Got a question about this article? Ask Jonathan

The Supply Chain Crash No One Sees (Yet)

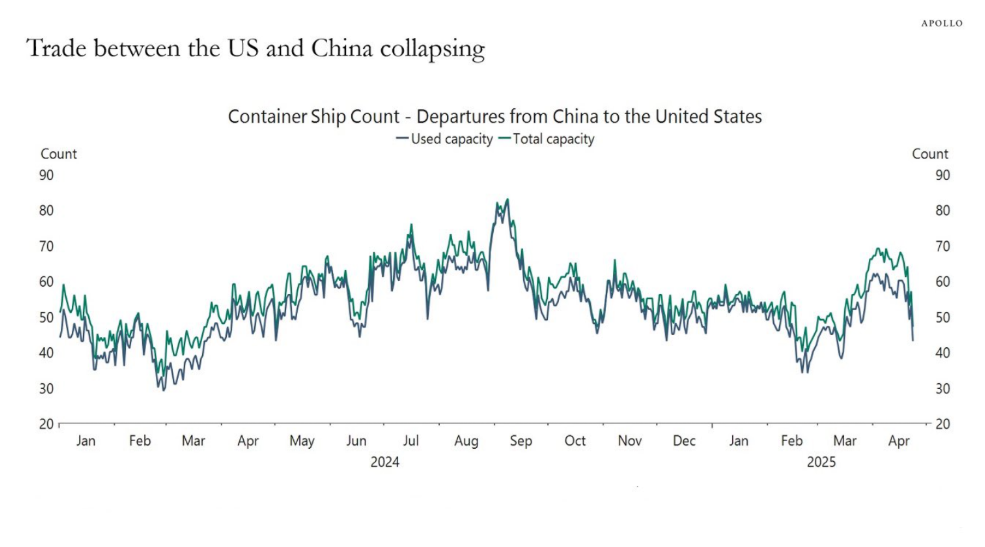

The U.S. economy is speeding toward a supply chain crisis — and most people haven’t noticed.

Back on April 10th, trade from China to the U.S. largely shut down. Shipping times mean the real pain doesn’t hit immediately: Here are shipping times from Shanghai

30 days to Los Angeles

45 days to Houston and Chicago

55 days to New York

That means the real economic fallout starts mid-May and intensifies through June.

Right now, everything looks normal. Store shelves are stocked. Retailers are still shipping goods. But that’s because companies frontloaded inventory earlier this year, fearing tariffs. Most big retailers carry 60–90 days of inventory. That cushion is about to vanish.

Trucking work will dry up first. Warehouses will start layoffs. Shortages will creep in, starting with seasonal goods and toys (fast turnover, thin margins, Chinese-dependent). Next: basic apparel like T-shirts, leggings, socks. By late June, the cracks will be visible across the country.

Even if the White House reverses course tomorrow, even if China says “no hard feelings,” there’s no instant fix. Best case: it takes another 30–55 days for goods to reach American ports. Supply chains don’t snap back — they have to be rebuilt.

It’s eerily similar to lockdowns: shutting down was easy. Restarting takes far longer.

As an investor or business leader, here’s what you need to know:

Who Wins:

Domestic manufacturers (apparel, home goods, outdoor gear)

Final-mile delivery firms (inside the U.S.)

Big membership retailers (Costco, Sam’s) — they have pricing power and sourcing muscle

Who Loses:

Discount retailers (Dollar Tree, Five Below) — ultra-low margins, heavy China exposure, no flexibility

International shipping firms — collapsing Asia-U.S. volume

The critical insight: Supply chain crashes aren’t immediate — they’re gradual, then sudden.

By the time headlines scream about “shortages,” the biggest moves in stocks and sectors will already be underway. Those who understand the mechanics and timing will be positioned first.

We are not sounding an alarm without reason. The driver of the economy is hurtling toward a brick wall — but they won’t see it until it’s too late to hit the brakes.

The time to prepare is now.

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.