What's Affecting Markets Today

Asia-Pacific Markets Mixed as China Holds Rates; Trade and Currency Moves in Focus

Asia-Pacific markets traded mixed Monday as the People’s Bank of China kept both its 1-year and 5-year loan prime rates unchanged, prompting a cautious tone across the region. Investors also monitored trade developments after the White House reaffirmed its tariff stance. U.S. Commerce Secretary Howard Lutnick reiterated that August 1 is a “hard deadline” for tariff implementation, though he noted that discussions could continue thereafter.

In currency markets, the Japanese yen firmed 0.22% to 148.49 per U.S. dollar following the ruling party’s defeat in Japan’s upper house elections, which added political uncertainty. Meanwhile, the Chinese yuan remained steady, with the offshore yuan at 7.1788 per dollar after the PBOC’s rate decision.

Equity markets were mixed. Singapore’s Straits Times Index hit a fresh all-time high of 4,225.79, extending its winning streak to an eleventh session. Chinese and Hong Kong stocks opened higher, with the Hang Seng Index up 0.55% and the CSI 300 rising 0.28%.

Bitcoin gained 0.21% to $118,368.56, extending its rally amid growing investor optimism.

ASX Stocks

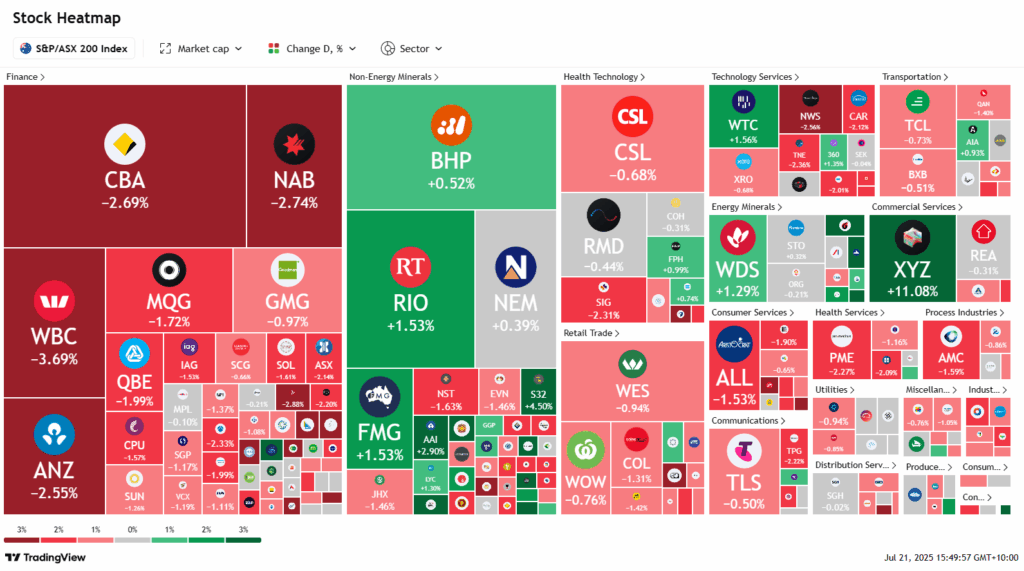

ASX 200 8,660.80 (-1.10%)

ASX Suffers Sharpest Decline Since April as Banks Retreat

The Australian sharemarket is facing its steepest one-day fall since April, with the S&P/ASX 200 down 1.2% to 8656.40 by 2:05pm AEST. Financials led the decline, falling 2.2% as investors booked profits from last week’s gains. Major banks were hit hard, with Westpac down 3.4%, Commonwealth Bank 2.9%, ANZ 2.7%, and NAB 2.6%.

AMP defied the trend, rising 8.6% to a five-month high after reporting its first positive net superannuation inflows since 2017, driven by platform growth and increased assets under management. South32 gained 4.3% after achieving 102% of its FY25 production guidance.

Materials edged higher as Singapore iron ore futures rose 3.3% to a four-month high of US$104.10/t, supported by China’s Tibet dam plans. Fortescue rose 1.5%, Rio Tinto 1.2%, and BHP 0.1%.

IG analyst Tony Sycamore cited profit-taking and stretched valuations ahead of earnings season, with the ASX 200 trading at 28.3x P/E versus a 3-year average of 22.8x.

Insignia fell 6.5% amid ongoing but uncertain takeover talks. Block surged 10.8% on news of its S&P 500 inclusion.

Leaders

XYZ Block, Inc (+10.96%)

LTR Liontown Resources Ltd (+9.73%)

PNR Pantoro Gold Ltd (+9.33%)

AMP AMP Ltd (+8.80%)

DRO Droneshield Ltd (+6.12%)

Laggards

IFL Insignia Financial Ltd (-5.76%)

MSB Mesoblast Ltd (-4.98%)

PNI Pinnacle Investment (-4.69%)

RRL Regis Resources Ltd (-4.14%)

FCL Fineos Corp (-4.12%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!