Read the Weekend Edition

In this episode of MPC Markets Bulls vs Bears, Mark and Jonathan discuss the implications of Trump’s semiconductor manufacturing threat, the recent performance of the ASX, and the challenges it faces. They analyze market reactions to economic indicators, particularly focusing on tech stocks and their influence on the market. The conversation also delves into Trump’s economic strategy, the trends in commodities, and potential trade opportunities in gold and mining stocks. Finally, they share their predictions for market sentiment and performance in the near future.

Takeaways

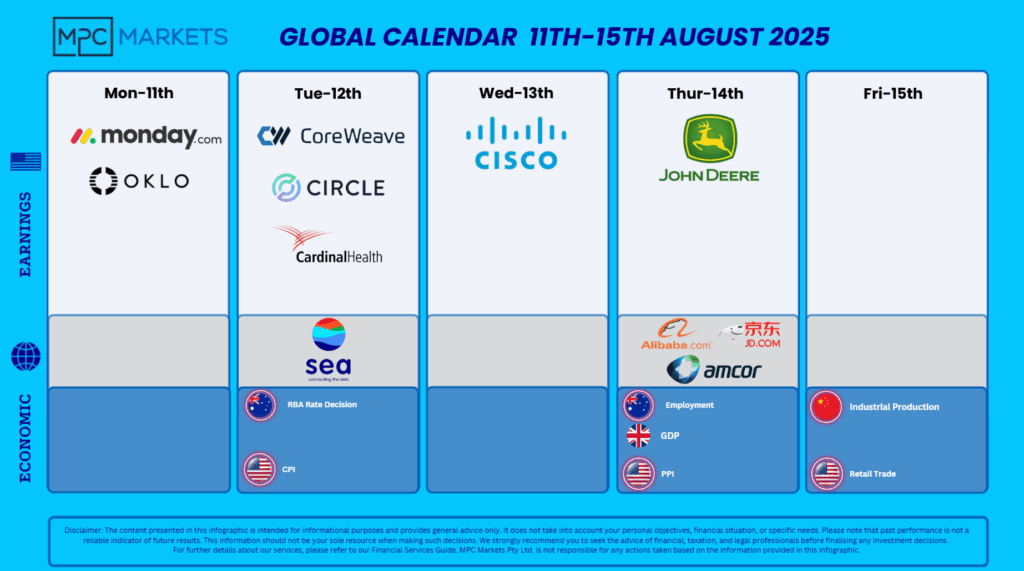

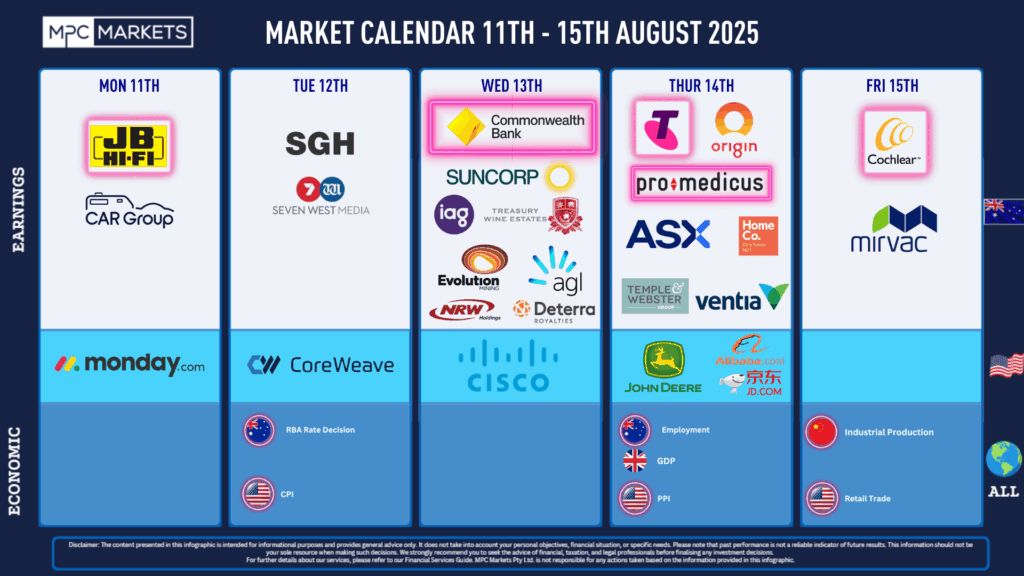

- Trump’s semiconductor threat aims to bring manufacturing back to the US.

- The ASX faced challenges with a recent trading mishap.

- Market reactions are influenced by economic indicators and consumer sentiment.

- Tech stocks like Apple and Nvidia are pivotal in market performance.

- Trump’s economic strategy may involve manipulating employment numbers.

- Commodities, especially gold, are showing signs of recovery.

- Barton Gold presents a significant investment opportunity with high potential returns.

- Market sentiment is cautious, with predictions of volatility ahead.

- The financial sector is experiencing a slowdown after a strong run.

- Analysts are struggling to provide accurate insights in the current market environment.