Read the Weekend Edition

We review a week of near-flat US indexes, aside from ASX volatility from GDP data and a pivotal antitrust decision favoring Apple and Google. Commentators noted the “bad news is good news” attitude, as weak job numbers fueled expectations of rate cuts, while credit remained abundant and correlations between assets broke down.

ASX banks dropped then bounced; Domino’s and mortgage finance stocks like COG surged, reflecting strong lending growth.

S&P and NASDAQ shifted quickly from sell to strong buy signals; gold and silver miners rallied with Newmont singled out for outperformance — the only gold stock in the S&P 500.

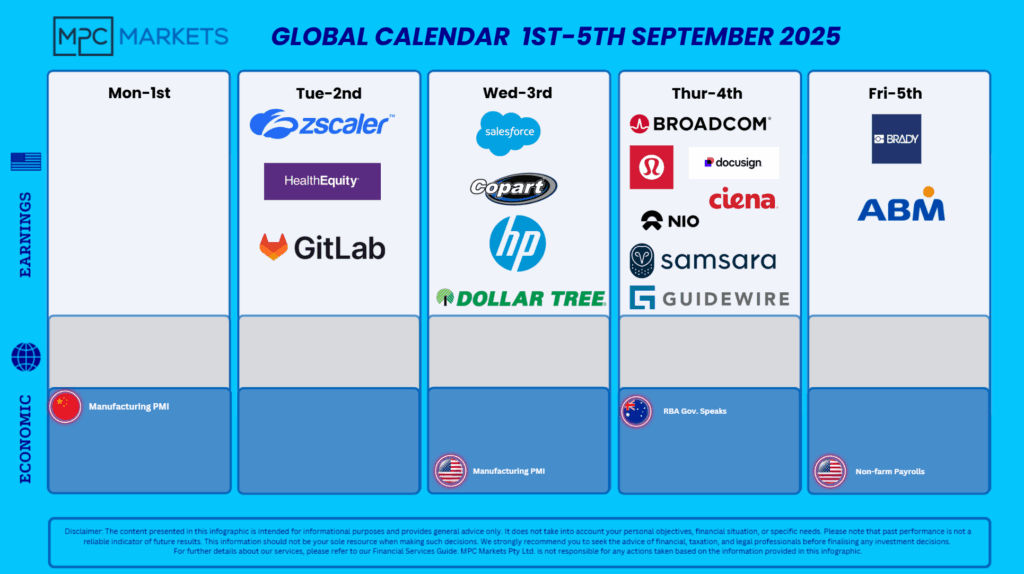

Salesforce warned of enterprise cuts in AI spending, while Broadcom beat earnings and rumors emerged of new chips to rival Nvidia. Netflix also appears to have bottomed.

Strategic themes included leveraged gold/silver miner trades, bullish outlook for silver based on the historic gold-silver ratio, and Bitcoin’s merits as a non-printable, inflation hedge asset.

Hosts were cautiously bearish heading into payrolls, citing risk of surprises, widespread overvaluation, and government policy uncertainty. Seasonality, safe-haven flows, and geopolitics remain critical watchpoints for market direction in the coming weeks.