Overnight – Stocks hit fresh records as Uranium, Tesla & Nvidia Rally

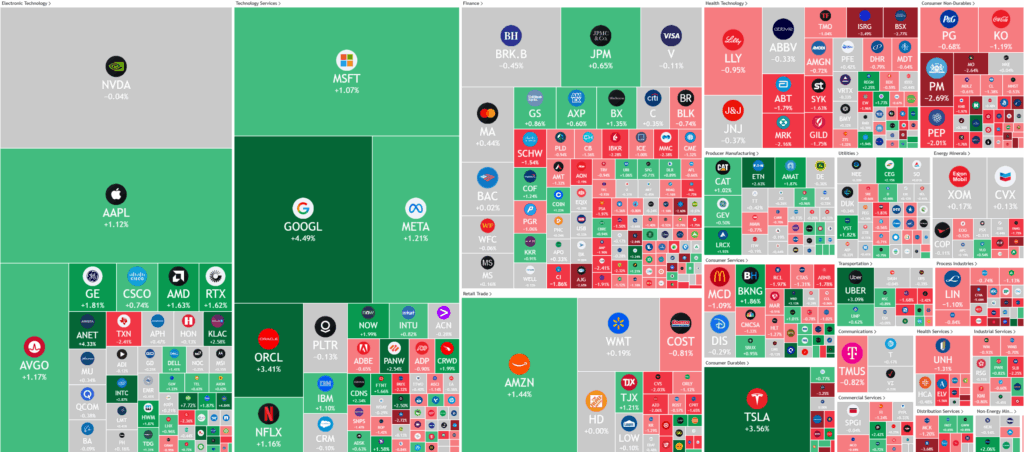

Stocks hit fresh record highs overnight, driven by a rally in Tesla and Nvidia ahead of a widely expected Federal Reserve rate-cut later this week. Uranium stocks sky-rocketed to fresh records on US policy announcements.

