What's Affecting Markets Today

Asia Stocks Rally as Trump–Xi Meeting Confirmed; Kospi Hits Record High

Asian markets advanced on Friday after the White House confirmed that U.S. President Donald Trump and China’s Xi Jinping will hold talks next week, lifting investor sentiment across the region.

South Korea’s Kospi surged 2% to a record high, buoyed by optimism over easing trade tensions. The smaller Kosdaq gained 0.9%, while the finance ministry reiterated its readiness to stabilize the foreign exchange market amid ongoing won volatility. The won strengthened 0.11% to 1,434.7 per U.S. dollar but remains down 4% over the past three months.

Japan’s Nikkei 225 climbed 0.78% and the Topix rose 0.39%, as September’s core inflation accelerated to 2.9%, matching forecasts and marking the first uptick since May. Headline inflation also rose to 2.9% from 2.7% in August.

Australia’s S&P/ASX 200 edged 0.19% higher at the open, with investors noting RBA Governor Michele Bullock’s plans to modernize the nation’s interbank settlement system. Hong Kong’s Hang Seng added 0.83%, and China’s CSI 300 gained 0.57%.

ASX Stocks

ASX 200 9,026.5 (-0.08%)

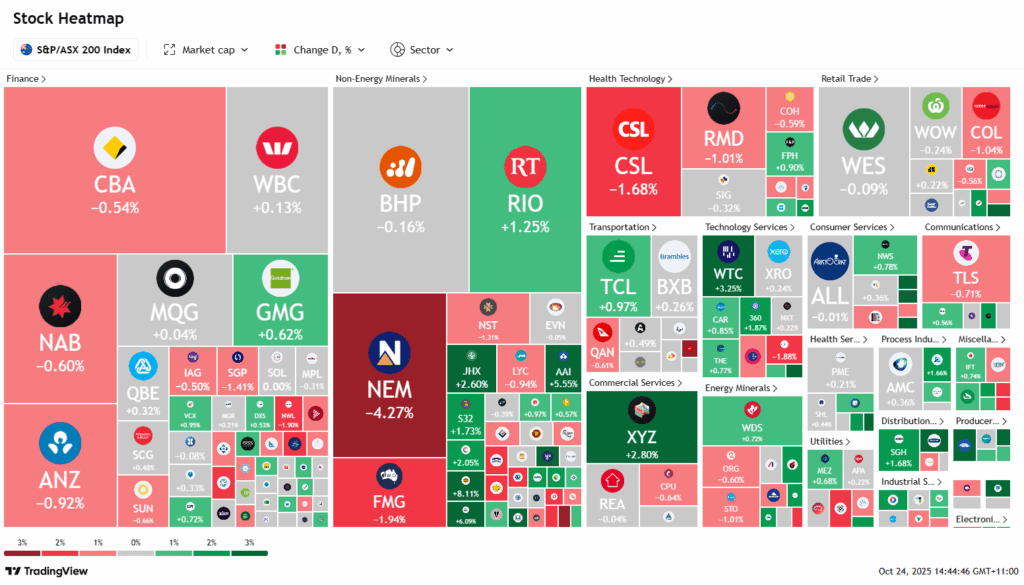

ASX Eases on Trade Jitters as Banks Weigh on Market

The Australian share market dipped on Friday as investors turned cautious ahead of next week’s high-stakes meeting between US President Donald Trump and China’s Xi Jinping, while renewed trade tensions with Canada added to uncertainty. The S&P/ASX 200 slipped 0.2% or 13.7 points to 9019.1 in afternoon trade, though remained up 0.2% for the week after setting a record high earlier.

Technology stocks led gains, while healthcare and major banks dragged. ANZ fell 1%, and Commonwealth Bank slipped 0.7%. Energy shares were mixed following US sanctions on Russian oil majors, with Beach Energy and Woodside up around 0.7%, but Santos down 0.9%.

Miners diverged—Rio Tinto rose 1.1% as BHP eased 0.5%. Lithium and critical mineral producers outperformed, led by Pilbara Minerals’ 8.3% surge after strong quarterly revenue. Gold stocks weakened as bullion retreated from Monday’s record high.

Among notable movers, GPT gained on an $860 million Sydney property deal, while Mount Gibson Iron slumped 28% after closing its Koolan Island mine.

Leaders

REG Regis Healthcare Ltd (+10.49%)

LTR Liontown Resources Ltd (+8.37%)

PLS Pilbara Minerals Ltd (+8.11%)

IGO IGO Ltd (+7.33%)

SLX SILEX Systems Ltd (+6.95%)

Laggards

EOS Electro Optic Systems Holdings Ltd (-7.14%)

ARU Arafura Rare EARTHS Ltd (-6.52%)

QOR QORIA Ltd (-4.62%)

DYL Deep Yellow Ltd (-4.43%)

PNR Pantoro Gold Ltd (-3.93%)