Overnight – The record run continues on iPhone, AI and Rate-cut optimism

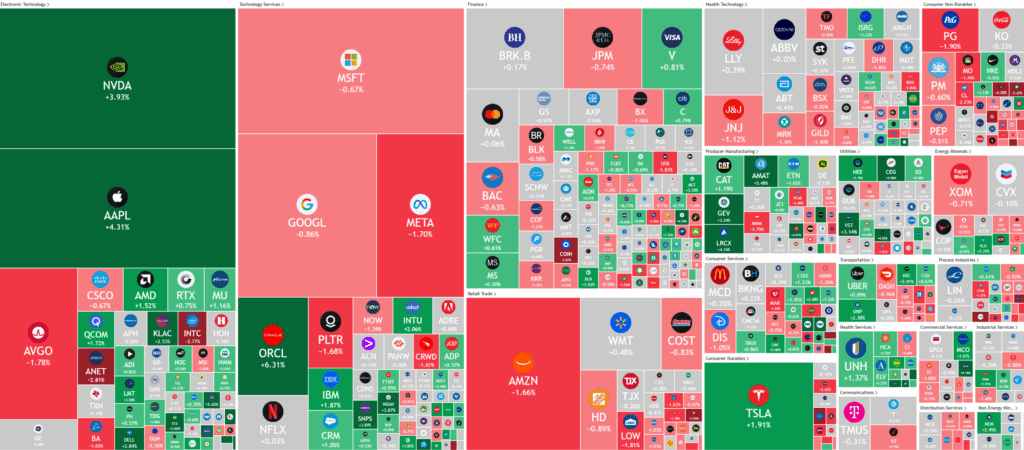

Stocks clinched another record high as investors continued to pile into big tech, with Nvidia and Apple leading to the upside amid AI optimism and expectations for strong iPhone demand.

Nvidia’s stock saw a jump of more than 3% after announcing plans to invest up to $100 billion in OpenAI, aiming to build 10 gigawatts of computing capacity over several years. Meanwhile, Apple shares hit eight-month highs following Wedbush’s decision to increase its price target to $310 from $270, reflecting optimism regarding iPhone demand. Wedbush projects iPhone 17 pre-orders to rise by 5-10% compared to last year, with significant upgrades anticipated from the existing 1.5 billion global users, many of whom have not purchased a new phone in the past four years.

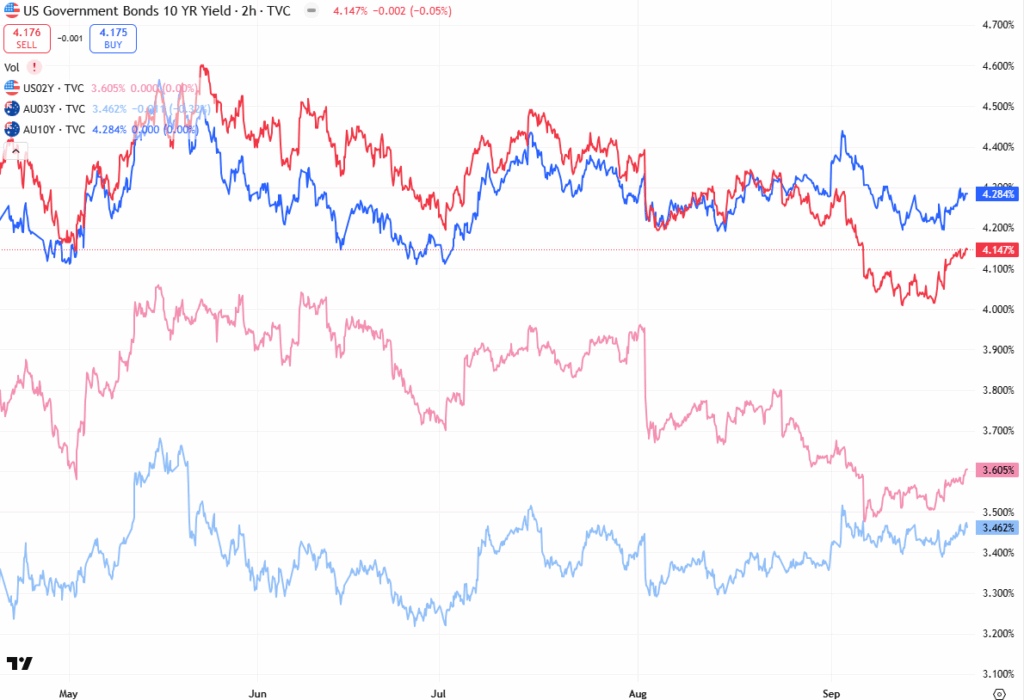

On the policy front, several Federal Reserve officials expressed caution about enacting further interest rate cuts, citing persistent inflation concerns. Atlanta Fed President Raphael Bostic stated that additional cuts were unnecessary for now, while other Fed officials echoed a cautious approach, noting that the labor market remains resilient but that inflation still runs above the Fed’s target. These remarks precede a speech by Fed Chair Jerome Powell and the release of several critical economic data points, including September’s purchasing managers index, second-quarter GDP growth, and the closely watched PCE price index, which serves as the Fed’s preferred gauge of inflation.