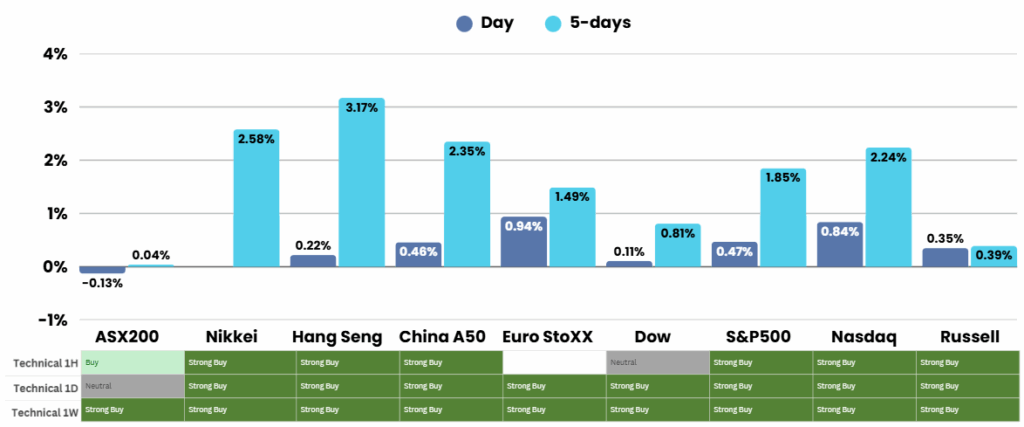

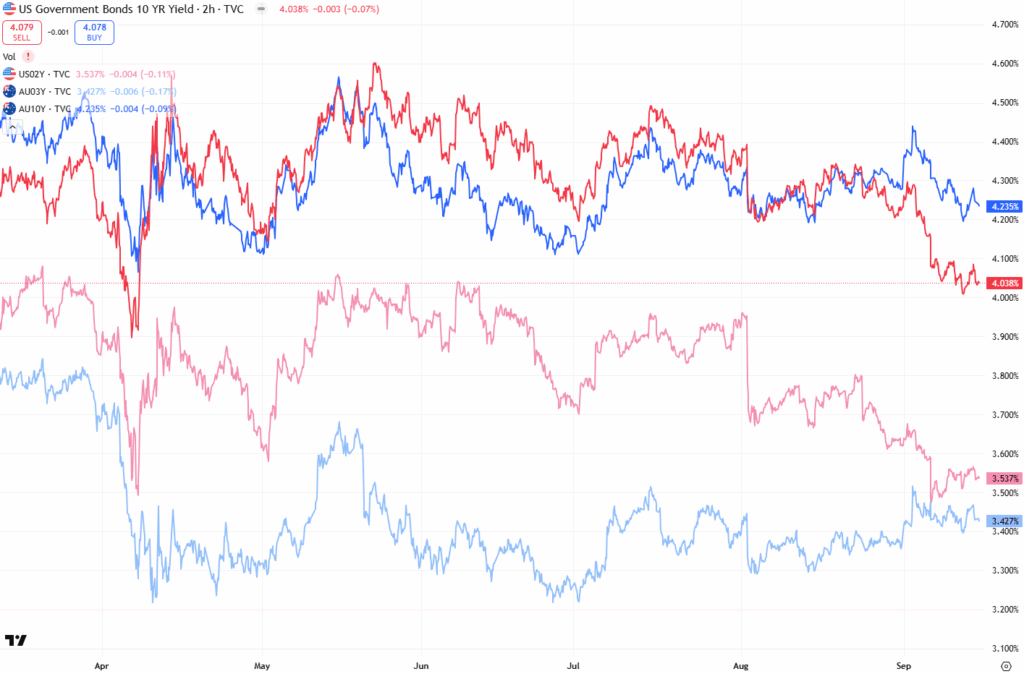

Markets are focused on the Federal Reserve this week, with expectations nearly certain that policymakers will deliver the first interest rate cut since halting their easing cycle in December. The move is largely driven by signs of cooling in the U.S. labor market and deteriorating manufacturing data, including a sharp drop in the New York Empire manufacturing index. While a rate cut is intended to support investment and hiring, it comes against the backdrop of stickier inflation pressures, with recent consumer price data showing rises in housing and food costs. Still, markets are pricing in around a 95% chance of a 25-basis-point cut, with only a small chance of a larger half-point reduction. Investors will also scrutinize updated Fed economic projections and Fed Chair Jerome Powell’s commentary for forward guidance.

In equity markets, major corporate developments drove notable moves. Nvidia closed flat after paring early losses, as China’s regulators announced they would extend their antitrust probe into the company. The chipmaker’s business partner, CoreWeave, saw shares jump after revealing a massive $6.3 billion order tied to Nvidia. Oracle surged on stronger-than-expected cloud infrastructure growth and new AI-related contracts, helping fuel broader optimism for technology stocks. Tesla meanwhile soared after CEO Elon Musk bought more than 2.5 million shares, sparking renewed investor confidence. With the stock up 85% from its April lows, Tesla has now turned positive for the year.

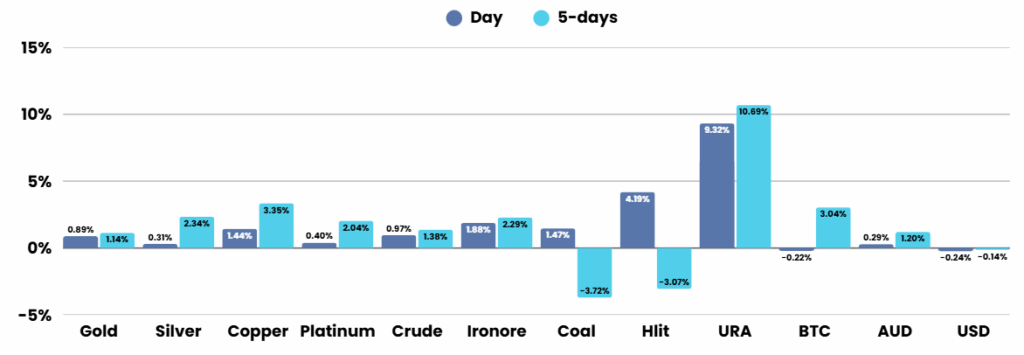

Outside of tech and Fed developments, energy and geopolitics also featured prominently. U.S. Treasury Secretary Scott Bessent said progress was made in trade negotiations with China over TikTok, reportedly paving the way toward U.S. ownership of the video-sharing platform. Uranium stocks surged after the U.S. announced plans to expand its strategic uranium reserves and unveiled a landmark nuclear energy pact with the UK. The policy shift toward nuclear energy support pushed major uranium miners higher and sent the URA ETF to a record level, underscoring strong momentum in the sector as governments seek long-term alternatives to carbon-based energy.

ASX Overnight: SPI 8889 (+0.46%)

The Day Ahead:

The material sector should do the heavy lifting today with Iron ore, Copper and gold positive. The Uranium stocks should see significant strength.

CSL will invest up to $760 million in Dutch biotech VarmX,

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.