The artificial intelligence (AI) revolution is no longer a future promise—it’s reshaping the world today, with data centers at its core. As of August 2025, the global data center market, valued at $348 billion, is forecasted to nearly double to $652 billion by 2030, reflecting an 11.2% compound annual growth rate (CAGR). This explosive growth is driven by hyperscalers—tech giants like Google, Microsoft, AWS, and Oracle—who are building massive infrastructure to support AI’s insatiable appetite for computing power. At MPC Markets, we’ve been tracking this thematic investment opportunity for years, and it’s time for investors to take notice.

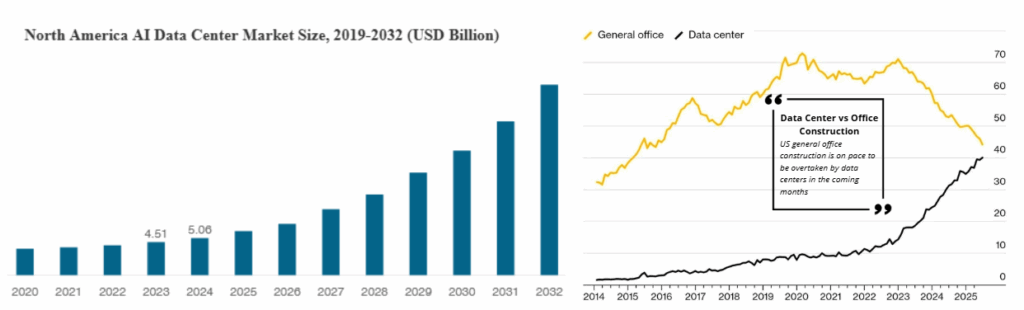

AI isn’t just about the MAG7 (Meta, Amazon, Google, etc.); it’s a global force transforming infrastructure, resources, and the digital economy. Data centers are the backbone, with U.S. construction projected to surge past office buildings, reaching $112 billion by 2030. This boom is fueled by hyperscalers’ investments, controlling 61% of global capacity by 2030, up from 44% in 2025. The energy demand is staggering—global data center electricity consumption is set to double to 945 terawatt-hours (TWh) by 2030, with U.S. power needs rising to 123 gigawatts (GW) by 2035. This creates a multi-trillion-dollar opportunity beyond tech giants, spanning commodities, power solutions, and innovative supply chains.

Commodities like copper and water are critical enablers. Data centers consume hundreds of thousands of tonnes of copper for wiring and cooling, driving demand up 2.4-2.9% annually through 2027, while water usage could add 0.12-0.24 billion cubic meters yearly by 2027. Supply constraints and rising prices make these strong investment targets. Meanwhile, power management faces challenges, with cooling systems eating up to 40% of energy. Enter Small Modular Reactors (SMRs)—scalable, carbon-free solutions gaining traction with Amazon and Oracle, promising reliable baseload power for hyperscale facilities.

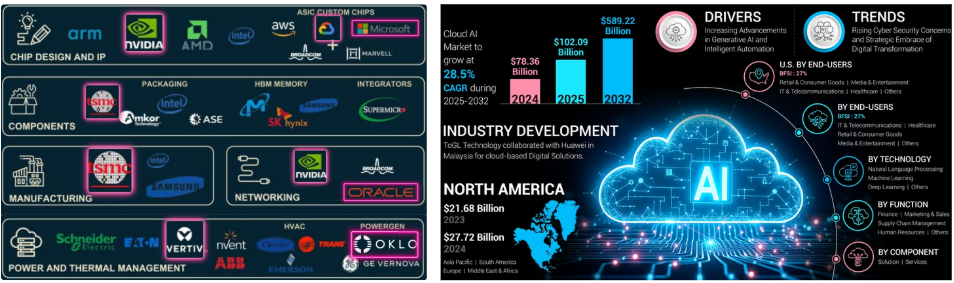

The cloud AI sector is another growth engine, expanding from $81 billion in 2024 to $110 billion in 2025, with a 28.5% CAGR projected to $589 billion by 2032. Hyperscalers like Google (with TPUs) and Oracle (via OCI) lead, catering to enterprises with secure, high-performance platforms. This shift fuels demand for suppliers like Vertiv (power solutions) and Ecolab (water treatment), alongside innovators like Oklo (nuclear microreactors).

At MPC Markets, we’ve invested in this theme across sectors, not just the MAG7. Join our CEO, Mark Gardner, for a free webinar on September 2, 2025, at 12:30 PM AEST. With 29 years of financial expertise, Mark will reveal insights from our Hyperscaling A.I. report and share 3 FREE stock picks. Don’t miss this chance to tap into AI’s infrastructure boom.

General advice only. Consider your personal circumstances before investing.

REGISTER FOR THE WEBINAR

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.