I keep getting asked if gold’s run is over, and I answer that question with this question: “Do you think governments will manage economies responsibly and not lower rates and print money?” If history is any guide—and it always is—the answer is a resounding no.

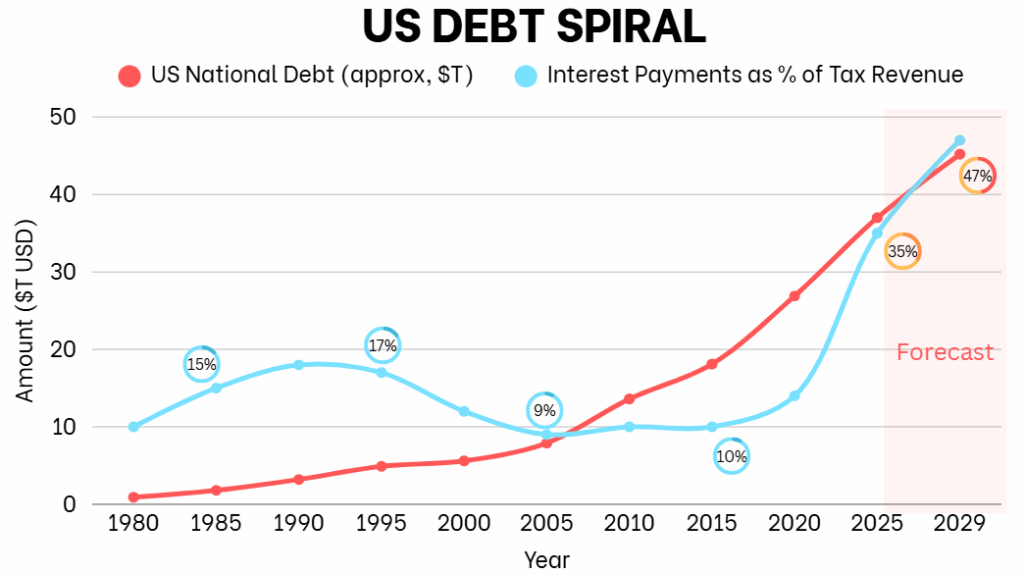

With U.S. debt spiraling to $37 trillion (that’s 119% of GDP and climbing by roughly $1 trillion every few months), interest payments gobbling up 18.4% of federal revenues, and the Fed eyeing cuts to 4-4.25% by year-end, precious metals like gold and silver are just getting warmed up. Despite their stellar 20-25% gains in 2025 so far, the rally is poised to accelerate, driven by a confluence of fiscal uncertainty, currency debasement, low real yields, and geopolitical shifts. Over the next 12 months, these factors will dominate investor minds, making gold and silver indispensable stores of value.

Let’s dive deeper into the macroeconomic tailwinds fueling this bull market. The U.S. dollar’s weakness is impossible to ignore: the DXY index has already dipped to 98.38, with forecasts pointing toward 95 as rate cuts weaken its appeal. This creates a textbook low real-yield environment, where non-yielding assets like precious metals shine brightest. Global central banks are leading the charge, projected to purchase 1,000 tons of gold in 2025—up from 1,037 tons in 2024—according to the World Gold Council. They’re diversifying aggressively from U.S. Treasuries, especially after Moody’s shocking Aa1 downgrade in May 2025, which signals growing doubts about America’s creditworthiness. Public debt worldwide now exceeds $100 trillion, amplifying the unsustainable path and pushing institutions toward tangible hedges.

Enter the BRICS bloc (Brazil, Russia, India, China, South Africa, plus recent additions like Egypt and the UAE), which is aggressively pursuing de-dollarization. They’re holding back 20% of global gold reserves and exploring gold-backed currencies and trade settlements. This isn’t just rhetoric; it’s a strategic shift that’s already boosted demand by 20-30% annually for silver in industrial uses like EVs and solar. Silver’s dual role as a monetary and industrial metal gives it extra upside: from its current $41/oz, it could surge to $60/oz by mid-2026, while gold climbs from $3,500/oz to $4,000-$4,500/oz. Safe-haven flows amid geopolitical tensions, combined with silver’s 50% allocation to green tech, create a multi-year bull case that’s hard to fade.

History provides stark lessons on why this rally has legs. Currency debasement is as old as civilization itself. Think of ancient Rome weakening its denarius coins to fund endless wars, or post-World War II Britain watching the pound plummet as debt mounted. These episodes eroded trust in paper money, driving people toward physical assets. Fast-forward to today: the U.S. debt spiral mirrors those patterns, with interest payments hitting $1 trillion in 2025 alone. As debt piles up, the dollar’s value erodes, making gold and silver smarter picks for preserving wealth. Past currencies losing power—from the Roman Empire to modern hyperinflation cases—underscore why investing in metals makes sense in our debt-laden world.

