What's Affecting Markets Today

Asia-Pacific markets traded mixed following the U.S. Federal Reserve’s widely anticipated decision to hold interest rates steady. The Federal Open Market Committee kept the benchmark rate unchanged at 4.25%–4.5%, where it has remained since December.

Japan’s Nikkei 225 rose 0.25%, while the broader Topix slipped 0.11%. South Korea’s Kospi added 0.21%, with the Kosdaq up 0.58%. Australia’s S&P/ASX 200 was flat. In China, Hong Kong’s Hang Seng Index rose 0.24%, while the mainland CSI 300 was unchanged.

Fed Chair Jerome Powell, in his post-meeting remarks, flagged concerns that existing tariff increases could slow growth and fuel longer-term inflation. Market participants are also focused on the upcoming U.S.-China trade discussions, with Treasury Secretary Scott Bessent scheduled to meet Chinese officials in Switzerland this week.

Despite the Fed’s cautionary tone, Wall Street finished higher overnight. The Dow gained 284.97 points (0.70%) to close at 41,113.97, while the S&P 500 rose 0.43% to 5,631.28. The Nasdaq added 0.27%, closing at 17,738.16. U.S. equity futures were marginally lower in early Asia trade.

ASX Stocks

ASX 200 - 8,193.0 (+0.20%)

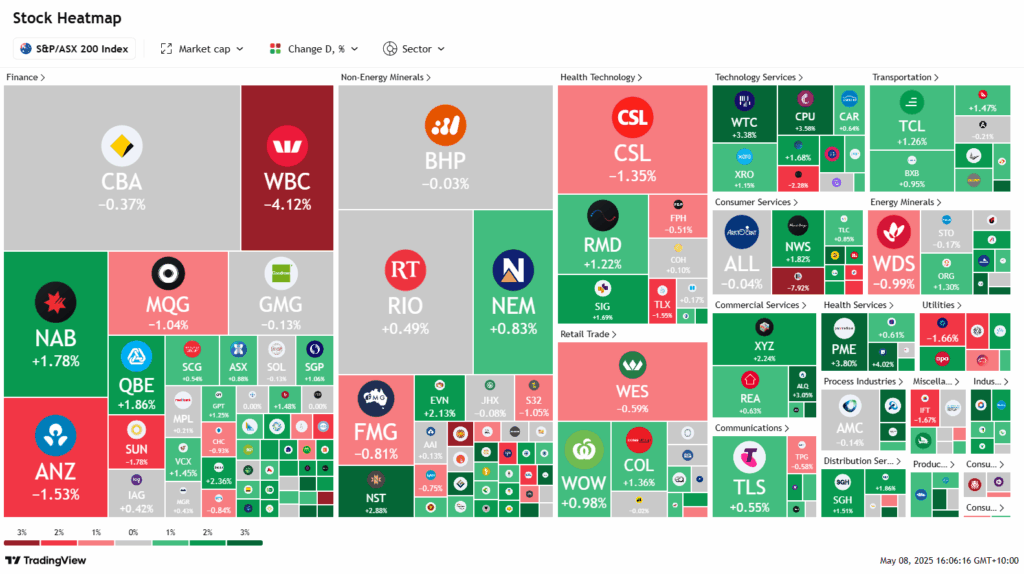

Australian shares rebounded from early losses as optimism around a potential trade agreement and expectations of US rate cuts lifted sentiment. The S&P/ASX 200 rose 30.3 points, or 0.4%, to 8208.6 by 2pm, with nine of eleven sectors trading higher. The All Ordinaries also gained 0.4%.

US futures turned positive after President Trump signalled a trade deal announcement this Thursday, likely with the UK. Treasury Secretary Scott Bessent is set to begin trade talks with China. Bitcoin rallied 2.6% to approach US$100,000, reflecting the risk-on tone.

Despite keeping rates steady, Fed Chair Jerome Powell acknowledged growing economic uncertainty. Markets remain confident of three rate cuts this year, pricing in a 70% chance of a July move.

Defensive sectors led the ASX gains, with AGL Energy up 2.2% and Coles up 2%. Computershare rose 4.3%. Banks were mixed, with ANZ falling 2% on weak results, while NAB gained 1.6%.

Notable movers: Orica jumped 8.4% on a strong earnings update; Guzman y Gomez rose 3.5%; Pro Medicus gained 4.1%; Light & Wonder dropped 6.3%.

Leaders

MGH Maas Group Holdings Ltd (+10.72%)

PNV Polynovo Ltd (+10.69%)

CYL Catalyst Metals Ltd (+9.61%)

GDG Generation Development Group Ltd (+9.22%)

ORI Orica Ltd (+7.84%)

Laggards

KLS Kelsian Group Ltd (-8.79%)

LNW Light & Wonder Inc (-7.73%)

FCL Fineos Corporation Holdings Plc (-5.19%)

WBC Westpac Banking Corporation (-4.14%)

PLS Pilbara Minerals Ltd (-4.06%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!