Why do I need to replace my Hybrids?

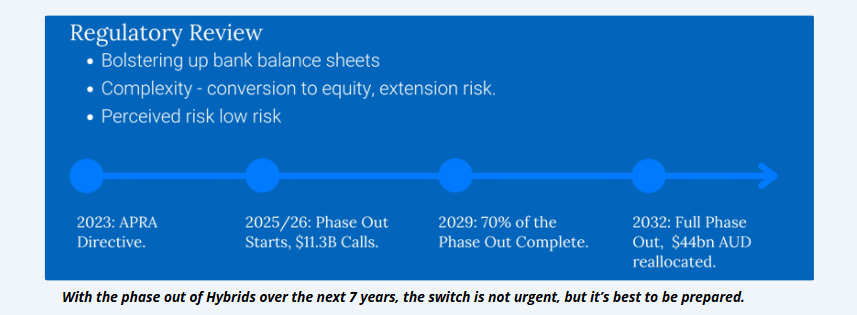

The Australian Prudential Regulation Authority (APRA) is phasing out hybrid securities (Additional Tier 1 capital instruments) from bank capital structures by 2032 to simplify capital frameworks and enhance financial stability, following concerns about their effectiveness in absorbing losses during crises-particularly highlighted by the Credit Suisse collapse in 2023.

What does it mean for my portfolio?

Many investors use Hybrids as their Fixed Income allocation in their portfolios. The impact of APRA’s regulatory changes on AT1 hybrids will inevitably result in a gap in attractive income investment options

What are Structured Investments and how can they help?

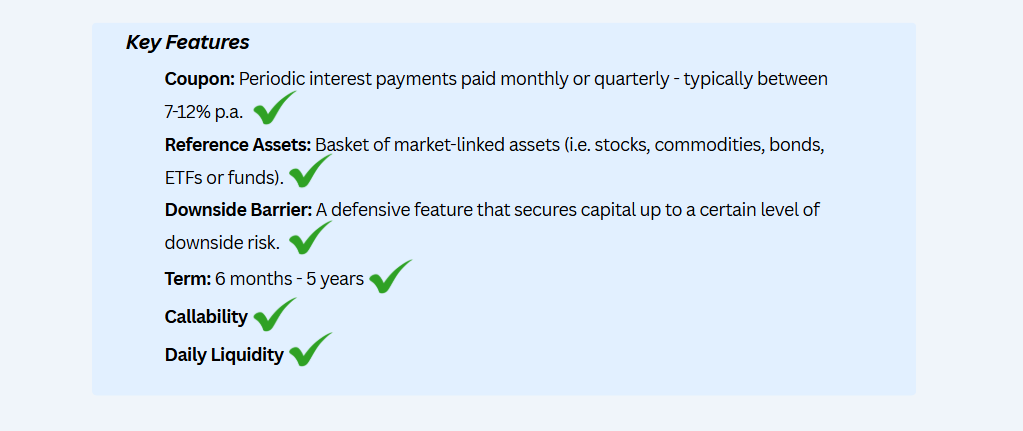

Structured investments are customized financial products that combine traditional securities with derivatives to achieve specific investment goals, in this case income investments with Fixed Coupon Notes

Why are Fixed Coupon Notes a suitable alternative to Hybrids

Fixed Coupon Notes have many similarities in terms of risk profile and income and liquidity

How do I Replace my Hybrids with a Fixed Coupon note?

In conjunction with our Product Provider StroPro, and a panel of top rated investment banks, MPC Markets experienced team, formulates fixed coupon note, then times the market to get you the best rate.

Download our guide, or watch our webinar explaining how you can switch today!

Previous fixed coupon deals have ranged from 10.1% to 13%!

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.