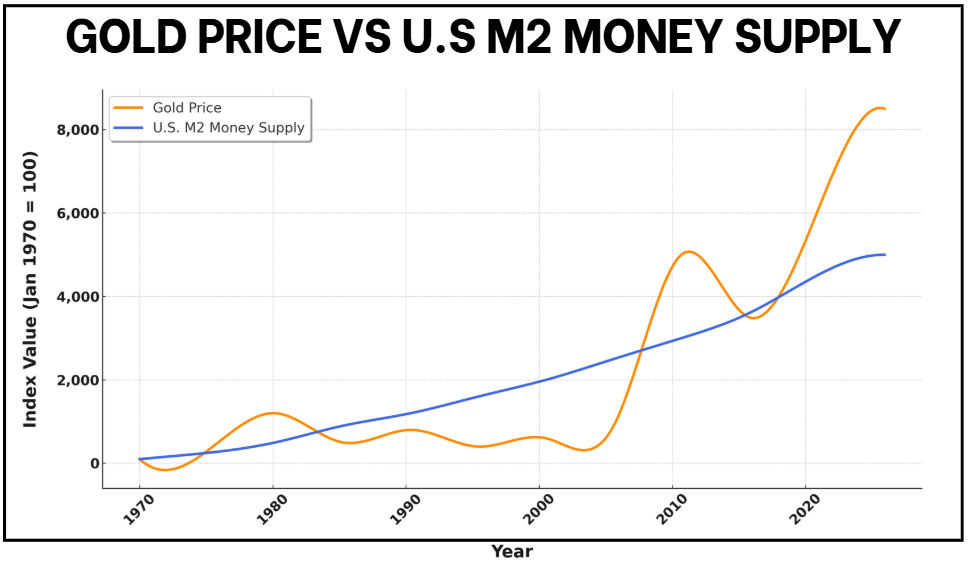

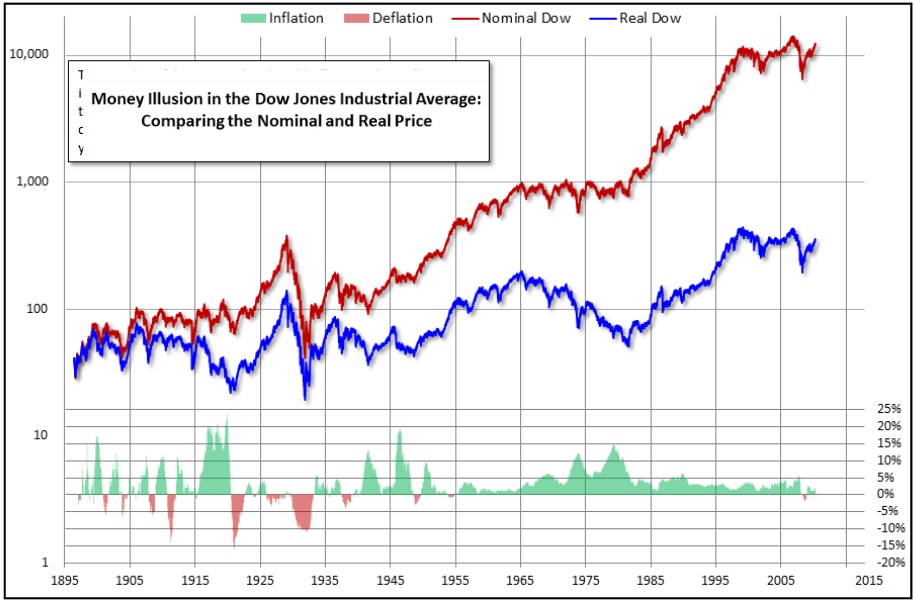

Inflation adds another layer of urgency. Stock market gains can be misleading; the Dow Jones might flash impressive nominal highs, but inflation-adjusted, they often shrink dramatically. It’s like a pay raise that doesn’t match rising grocery bills—your real purchasing power stagnates. Historical data shows stocks frequently lose real value during inflationary spikes; for instance, 1970s market peaks took years to regain true worth after prices soared. The U.S. M2 money supply has ballooned since 1970, and gold has tracked it closely, proving its role as an inflation hedge. In 2025, with government spending fueling money printing, inflation risks are mounting. Gold is up 20%, silver 25%—the latter boosted by solar panel demand—and they’re protecting against the erosion of cash value. Like the 1970s gold boom amid stagflation, these metals ensure your savings grow in real terms, not just on paper.

