What's Affecting Markets Today

Asia-Pacific Markets Climb as Investors Weigh Trade and Policy Signals

Asia-Pacific equities advanced on Thursday as investors digested mixed signals from global trade developments and central bank policy. Market sentiment steadied after U.S. President Donald Trump walked back comments suggesting he would fire Federal Reserve Chair Jerome Powell, stating, “We’re not planning on doing it,” while not entirely ruling out the possibility.

Trump also reaffirmed a planned 25% tariff on Japanese imports and expressed skepticism about reaching a broader trade agreement with Japan.

Regionally, Japan’s exports declined for a second consecutive month, adding to concerns about global trade. Shares in Seven & i Holdings tumbled 7% after Canadian convenience store giant Couche-Tard withdrew its $47 billion takeover offer.

In Australia, the unemployment rate surged to a 43-month high, reinforcing expectations of monetary easing by the Reserve Bank.

Singapore’s equity market extended its winning streak to a ninth session, marking a new high. Meanwhile, Singapore’s non-oil domestic exports outperformed expectations in June, climbing to an 11-month high and offering a bright spot in regional economic data.

ASX Stocks

ASX 200 8,628.6 (-0.91%)

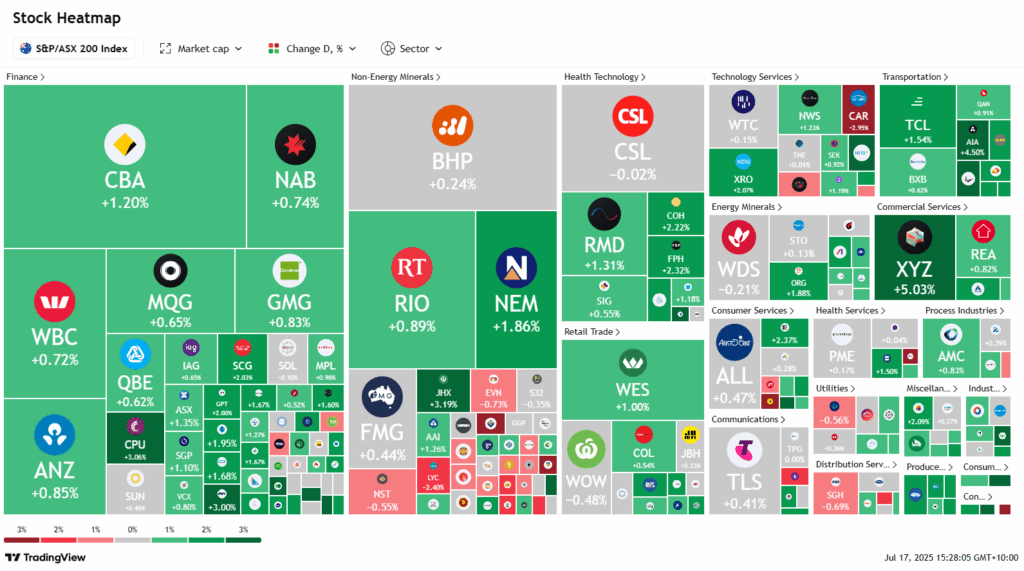

ASX Rebounds as Unemployment Rises, Boosting Rate Cut Expectations

The Australian sharemarket is poised to recover from Wednesday’s sharp decline, following a surprise uptick in the national unemployment rate to 4.3% in June. The softer labour data has strengthened expectations of a 25 basis point rate cut at the Reserve Bank’s next meeting on August 12, with market pricing lifting the probability to 94%.

At 2:15pm AEST, the S&P/ASX 200 was up 0.7% to 8619.30, nearing Tuesday’s record close of 8630.30. The rally was broad-based, led by a rebound in the major banks. ANZ and Westpac rose nearly 1%, Commonwealth Bank added 0.8%, and NAB gained 0.5%.

Rate-sensitive real estate stocks also advanced, with Mirvac climbing over 2.5%, while Scentre Group and Charter Hall each added around 1.7%.

In company news, Car Group dropped 2.5% as CEO Cameron McIntyre announced his resignation. PointsBet rose 0.4% after receiving a $1.03 per share takeover bid from Betr Entertainment. Qantas gained 1.2% following a Citi upgrade to “Buy” with a $12.20 price target.

Leaders

FCL Fineos Corporation Holdings Plc (+6.23%)

XYZ Block, Inc (+5.11%)

AIA Auckland International Airport Ltd (+4.87%)

SDR Siteminder Ltd (+4.61%)

IPX Iperionx Ltd (+4.18%)

Laggards

DRO Droneshield Ltd (-9.33%)

OBM Ora Banda Mining Ltd (-3.73%)

WAF West African Resources Ltd (-3.46%)

DVP Develop Global Ltd (-2.99%)

CAR CAR Group Ltd (-2.97%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!