Overnight – Stocks grind higher on US/China positivity

Stocks ground higher overnight as the market managed to find fresh positivity on the old news story that Trump & Xi will meet in South Korea next week.

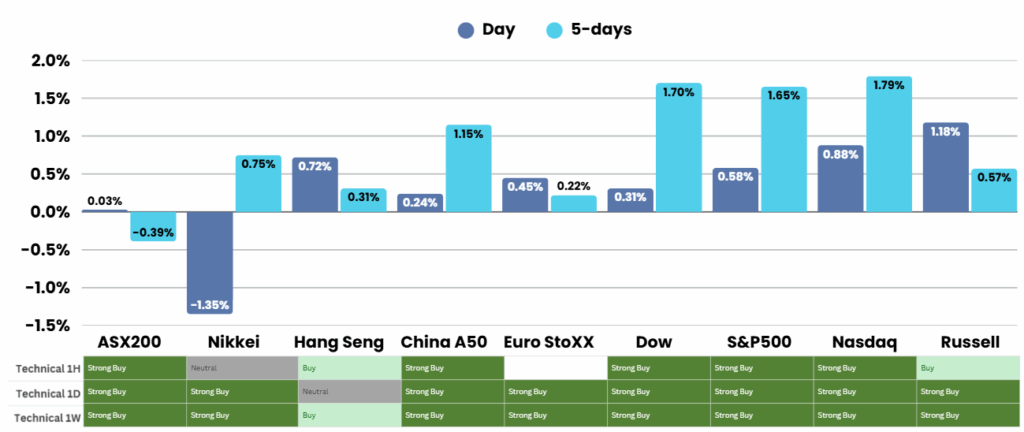

Global markets gained traction after the White House confirmed President Donald Trump will meet Chinese President Xi Jinping next week during Trump’s Asia tour. The news eased escalating trade tension between Washington and Beijing, which had recently traded threats of tariff hikes. Investors interpreted the confirmation as a stabilizing moment amid uncertainty over U.S. policy toward China. Market strategist Zachary Hill described the upcoming meeting as a “positive checkpoint for sentiment,” noting its role in lifting investor confidence. Major indexes responded strongly, with the Dow Jones Industrial Average rising 0.31%, the S&P 500 up 0.58%, and the Nasdaq Composite gaining 0.89%.

Earnings season further buoyed sentiment as results from major companies broadly surpassed expectations. Tesla shares rebounded 2.3% despite a profit miss, while IBM slipped 0.9% on weak cloud growth. Roughly one-quarter of S&P 500 companies have reported third-quarter results, and 86% have beaten forecasts, reflecting solid corporate health. Analysts now expect 9.9% earnings growth year-on-year, up from earlier estimates of 8.8%. Notable moves included Molina Healthcare plunging 17.5% after cutting profit guidance, while Honeywell, American Airlines, and Valero Energy saw significant gains following stronger projections and results.

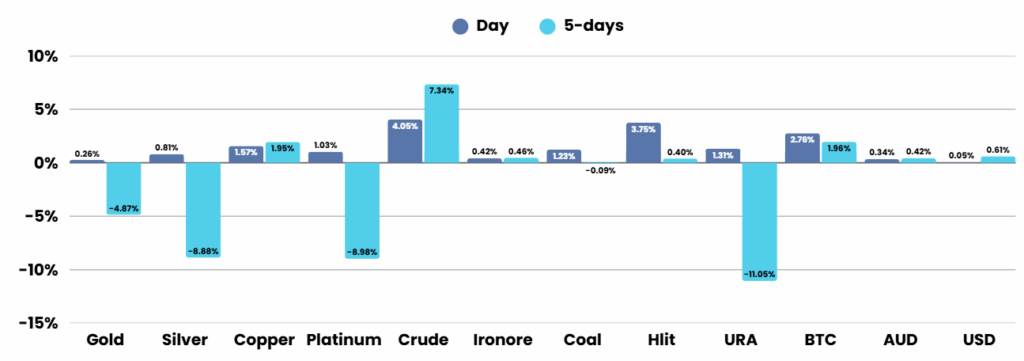

Geopolitical developments added momentum to specific sectors. Trump’s newly announced sanctions on Russian oil giants Lukoil and Rosneft triggered a surge in oil prices, lifting energy shares by 1.3%. Exxon Mobil and Chevron posted modest gains, while Valero Energy climbed 7%. The move also signaled a shift in Trump’s approach to Moscow, heightening geopolitical risk but easing oversupply concerns in crude markets. Meanwhile, defense stocks rose 2.2% amid growing global instability, and quantum computing firms rallied sharply after reports that the administration may invest in the sector through equity stakes in exchange for federal funding. The combination of diplomatic progress, strong earnings, and targeted policy actions strengthened overall market confidence heading into the final quarter.