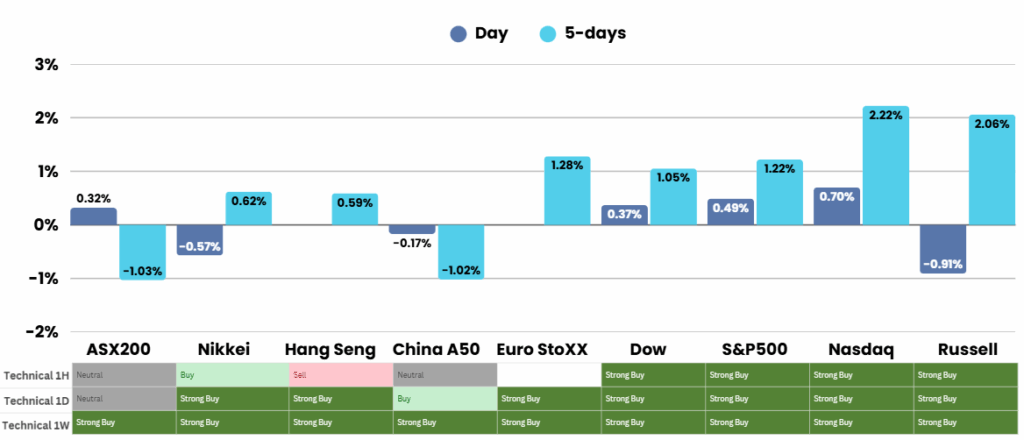

As the market digests these policy signals, Goldman Sachs has increased its S&P 500 targets, citing robust earnings growth as a catalyst for further gains even amidst elevated valuations. Goldman now predicts the index will reach 6,800 by year-end, 7,000 within six months, and 7,200 over the next year, projecting respective returns of 2%, 5%, and 8% from the previous close. Both Goldman and RBC Capital note that historical trends following Fed rate cut cycles suggest further upside potential for the S&P 500, especially if earnings continue to be the primary growth driver.

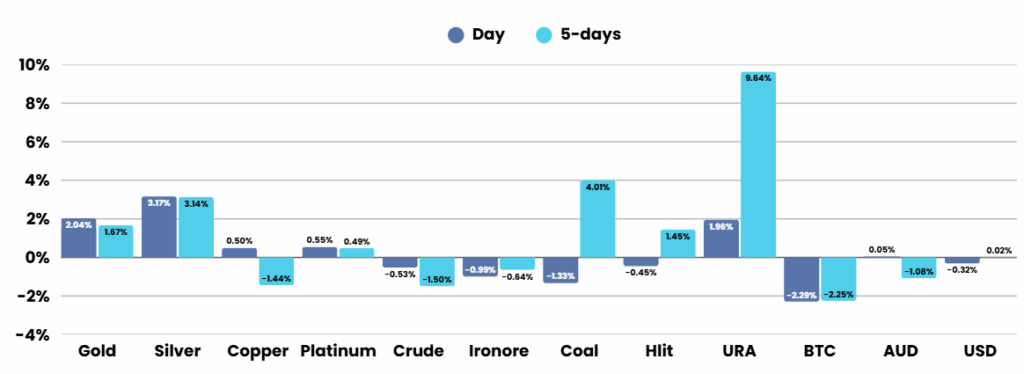

In sector-specific news, Micron Technology is set to report earnings, with investor sentiment positive following strong results from peers like Broadcom and Oracle. Jabil Circuit and Accenture will also post results amid ongoing debate about artificial intelligence’s sector impact. Meanwhile, gold prices hit a record high at $3,771.60 per ounce, buoyed by expectations of further U.S. rate cuts, which also lifted silver to 14-year highs. Conversely, oil prices declined, giving up gains previously driven by Middle Eastern geopolitical tensions and new EU measures against Russian energy.

ASX Overnight: SPI 8826 (+0.03%)

The Day Ahead:

Gold, Silver and AI themed stocks will be the glimmers of green on the boards today, while the rest of the market will likely remain patchy

Fridays Session:

Mining stocks rallied with Rio Tinto, Fortescue, and BHP all gaining, boosted by strong moves in gold miners and uranium producers on rising commodity demand. Reece jumped over 14 per cent on a major buyback, while Starpharma soared 73 per cent after striking a licensing deal, but Viva Energy slid 8 per cent following a key executive’s resignation.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.