What's Affecting Markets Today

Nikkei Breaks 45,000 as Asian Markets Rally on Trade Optimism

Asian equity markets started the week on a strong note, led by Japan’s Nikkei 225, which surged past 45,000 for the first time on Monday. The milestone came after U.S. President Donald Trump signalled progress in U.S.-China trade negotiations taking place in Spain.

Adding to the positive tone, U.S. Treasury Secretary Scott Bessent announced a “framework” agreement for the divestment of TikTok’s China-owned assets, noting that commercial terms have already been finalised. Both Trump and Chinese President Xi Jinping are expected to speak on Friday to outline next steps.

Japan’s broader Topix index gained 0.41 per cent to a record 3,172.33. South Korea’s Kospi also closed at fresh highs, advancing for a second consecutive day after the government scrapped its plan to raise capital gains tax on stock investments. Leading gainers included Kolon Mobility Group, up 29.9 per cent, Il Dong Pharmaceutical, up 18.2 per cent, and food producer Nongshim, up 16.8 per cent.

Elsewhere, Australia’s S&P/ASX 200 climbed 0.26 per cent, while Hong Kong’s Hang Seng slipped 0.13 per cent and China’s CSI 300 eased 0.28 per cent.

ASX Stocks

ASX 200 8,877.7 (+0.28%)

Commodities Rally Lifts ASX; CSL and Super Retail Slide

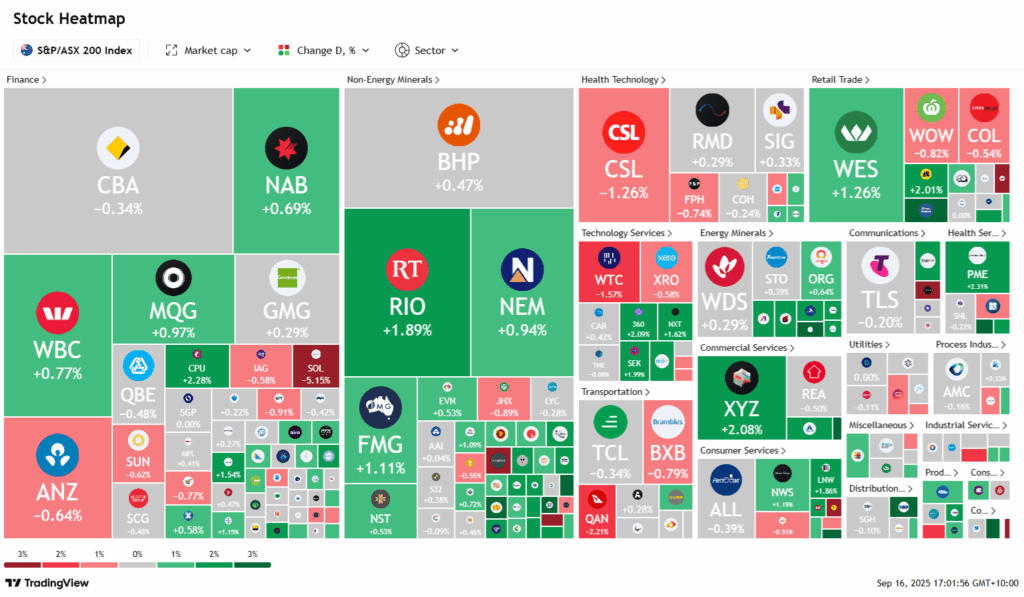

The Australian sharemarket ended higher on Tuesday, buoyed by strength in resources and record-setting gains on Wall Street. The S&P/ASX 200 rose 24.7 points, or 0.3 per cent, to close at 8877.7, with eight of 11 sectors in positive territory. The Australian dollar also hit a fresh 10-month high at US66.76¢.

Materials led the gains as iron ore traded near US$107 a tonne. BHP added 0.5 per cent, Rio Tinto climbed 1.9 per cent and Fortescue gained 1.1 per cent. Gold miners rallied strongly on record bullion prices, with Bellevue up 6.3 per cent. Energy also advanced, led by New Hope, which jumped 5.1 per cent after reporting a $439.4m profit and declaring a 15¢ dividend. Uranium producers surged, with Deep Yellow and Boss Energy up 9.2 and 7.1 per cent respectively, on reports of US strategic stockpiling.

In corporate news, CSL fell 1.3 per cent after announcing a $760m investment in biotech VarmX. Super Retail plunged 4.3 per cent after its chief executive was dismissed over an office romance.

Leaders

DYL – Deep Yellow Ltd (+9.19%)

NXG – Nexgen Energy (+8.75%)

CU6 – Clarity Pharma (+6.81%)

BGL – Bellevue Gold Ltd (+6.32%)

ILU – Iluka Resources Ltd (+5.48%)

Laggards

OBM – Ora Banda Mining Ltd (-5.29%)

SOL – Washington H. Soul (-5.15%)

DTR – Dateline Resources Ltd (-4.92%)

SUL – Super Retail Group Ltd (-4.29%)

DRO – Droneshield Ltd (-3.68%)