Overnight – Google saves the day as positive Anti-trust ruling delivered

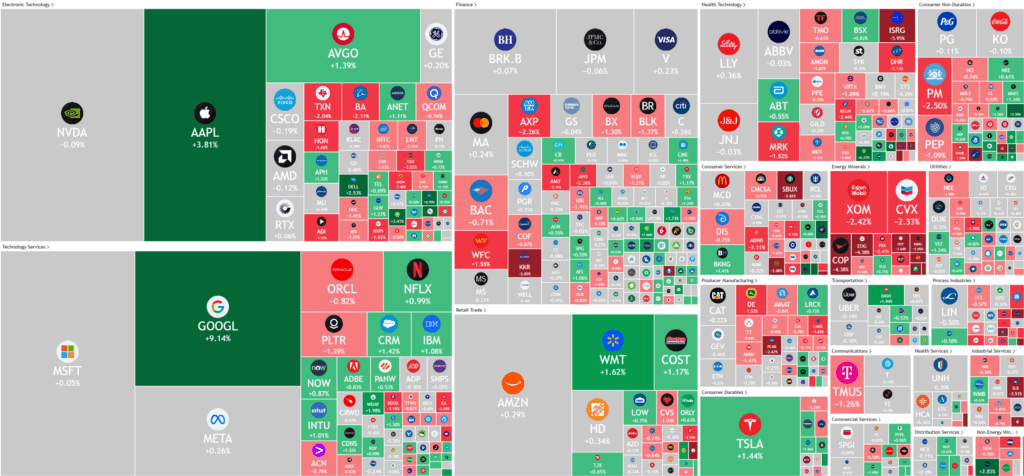

Stocks recovered overnight as Alphabet led a rebound in tech following a favourable antitrust ruling and Treasury yields cooled their recent ascent as signs of a softer labor demand boosted rate-cut hopes.

Shares of Alphabet jumped 9% after a federal judge ruled the company will not be forced to spin off its Chrome browser or Android operating system in the government’s antitrust case. While the ruling still requires Google to share search data with competitors and forbids exclusive contracts to promote its services, it was seen as a major legal victory that removed regulatory uncertainty. Analysts at Oppenheimer raised their price target on Alphabet to $270, citing the company’s ability to maintain its partnership with Apple and continue pursuing AI collaborations.

Apple also saw its stock rise as the decision ensured Google could keep paying billions to remain the default search engine on Safari, bolstering a lucrative arrangement between the two tech giants. Meanwhile, elsewhere in the markets, Newsmax filed a lawsuit against Fox News, alleging suppression of conservative competitors. On the corporate earnings front, Dollar Tree shares tumbled despite beating expectations with second-quarter results, while Macy’s surged after posting stronger-than-anticipated earnings that reassured investors about the retail sector.

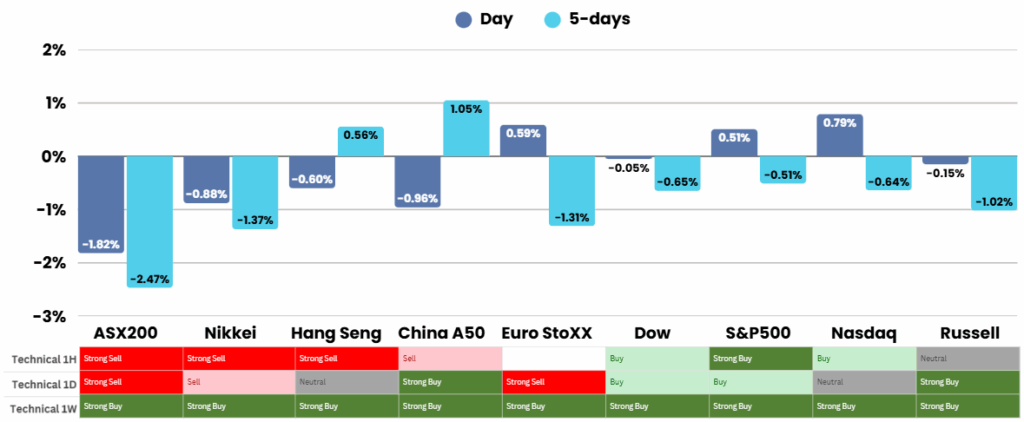

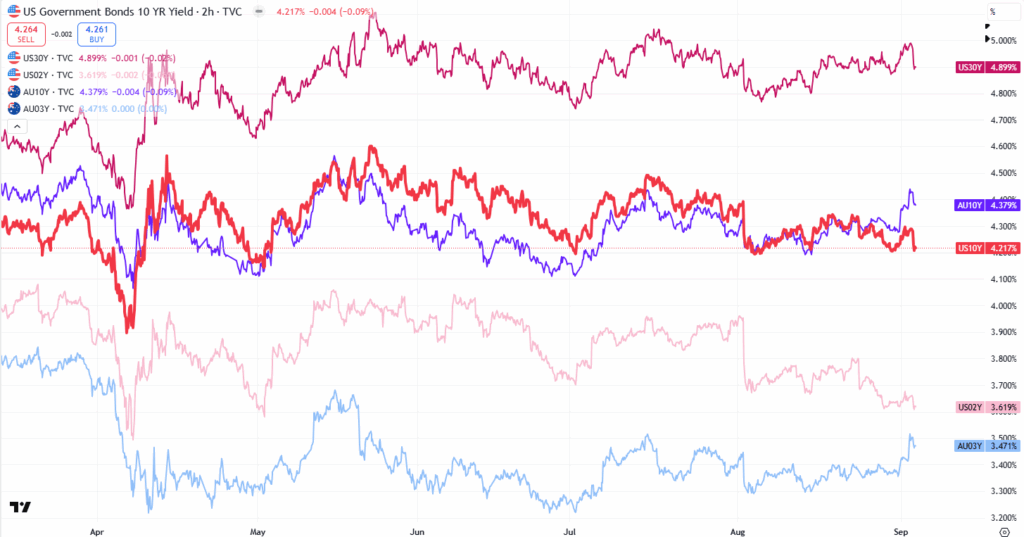

Beyond corporate news, financial markets were focused on signs of a cooling U.S. labor market ahead of the August jobs report. Job openings recorded their steepest drop since the pandemic, fueling expectations that the Federal Reserve could cut interest rates this month. Treasury yields eased from recent highs as investors bet on easier monetary policy. Supporting this view, Fed Governor Christopher Waller reiterated support for a September rate cut, while the Fed’s Beige Book pointed to weakening consumer demand and persistent inflation pressures.

Corporate Earnings

- Salesforce CRM -5% – Salesforce forecast weaker-than-expected third-quarter revenue as enterprises scale back cloud spending amid global economic uncertainty, sending its shares down over 4% after hours and extending a 24% slide this year. The company expanded its share buyback program by $20 billion to a total of $50 billion while facing investor pressure to deliver returns from its heavy AI investments. CEO Marc Benioff said Salesforce cut 4,000 support jobs due to automation, with AI now handling 30–50% of its work. Its new “Agentforce” platform, already with over 4,000 paid deals, provides AI-powered agents to assist in areas like recruiting and customer service.

ASX SPI 8756 (+0.35%)

The local bourse should see a rebound today after the worst day since April yesterday. Over the last 4-5 years, I am usually one of the only pundits talking about “seasonal weakness” but surprisingly, it has become a trending topic in AU financial media, which probably explains the small “freak out” yesterday.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.