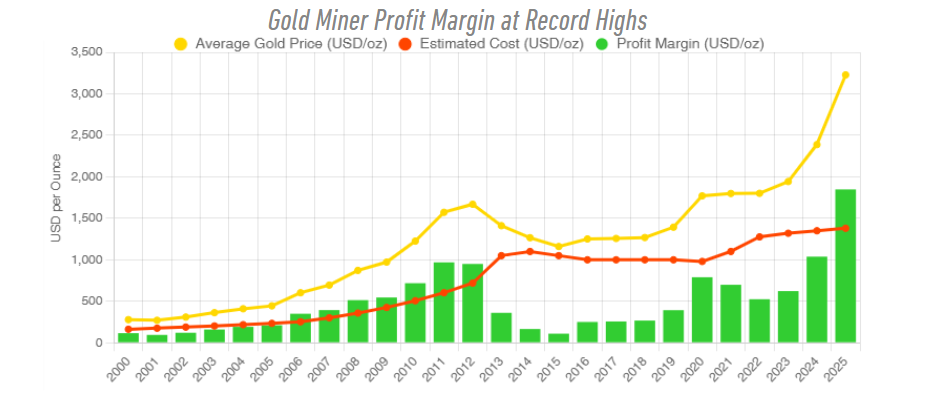

For investors seeking amplified exposure, physical metals are just the start. Precious metals miners offer operating leverage that can supercharge returns. Unlike bullion, miners’ profits explode as metal prices rise against fixed all-in sustaining costs (AISC). The GDX ETF’s holdings average $1,307/oz AISC; at $3,500/oz gold, margins hit 63% ($2,193/oz profit). Push gold to $4,000/oz, and margins expand to 67% ($2,693/oz), potentially driving 50-100% EPS growth for top names. Royalty firms like Wheaton Precious Metals (WPM) and Franco-Nevada (FNV) have even lower effective costs ($300-600/oz), sweetening the ETF’s overall margins to $1,025/oz.

Valuation-wise, GDX’s forward P/E of 12.45 (as of September 2, 2025) is undervalued compared to the S&P 500’s 20-22 or gold sector norms (10-20 for miners, 25-40 for royalties). High margins at $3,500+ gold aren’t fully priced in, with analyst targets implying 5-10% upside—but macro tailwinds could deliver 30-50% (GDX to $85-95). Year-to-date, GDX is up 25%, outperforming gold’s 20%, and it could yield 1.5-2x bullion returns. Top holdings like Newmont (NEM) with efficient Canadian ops and Barrick Gold (GOLD) in low-cost African mines exemplify this leverage. For sophisticated investors only, GDX is the premier way to capture the upside without storage hassles.

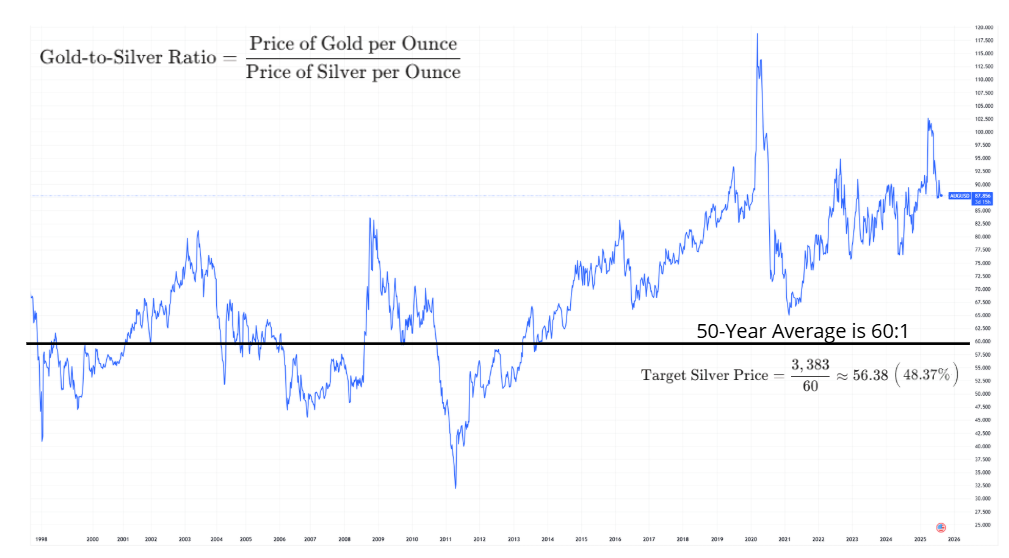

Silver’s story gets even more compelling. The gold-silver ratio at 89:1 towers over its 50-year average of 60:1—a rare extreme (only 1-2% of the time above 90:1), often signaling economic uncertainty like our current U.S. debt crisis. Historically, such highs—like the 115:1 peak in 2020—precede silver surges as markets correct. If the ratio reverts to 60:1 with gold at $2,500/oz, silver could rocket from $28 to $42, a 50% gain. But silver’s industrial demand in solar panels and electronics adds unique value, unlike gold’s purely financial focus. Amid global tensions—U.S. debt at $37 trillion, BRICS challenging the dollar—this scarcity-driven mispricing is primed for correction. Silver’s affordability and green tech tailwinds position it for stronger near-term upside than gold, making it essential for wealth preservation in a volatile economy.

In summary, with governments unlikely to rein in spending, gold and silver’s run is far from over—it’s entering a multi-year sprint. For wholesale, professional, or sophisticated investors, layering in miners via GDX offers leveraged protection and growth. Don’t let debt spirals and inflation erode your portfolio; position for this inevitable rally now.

WATCH OUR FREE WEBINAR

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.