What's Affecting Markets Today

Asia-Pacific Markets Mixed Amid Tariff Uncertainty and Regulatory Action

Asia-Pacific equities traded mixed on Tuesday as investors weighed the outcome of the Shanghai Cooperation Organization meeting in Tianjin and fresh uncertainty over U.S. tariffs. A U.S. federal appeals court ruled that most of former President Donald Trump’s global tariffs are illegal, while Trump claimed India had offered to reduce tariffs on U.S. imports to zero.

India’s Nifty 50 was flat, while the BSE Sensex edged up 0.18%. Japan’s Nikkei 225 gained 0.47% and the Topix rose 0.73%. South Korea’s Kospi advanced 0.86% and the Kosdaq 0.83%, as consumer inflation slowed to 1.7% in August, its weakest rise since November. Hong Kong’s Hang Seng index fell 0.61% and China’s CSI 300 dropped 0.91%. Australia’s S&P/ASX 200 pared early declines to finish flat.

In corporate news, ASIC fined Societe Generale Securities Australia AU$3.88 million for failing to prevent suspicious trades in electricity and wheat futures between May 2023 and February 2024. Separately, Australia posted a Q2 current account deficit of AU$13.7 billion, narrower than expectations. Spot gold climbed 0.54% to $3,494.87 an ounce.

ASX Stocks

ASX 200 8,899.1 (-0.35%)

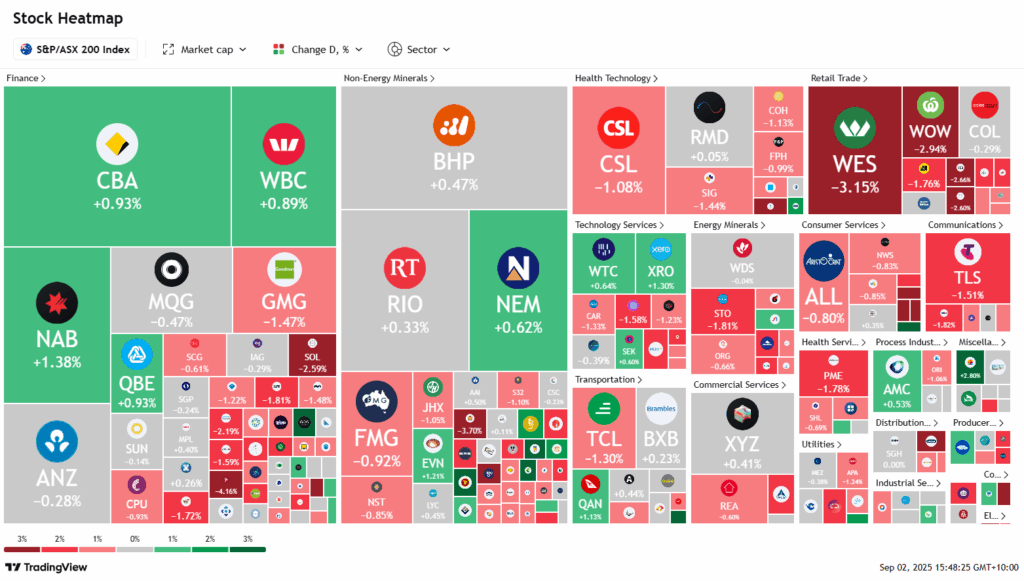

ASX Market Update: Banks and Miners Offset Ex-Dividend Drags

The Australian sharemarket pared early losses to trade slightly lower on Tuesday, as strength in banks and miners helped balance declines from ex-dividend heavyweights. The S&P/ASX 200 Index slipped 0.1 per cent, or 7.8 points, to 8919.90 at midday AEST, with Wall Street closed for the US Labour Day holiday.

Gold gained 1.4 per cent to $US3496.24 an ounce and silver surged past $US40 for the first time since 2011, driving miners higher. Ramelius Resources rose 2.7 per cent, Evolution 1.5 per cent, Perseus 2 per cent, Newmont 0.5 per cent, while BHP and Rio Tinto added 0.6 per cent and 0.2 per cent respectively.

Dividend adjustments weighed, with Wesfarmers down 2.6 per cent, Woolworths 3.2 per cent, Bendigo Bank 3.4 per cent, and Santos 2.2 per cent. Meanwhile, banks rallied: NAB rose 1.8 per cent, CBA 1.5 per cent, ANZ 0.7 per cent, and Westpac 1.4 per cent.

Key movers included Collins Foods, soaring 7.1 per cent on strong FY26 sales growth, and PolyNovo, up 8 per cent on positive US Medicare changes. In contrast, Platinum Asset Management slumped 5.5 per cent after a major client withdrew $580 million.

Leaders

PNV Polynovo Ltd (+8.75%)

NWH NRW Holdings Ltd (+8.68%)

CKF Collins Foods Ltd (+7.35%)

ZIM Zimplats Holdings Ltd (+7.19%)

SX2 Southern Cross Gold (+4.81%)

Laggards

REH Reece Ltd (-5.40%)

BAP Bapcor Ltd (-4.99%)

DRO Droneshield Ltd (-4.63%)

SMR Stanmore Resources Ltd (-4.49%)

QOR QORIA Ltd (-4.30%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!