Overnight – US Jobs numbers revised down 911k, largest drop in history, Oracle rockets on datacentres

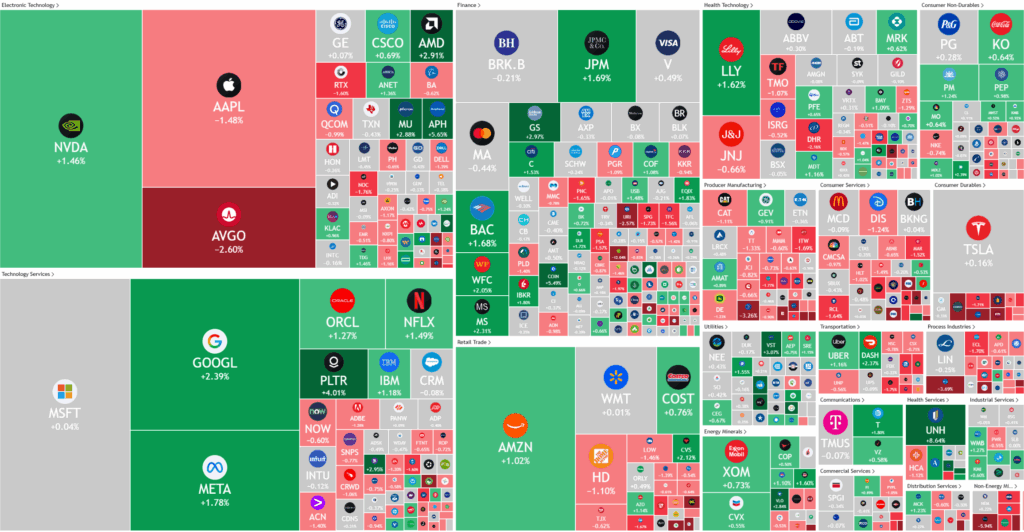

A stark range of news for stocks overnight as US jobs numbers were revised down a further 911,000 for the last 12 months, the worst revision in history, while Oracle jumped 27% on outstanding earnings and outlook due to the rapid expansion of Datacentres

Apple shares fell over 1% after its unveiling of new hardware at the “Awe Dropping” event, including the iPhone 17 Pro, which will start at $1099—$100 higher than its predecessor, matching analyst expectations. Apple also introduced a $999 iPhone Air to replace the iPhone 16 Plus, while keeping the entry-level iPhone 17 at $799. The new iPhone features very little (if any) innovative changes and we maintain that Apple is vulnerable to a leap in smartphone technology leaving them behind.

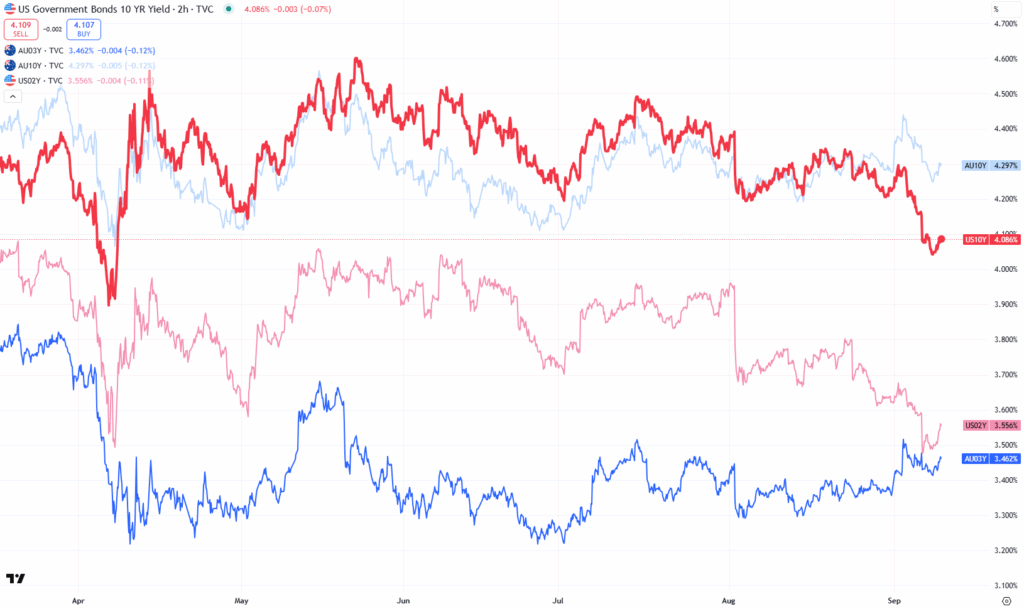

U.S. employment figures for the year ending in March were sharply revised downward by 911,000 jobs, pointing to potential labor market weakness even before recent trade tariffs imposed by President Trump. This preliminary benchmark revision was at the high end of economist expectations, and is derived from the Quarterly Census of Employment and Wages. Some skepticism persists regarding the magnitude of the downward adjustment, with Goldman Sachs noting that such estimates may undercount unauthorized immigrants and are often later revised upward. A final revision will be published with the January 2026 employment report, while attention this week also focuses on key inflation data—Wednesday’s producer price index and Thursday’s consumer price index—which could influence the Federal Reserve’s policy stance.

