What's Affecting Markets Today

Asia-Pacific markets were mixed on Wednesday as investors assessed key regional economic data and trade developments. Japan’s Nikkei 225 rose 0.14% and the Topix added 0.5%, while South Korea’s Kospi and Kosdaq slipped 0.2% and 0.25% respectively. Australia’s S&P/ASX 200 was little changed. Meanwhile, Hong Kong’s Hang Seng fell 0.53%, and China’s CSI 300 was flat after disappointing manufacturing data.

China’s factory activity contracted more than expected in April, hitting a near two-year low as trade tensions with the U.S. weighed on exports. In Australia, first-quarter inflation rose 2.4% year-on-year, slightly above Reuters’ forecast of 2.3%.

The Bank of Japan began its policy meeting and is expected to hold rates at 0.5% when the decision is announced Thursday.

On the trade front, U.S. President Donald Trump said talks with India are progressing well, while Treasury Secretary Scott Bessent highlighted “substantial” negotiations with Japan and emerging outlines of a deal with South Korea.

Overnight, Wall Street extended its rally. The Dow added 300 points, while the S&P 500 and Nasdaq gained 0.58% and 0.55% respectively.

ASX Stocks

ASX 200 - 8,098.5 (+0.30%)

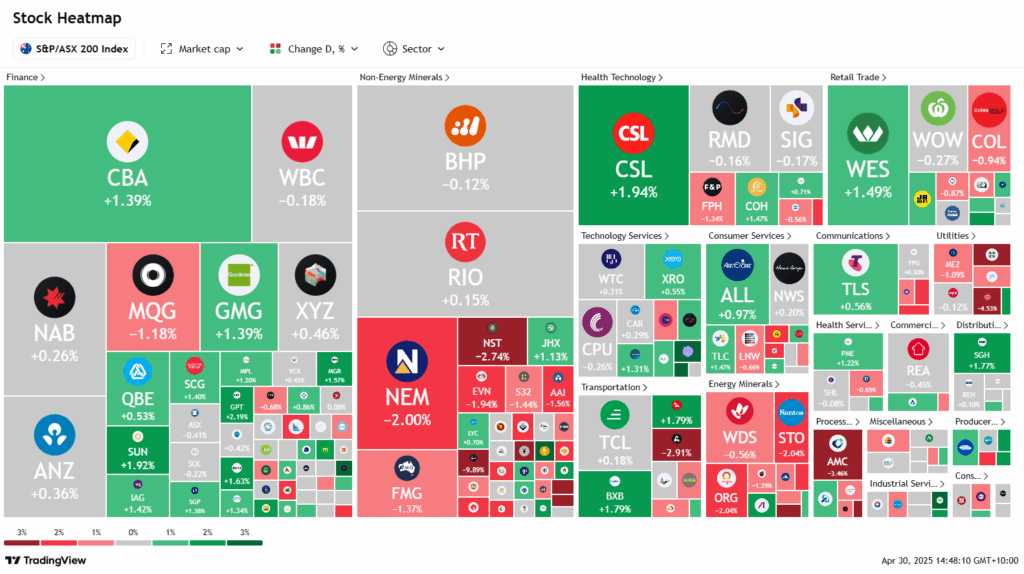

The Australian sharemarket extended gains on Wednesday, tracking Wall Street’s positive momentum despite weaker US economic data. The S&P/ASX 200 rose 0.3 per cent, or 23.2 points, to 8093.8 by 2pm, its highest in two months. The All Ordinaries also advanced 0.3 per cent, supported by strength in real estate and financials.

US equities continued higher, with the S&P 500 posting a sixth straight gain, even as job openings declined and consumer confidence hit a five-year low. Investor sentiment was supported by US Treasury Secretary Scott Bessent’s comments on progress with trade deals. However, US futures slipped following weak earnings from Super Micro Computer.

Locally, Commonwealth Bank gained 1.5 per cent and Goodman Group rose 1.4 per cent, while DigiCo added 2.4 per cent. In contrast, weakness in iron ore and gold weighed on miners—Newmont fell 1.9 per cent and Fortescue lost 1.7 per cent. Defensive sectors lagged, with Origin down 1.8 per cent.

Ora Banda dropped 7.1 per cent after cutting production guidance. Alcoa slipped 1.6 per cent, citing power disruptions in Spain. Star Entertainment and Champion Iron were marginally weaker.

Leaders

DVP Develop Global Ltd (+6.84%)

BVS Bravura Solutions Ltd (+4.50%)

PXA Pexa Group Ltd (+4.45%)

RMS Ramelius Resources Ltd (+3.32%)

MP1 Megaport Ltd (+3.08%)

Laggards

CYL Catalyst Metals Ltd (-8.47%)

OBM Ora Banda Mining Ltd (-6.60%)

LTR Liontown Resources Ltd (-6.14%)

NXG Nexgen (Canada) Ltd (-6.00%)

PDN Paladin Energy Ltd (-4.89%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!