What's Affecting Markets Today

Asia-Pacific Markets Mixed as U.S. Tariff Delay Weighed

Asia-Pacific markets traded mixed on Monday as investors digested U.S. President Donald Trump’s decision to delay a proposed 50% tariff on European Union imports until July 9, offering temporary relief but keeping uncertainty elevated.

Japan’s Nikkei 225 rose 0.86%, supported by gains in industrials and tech, while the broader Topix advanced 0.46%. South Korea’s Kospi climbed 1.15% and the Kosdaq added 1.38%, buoyed by semiconductor strength.

In contrast, Chinese equities declined, with the CSI 300 down 0.73% and Hong Kong’s Hang Seng falling 1%, as weak property sector sentiment and geopolitical tensions continued to weigh on investor confidence. India’s Nifty 50 and BSE Sensex rose 0.78% and 0.77%, respectively, driven by banking and energy stocks.

Australia’s S&P/ASX 200 was flat, reflecting cautious trade ahead of key economic data and as U.S. markets remained shut for Memorial Day.

U.S. futures edged higher in early Asia trade, following Friday’s broad-based decline. The S&P 500 fell 0.67%, the Nasdaq dropped 1%, and the Dow lost 0.61%, closing at 41,603.07 points.

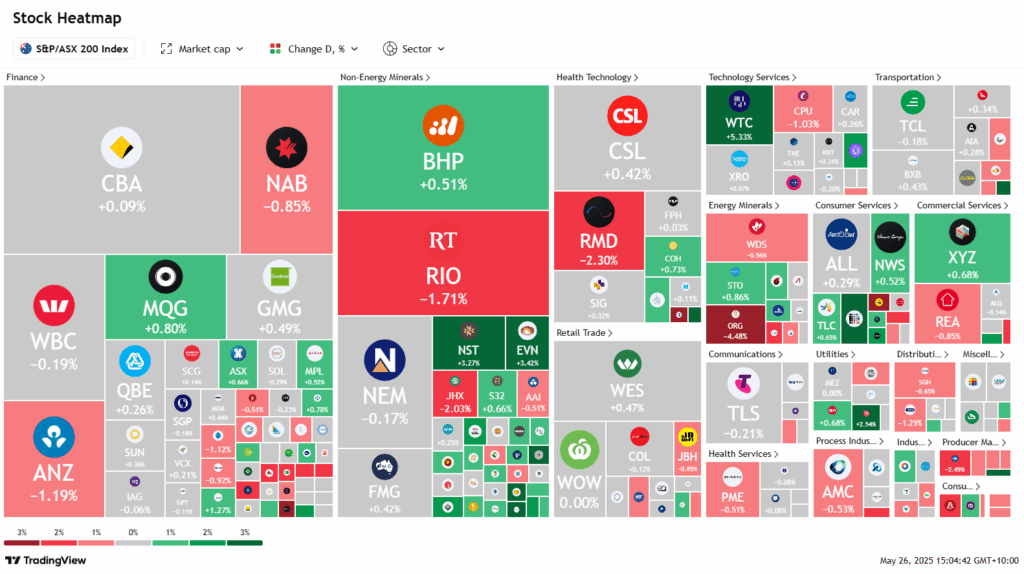

ASX Stocks

ASX 200 8,367.7 (+0.08%)

ASX Treads Water; Uranium Stocks Rally on U.S. Nuclear Boost

Australian shares fluctuated on Monday, with the S&P/ASX 200 Index edging just 0.6 points higher by 2pm, as markets reacted cautiously to U.S. President Donald Trump’s decision to delay a 50% tariff on EU imports until July 9. The Nasdaq rebounded, with futures up more than 1%, while the U.S. dollar weakened to its lowest level since 2023, lifting the Australian dollar and the yuan to six-month highs.

Technology led sector gains, with WiseTech jumping over 5% after announcing a $3.25 billion acquisition of U.S. supply chain platform e2open. Uranium stocks surged further following a U.S. executive order supporting nuclear energy. Deep Yellow rallied 17.3%, Paladin Energy rose 14.2%, and Boss Energy gained 9.3%.

Offsetting gains, Origin Energy fell 4% on weaker-than-expected earnings guidance. Elders dropped 6.8% despite reporting a sharp rise in half-year profit. Genesis Minerals rose 3.7% on its $250 million deal to acquire Focus Minerals’ Laverton Gold Project, sending Focus shares up 86.7%. Accent Group slipped 1.5% following its chairman’s retirement announcement.

Leaders

DYL Deep Yellow Ltd (+16.87%)

PDN Paladin Energy Ltd (+13.61%)

BOE Boss Energy Ltd (+9.55%)

NXG Nexgen Energy (Canada) Ltd (+7.62%)

IPX Iperionx Ltd (+6.62%)

Laggards

ELD Elders Ltd (-6.36%)

MYR Myer Holdings Ltd (-5.45%)

CAT Catapult Group International Ltd (-4.90%)

ORG Origin Energy Ltd (-4.39%)

VSL Vulcan Steel Ltd (-3.68%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!