Corporate News & Earnings

- Moderna -2.2% – stock fell after the drugmaker announced topline results from a Phase 3 study of its cytomegalovirus, or CMV, vaccine that did not meet its primary efficacy endpoint of preventing CMV infection in select female participants. The quarterly earnings season has seen roughly 86% of firms reported results that have topped analysts’ estimates. S&P 500 earnings growth for the period is seen rising 9.3% versus a year ago, on aggregate, according to LSEG data cited by Reuters.

- American Airlines +5.62% – stock rose after the carrier reported better-than-expected third-quarter results, with losses narrower than anticipated.

- Honeywell +6.85% – stock gained after the manufacturing conglomerate raised its 2025 profit forecast despite the impact of a planned separation of its advanced materials unit, signaling robust growth prospects fueled by strong aerospace demand.

- Beyond Meat -20.95% – fell reversing course following a more than 450% climb in the heavily-shorted stock so far this week.

- Rivian Automotive -1.32 – stock fell after the Wall Street Journal reported the electric-vehicle maker is set to lay off more than 600 people.

ASX Overnight: SPI 9052 (+0.01%)

The Day Ahead:

Likely a quest day ahead for the index, however corporate reporting could add some spice in individual stocks

- Quarterly updates on Friday include Newmont , Pilbara Minerals and Whitehaven Coal. Amotiv is scheduled to hold its annual meeting.

- At 11.05am, Reserve Bank of Australia governor Michele Bullock will speak at the Bradfield Oration in Sydney.

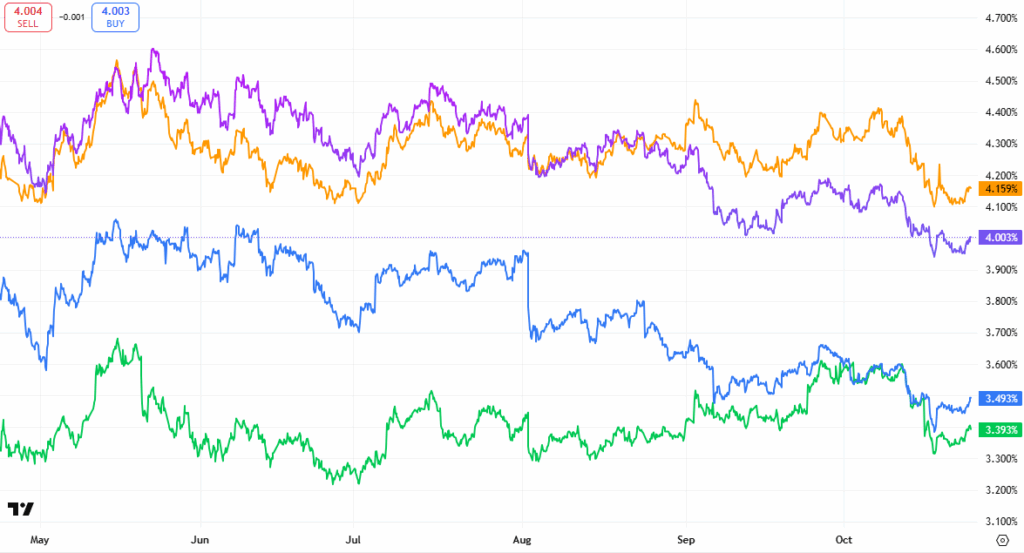

- Overseas, Japan will release CPI, as well as manufacturing PMIs from Japan, France, Germany, the EU, the UK and the US. Most importantly, the US will release the September CPI at 11.30pm.

Yesterdays Session:

The Australian sharemarket edged up 0.1% to 9039 on Thursday as surging energy stocks offset weakness in technology shares. Oil producers rallied after U.S. sanctions on Russian firms lifted Brent crude above US$64, with Woodside up 4.1%, Santos 2.2%, and Karoon Energy 8.8%. Tech stocks fell in line with Wall Street, while materials were mixed, as BHP slipped but Fortescue rose. Among other movers, IAG gained on upgraded guidance, Ainsworth Game Technology jumped on a takeover bid, and Super Retail Group declined after modest sales growth.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.