Overnight – Stocks higher on US – UK Trade deal

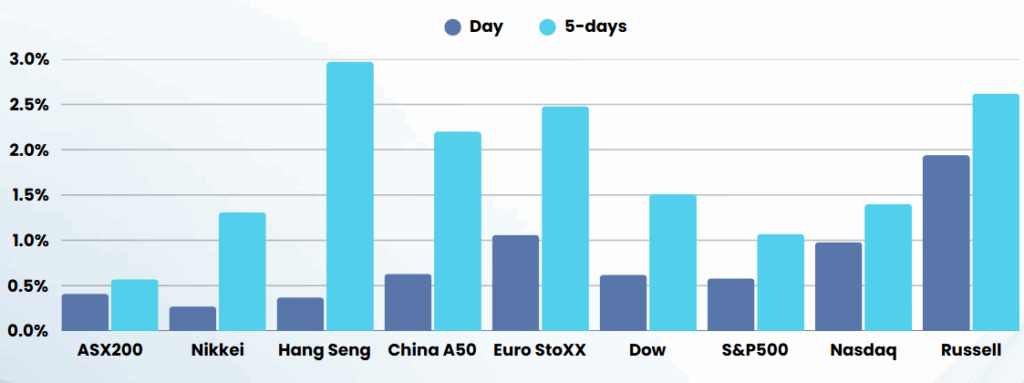

Stocks rallied over night as President Trump announced a trade deal between the U.S. and the U.K., which he described as the “first of many,” stoking hopes for a flurry of trade deals ahead.

Trump signed a framework for a trade deal with the United Kingdom, raising hopes that the Trump administration’s chaotic trade policies could soon be settling down. “It’s very conclusive and we think everyone’s going to be happy,” Trump said. “Many countries want to make a deal, and many countries are very unhappy that we happened to choose this one,” he said. Under the deal, the 10% tariff that was imposed on goods imported from the UK remains in place, while the U.K. agreed to lower its tariffs to 1.8% from 5.1% and provide further access to U.S. goods. But steel and aluminium imports to the US would be exempt from the U.S.’s 25% levy and U.K. “It opens up a tremendous market for us,” Trump said. Thursday’s trade deal is the first after Trump in early-April announced a barrage of “reciprocal” trade tariffs against major U.S. trading partners. He had later announced a 90-day exemption from the tariffs amid widespread backlash. The U.K. was not subject to Trump’s reciprocal tariffs, although it still faces a 10% universal duty, as well as his steep sectoral tariffs. This followed news that U.S. officials were set to meet their Chinese counterparts over the weekend for trade talks.

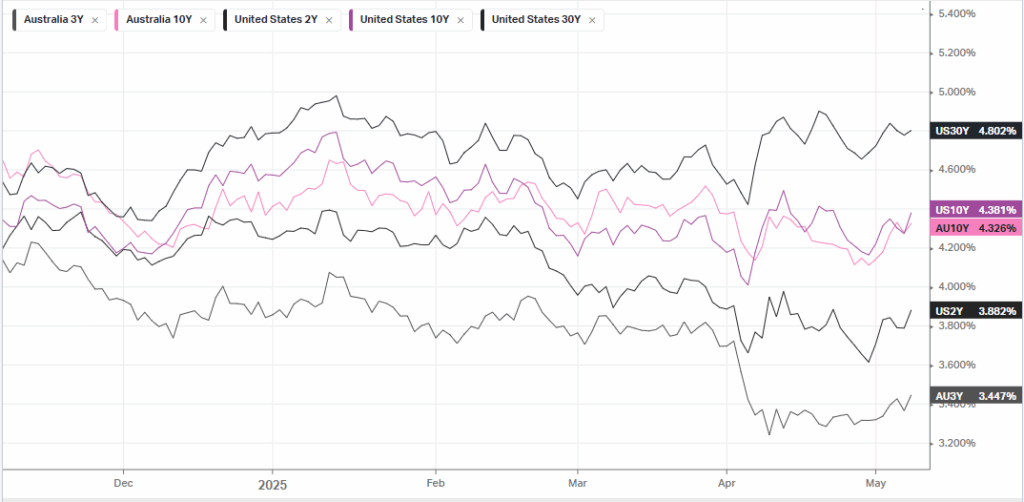

The Fed kept interest rates steady, but warned that risks of higher inflation and unemployment had increased, further clouding the economic outlook in the face of Trump’s trade tariffs. Chair Jerome Powell said it was unclear if the economy would continue to grow steadily, or shrink due to a potential spike in inflation. Powell flagged heightened uncertainty over just what Trump will do with his tariff agenda, and signalled that the central bank will not make any changes until the outlook was clear. That said, the Fed chief also noted that the U.S. economy remained relatively resilient.

The number of Americans filing new applications for unemployment benefits fell more than expected last week, as initial claims for state unemployment benefits dropped 13,000 to a seasonally adjusted 228,000 for the week ended May 3, the Labor Department said on Thursday. Economists had forecast 231,000 claims for the latest week.

Company Earnings

- Warner Bros Discovery – stock rose 5% even as the media giant missed first-quarter revenue estimates, weighed down by a lack of big box office hits and weakness in its traditional TV business.

- Peloton – stock dropped more than 6% after the fitness company reported a loss in the third quarter, even as it raised its 2025 revenue forecast, banking on an increase in subscriptions for its instructional videos to offset slowing demand for its exercise equipment.

- Arm Holdings – dropped 6% after the semiconductor name issued disappointing guidance.

ASX SPI 8216 (+0.01%)

The Aussie market should head higher over the day as progress around trade deals will ease investor anxiety.

- Macquarie Group’s full-year profit rose 5 per cent to $3.7 billion as the group’s asset management division grew profits by a third, though assets under management fell flat.

- REA Group grew revenues by 18 per cent in the nine months to March, despite mounting operating costs for the real estate platform.