Investment catalysts

Investment Thesis 💡

Disney represents a compelling investment opportunity based on:

- Streaming Profitability Inflection: After years of investment, streaming business turning profitable

- Parks & Experiences Resilience: Strong bookings and expansion plans support continued growth

- Content Monetization: Valuable IP portfolio provides multiple revenue streams

- Valuation Upside: Current price offers reasonable entry point with fair value estimate of $108.95

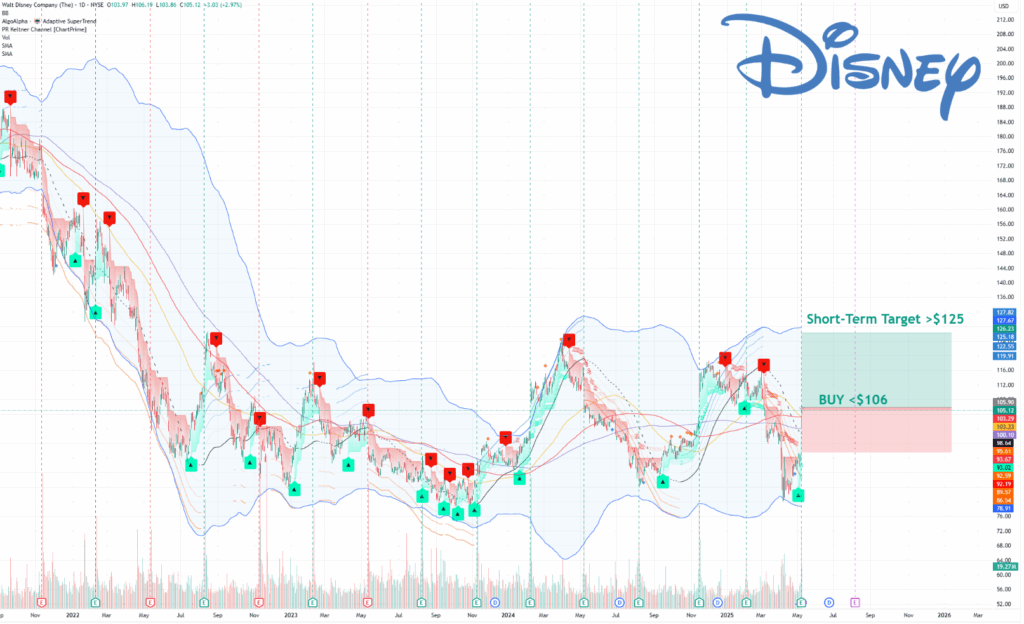

Trade Plan:

- Expected Timeframe: 1 month – Long term

- Entry:$105.50-$106

- Stop-loss: $99

- Trim Zone: (optional) $118-$120

- Target: potential long-term hold

Key Growth Drivers & Strategic Initiatives 🚀

1. Experiences Segment Strength

- Domestic park bookings for Q3 up 4% and Q4 bookings up 7%

- Planning $30 billion investment to expand Florida and California operations

- Announced Disneyland Abu Dhabi development (seventh global theme park)

- Cruise line expansion continues to drive growth in the Experiences segment

2. Streaming Progress

- Direct-to-consumer margin expansion expected to continue

- New ESPN direct-to-consumer product launching soon

- ESPN’s Q2 prime time audience in 18-49 demographic up 32% (most watched Q2 in primetime ever)

Recent Analyst Actions 📝

- Bernstein (May 8): Maintained Outperform rating with $120 target, projecting EPS could reach mid-$6 range in FY26

- Presidents Capital (May 8): Upgraded from Neutral to Buy with $137 target

- TD Cowen (May 8): Maintained Hold rating with $123 target, raising FY25 revenue estimate to $94.9B

- Loop Capital (April 29): Reduced target from $130 to $120, maintained Buy rating citing theme park competition

Risk Factors ⚠️

- Tariff Concerns: Trump’s proposed 100% tariff on foreign-produced films could impact Disney’s international production strategy

- DOJ Scrutiny: Planned merger with FuboTV facing Department of Justice scrutiny over market concentration concerns

- Theme Park Competition: New Comcast Epic Universe opening May 22, 2025, could pressure Disney’s parks business

- Overbought Indicators: RSI suggests the stock is in overbought territory after recent rally

- Earnings Revisions: 6 analysts have revised earnings downward for upcoming periods

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.