What's Affecting Markets Today

Asia-Pacific Markets Mixed as Japan Rebounds; SoftBank Rallies

Asia-Pacific equities traded mixed on Tuesday, with Japanese markets reopening higher despite political uncertainty, while investors weighed Wall Street earnings resilience amid renewed tariff risks.

Japan’s Nikkei 225 climbed 1.12% to 40,254.18 in early trade, rebounding as markets reopened following the ruling coalition’s loss of majority in the upper house. The broader Topix index rose 0.96% to 2,861.63.

Shares in SoftBank Group surged 5.74%, extending a three-day rally. The gains follow reports of a planned U.S. data center in Ohio in partnership with OpenAI and other stakeholders, part of a proposed $500 billion “Stargate” initiative to enhance U.S. AI infrastructure. Key terms, including data center locations, are reportedly still under negotiation.

Chinese and Hong Kong markets opened higher, with the Hang Seng Index up 0.28% and the CSI 300 rising 0.13% by mid-morning.

Meanwhile, Singapore’s Straits Times Index broke its 11-session winning streak, slipping 0.19% to 4,199.11. Financial, utility, and tech stocks led declines, with Wilmar International, Frasers Centrepoint Trust, and Keppel among the laggards.

ASX Stocks

ASX 200 8,661.70 (-0.08%)

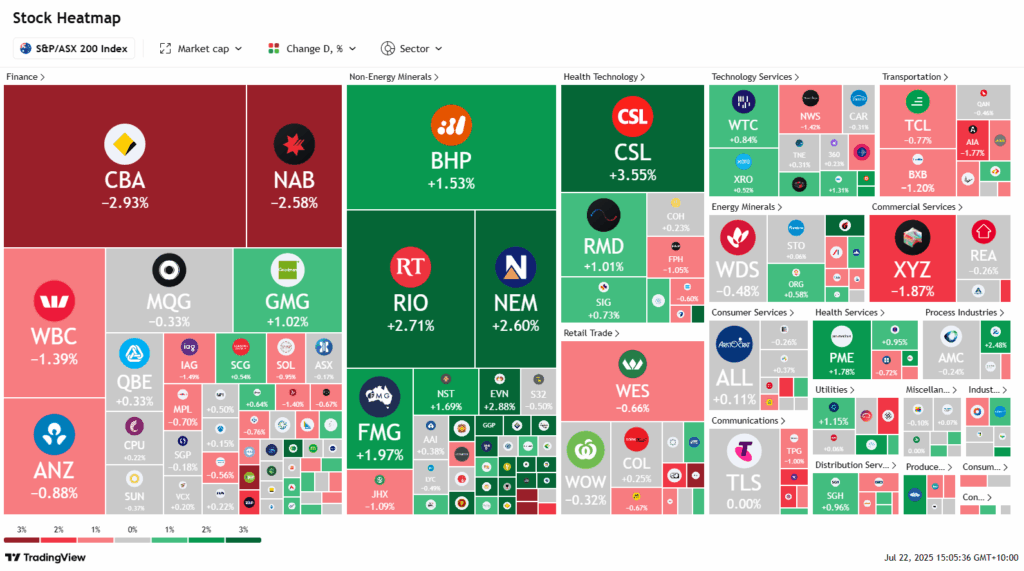

ASX Slips as Banks Weigh on Index; CBA Hits Two-Month Low

The Australian sharemarket gave up early gains to trade flat by mid-afternoon, weighed down by weakness in major banks following the release of the RBA’s July meeting minutes. At 1:55pm AEST, the S&P/ASX 200 was down 3.2 points to 8665.00, having earlier reached 8714.60.

Financials led the decline, with Commonwealth Bank falling 3.1% to a two-month low, shaving around 30 points off the index. The drop followed a 2.5% decline on Monday and would mark CBA’s steepest fall since early April. NAB slid 2.8%, Westpac 1.9%, and ANZ 1.2%.

Investors digested the RBA’s decision to hold rates steady at 3.85%, as policymakers await clearer signs of inflation easing.

In contrast, materials were the top-performing sector, driven by rising iron ore prices. Rio Tinto gained 3.1%, while BHP and Fortescue Metals both rose 2.3%. Champion Iron advanced 4.4% after partnering with Nippon Steel and Sojitz on its Canadian Kami project.

Insignia Financial soared 11.3% after CC Capital launched a $3.3 billion takeover bid at $4.80 per share.

Leaders

PNR – Pantoro Gold Ltd (+13.06%)

IFL – Insignia Financial Ltd (+12.21%)

WAF – West African Resources Ltd (+8.37%)

IMD – IMDEX Ltd (+8.21%)

RMS – Ramelius Resources Ltd (+7.93%)

Laggards

LTR – Liontown Resources Ltd (-5.34%)

BFL – BSP Financial Group Ltd (-4.01%)

GTK – Gentrack Group Ltd (-3.90%)

LOV – Lovisa Holdings Ltd (-3.85%)

SLX – SILEX Systems Ltd (-3.65%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!