% to $30.9 billion. Despite these gains, shares dipped 3% in after-hours trading as investors reacted to Microsoft’s massive $34.9 billion AI-related capital spending, well above expectations. The company’s deepening AI investments, including its renewed 27% stake in OpenAI, continue to drive growth, helping it reach a $4 trillion valuation—second only to Nvidia.

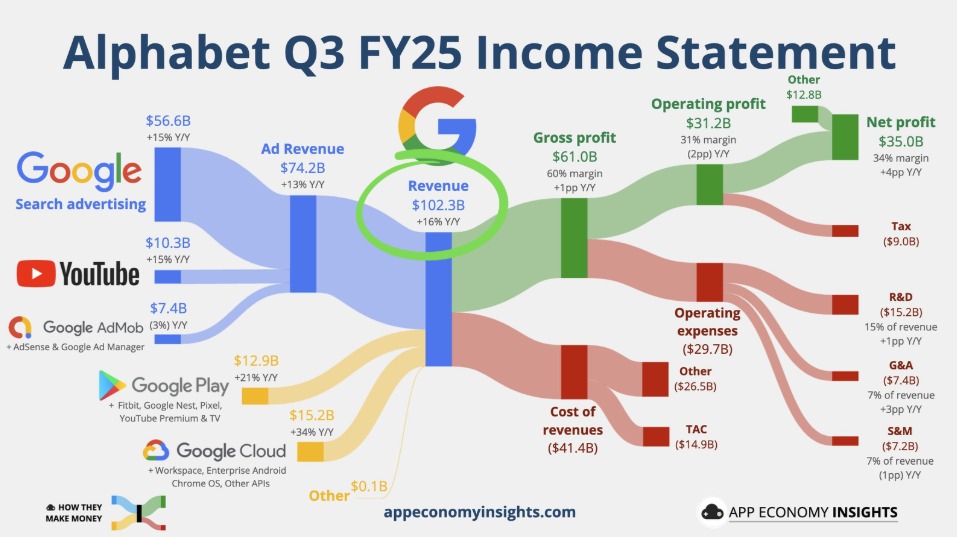

Google +8.11% – delivered a record-breaking third quarter, posting revenue of $102.35 billion—up 16% year-over-year and above forecasts—while earnings per share reached $2.87 versus the expected $2.29. Driven by strong growth in advertising, cloud, and AI services, the company’s net income rose 33% to $34.98 billion, and operating margin hit 30.5% (33.9% excluding fines). Google Cloud revenue surged 34% to $15.16 billion, supported by booming AI demand, while total ad revenue climbed 13% to $74.18 billion. Shares jumped over 6% after-hours to $275.17, marking gains of 44.9% in three months and 56.2% year-over-year, as Alphabet raised its full-year capital expenditure outlook to $91–93 billion amid escalating competition in AI and search.

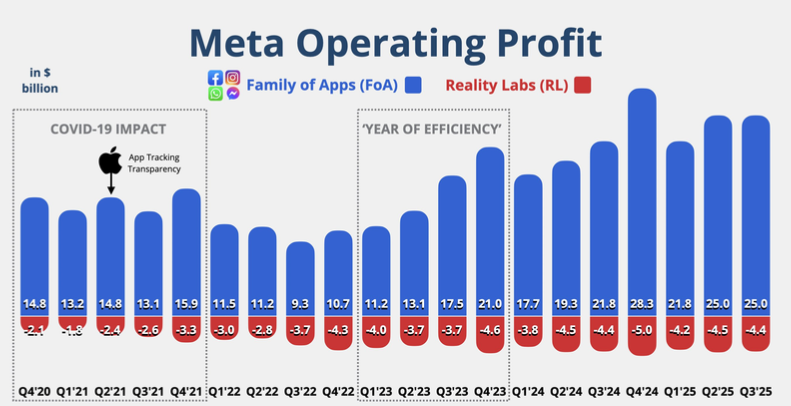

Meta -9.11% reported a sharp decline in quarterly profit due to a $15.9 billion tax charge, sending its shares down 6% in after-hours trading. Excluding the charge, its operating margin was 40%, and revenue rose 22% to $51.24 billion on strong ad demand. Despite surpassing expectations, Meta warned of regulatory and legal risks in the U.S. and Europe. The company raised its 2025 expense and capital spending outlooks to fund AI infrastructure, with CFO Susan Li citing higher cloud and talent costs, while CEO Mark Zuckerberg highlighted progress in its Superintelligence Labs and AI-powered devices.

Overall

All three tech giants reported results against a backdrop where investors were seeking tangible proof that heavy investments in AI and digital transformation could translate into profitable, sustainable growth, especially with strong margin management despite rising capital expenditures and global competition

Overall, the results highlighted that while AI continues to fuel impressive top-line growth, investor sentiment is increasingly sensitive to cost control and the pace at which these investments yield bottom-line returns.

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.