A weak labour market, coupled with inflation around 3% is the definition of Stagflation, historically the worst economic conditions for equity markets

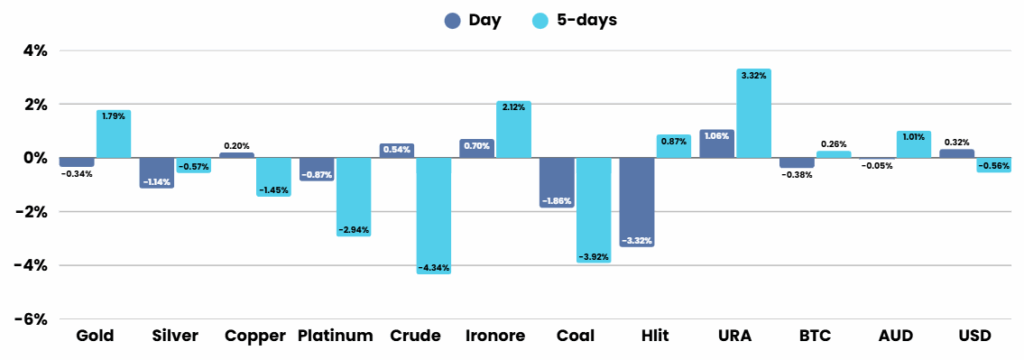

Energy markets responded to geopolitical tensions after Israel struck senior Hamas leaders in Doha, Qatar, provoking condemnation from the Qatari government and pledges to defend its sovereignty. Brent crude futures rose 0.8% to $66.56 per barrel, while U.S. West Texas Intermediate futures increased by 0.8% to $62.78 per barrel on the news. These price movements added to market uncertainty as investors digested corporate earnings, major economic data, and global developments.

In addition, Atlassian shares rose on news of the firm’s plan to phase out Data Center products over six years to boost cloud usage, while Core & Main stock dropped after disappointing quarterly results and guidance. Oracle was set to report its earnings after the market closed.

Corporate Earnings

- Oracle +27% – raised its forecast for its Oracle Cloud Infrastructure (OCI) business, projecting 77% growth this fiscal year to $18 billion, surpassing its earlier 70% estimate, with plans to scale revenue to $144 billion over the next four years. The company’s shares surged 23% after the announcement, which was fueled by four multi-billion-dollar contracts signed in the first quarter. Overall quarterly revenue climbed 12% to $14.93 billion, while remaining performance obligations soared 359% to $455 billion. CEO Safra Catz said additional large customer deals are expected soon, reinforcing demand for Oracle’s cost-effective AI cloud tools, while Chairman Larry Ellison highlighted a 1,529% jump in multi-cloud database revenue from partnerships with Amazon, Google, and Microsoft. Oracle plans to further scale its cloud capacity with 37 new data centers for these hyperscalers, bringing the total to 71.

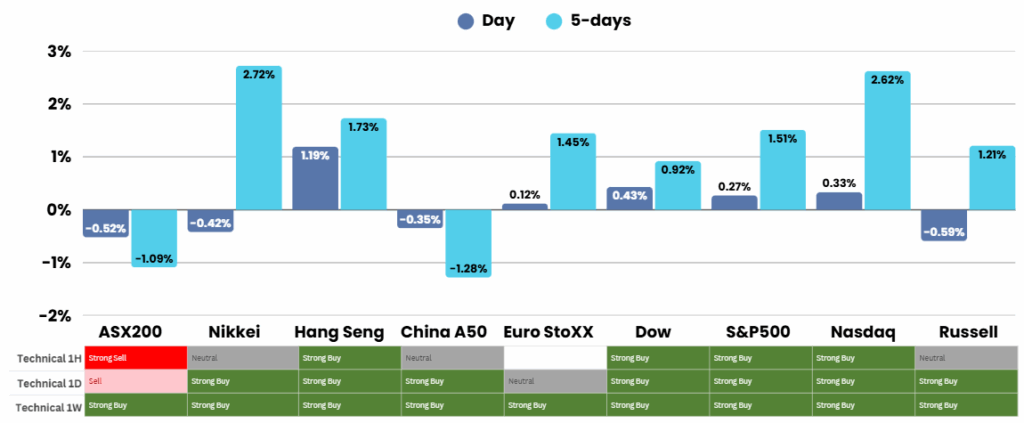

ASX Overnight: SPI 8820 (-0.01%)

The Day Ahead:

We don’t expect major movement in the ASX market today, however the negative US jobs numbers may weigh on the Asian session as global fund managers digest the horrible numbers

Yesterdays Session:

Heavyweight banks dragged the market lower as investors took profits, with Commonwealth Bank and Macquarie down 1.3 per cent, Westpac off 0.8 per cent after a downgrade, and ANZ slipping 0.6 per cent on job cut reports. Energy stocks also weakened following OPEC+’s plan to boost output, led by declines in Woodside, Viva, Beach and Santos. Among bright spots, Telix Pharmaceuticals jumped 4.3 per cent on FDA progress, Life360 rose 3.4 per cent to extend its stellar run, while BHP eased 0.7 per cent after settling a class action.

You can now listen & Watch to the Pre Market Pulse

Be Alert, But Not Alarmed: Cracks Showing in Credit Markets

With so much happening in AI, precious metals, geopolitics & US politics, it’s easy to get caught up in the day-to-day noise. But one thing that is very important to monitor is the subtle yet significant shift is emerging in credit markets that’s worth keeping on your radar.

The Scramble for Critical Minerals: A Boom for ASX Investors?

In the high-stakes world of global commodities, a new scramble is underway—one that could redefine supply chains and spark massive investment opportunities