In a seismic shift for the energy sector, last night’s announcements from the U.S. Department of Energy (DOE) and international diplomacy have ignited a firestorm of optimism around nuclear power—and for good reason. As AI datacenters devour ever-increasing amounts of electricity, these policy moves signal a golden era for nuclear investments, positioning the technology as the backbone for sustainable hyperscaling. Energy Secretary Chris Wright’s comments on bolstering the strategic uranium stockpile sent U.S. uranium stocks soaring, with Energy Fuels Inc., Uranium Energy Corp., and Cameco Corporation posting double-digit gains in after-hours trading. The DOE’s pledge to procure up to $2.7 billion in domestically enriched uranium underscores a strategic pivot away from Russian imports, fortifying supply chains amid national security concerns.

But the real blockbuster is the impending U.S.-UK nuclear pact, set to be inked during President Trump’s upcoming visit to Britain. This landmark deal will turbocharge investments in advanced nuclear projects, including up to 12 small modular reactors (SMRs) at Hartlepool, spearheaded by U.S. firm X Energy in partnership with UK’s Centrica. By streamlining regulatory hurdles and unlocking private capital, the agreement aims to slash deployment timelines and address ballooning electricity demands—explicitly targeting the AI boom. Back home, executive orders are on the horizon to expedite reactor approvals and ramp up domestic production, directly responding to the power crunch from tech giants’ datacenters.

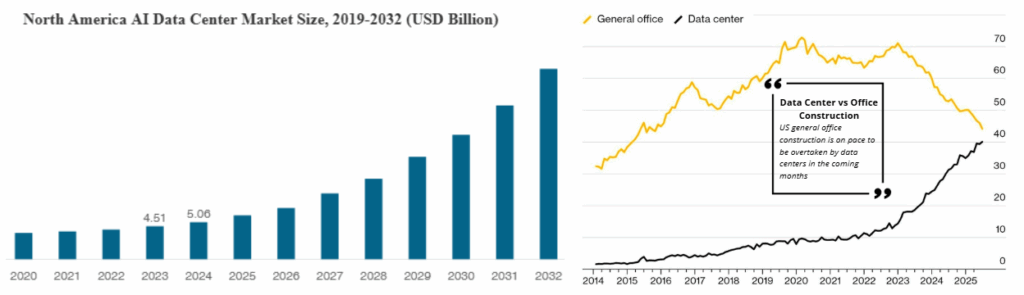

This isn’t just policy theater; it’s a direct response to the explosive growth in AI infrastructure. As detailed in a recent McKinsey report on hyperscaling AI, datacenters are at the epicenter of a global energy transformation. The International Energy Agency (IEA) projects worldwide datacenter electricity consumption to more than double by 2030, reaching approximately 945 terawatt-hours (TWh)—equivalent to Japan’s entire annual usage. In the U.S. alone, BloombergNEF forecasts a doubling of datacenter power demand by 2035, from 35 gigawatts (GW) in 2024 to 78 GW. Goldman Sachs chimes in with a staggering 165% surge in global datacenter electricity needs by 2030, driven by hyperscalers like Google, Microsoft, Meta, Apple, and Nvidia.

This isn’t just policy theater; it’s a direct response to the explosive growth in AI infrastructure. As detailed in a recent McKinsey report on hyperscaling AI, datacenters are at the epicenter of a global energy transformation. The International Energy Agency (IEA) projects worldwide datacenter electricity consumption to more than double by 2030, reaching approximately 945 terawatt-hours (TWh)—equivalent to Japan’s entire annual usage. In the U.S. alone, BloombergNEF forecasts a doubling of datacenter power demand by 2035, from 35 gigawatts (GW) in 2024 to 78 GW. Goldman Sachs chimes in with a staggering 165% surge in global datacenter electricity needs by 2030, driven by hyperscalers like Google, Microsoft, Meta, Apple, and Nvidia.

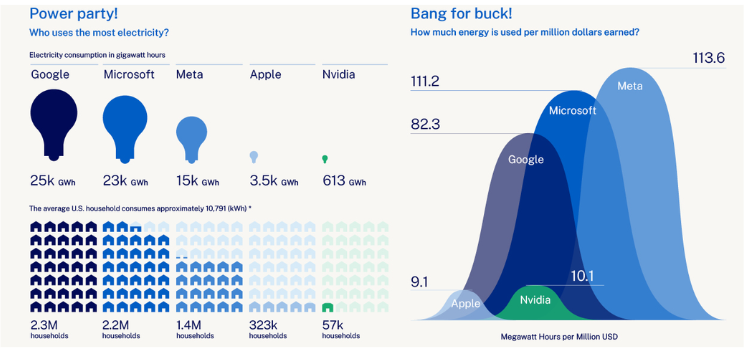

The numbers are eye-popping. Google’s datacenters guzzle 25 GW on average—over 2.5 million U.S. households’ worth—while Microsoft’s hit 23 GW. Yet, the “bang for the buck” metric reveals inefficiencies: Nvidia burns 113.6 megawatt-hours (MWh) per million dollars earned, far outpacing traditional sectors. Renewables like solar and wind, while vital, falter on intermittency, unable to guarantee the 24/7 reliability AI demands. Enter nuclear, particularly SMRs: compact, scalable, and carbon-free, these reactors offer around 300 MW per unit, deployable faster and closer to load centers than traditional plants.

The investment case is compelling. Amazon has already inked deals for SMR projects, and Oracle is designing facilities powered by multiple units. For investors, this opens doors to uranium miners like Cameco (trading at a premium post-announcement), SMR innovators such as X Energy, and ancillary plays in advanced cooling tech like liquid immersion systems. The U.S.-UK deal alone could catalyze billions in funding, with governments de-risking the sector to meet climate goals without compromising growth.

Challenges remain—high upfront costs and grid integration—but policy tailwinds are mitigating them. By prioritizing SMRs alongside efficient power management, the AI boom can propel economic expansion sustainably. Nuclear isn’t just an energy source; it’s the cornerstone of a future where AI thrives without blacking out the planet. For savvy investors, this is the moment to go nuclear—heavy on uranium ETFs, SMR developers, and nuclear tech firms. The surge has begun; don’t miss the reactor.

WATCH OUR FREE WEBINAR

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.