Overnight – Stocks lower as Banks beat analyst expectations, disappoint investors

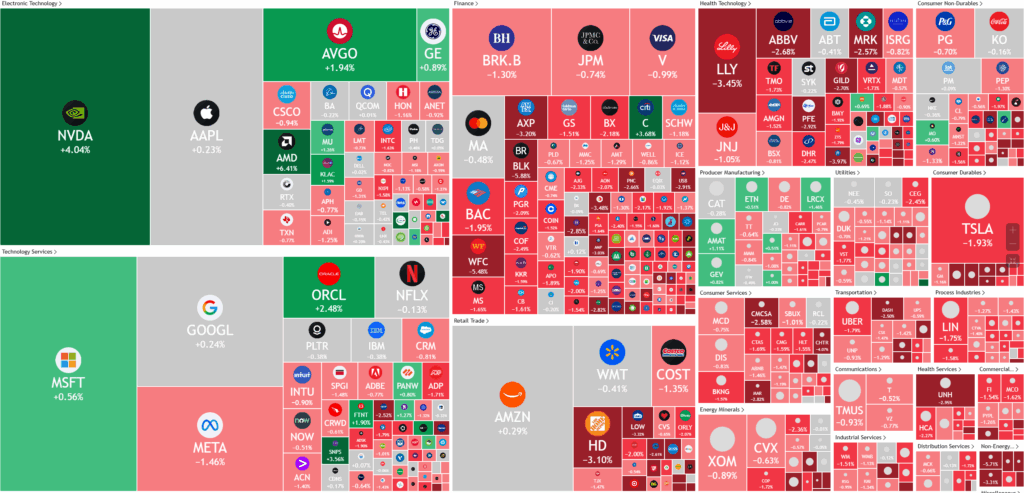

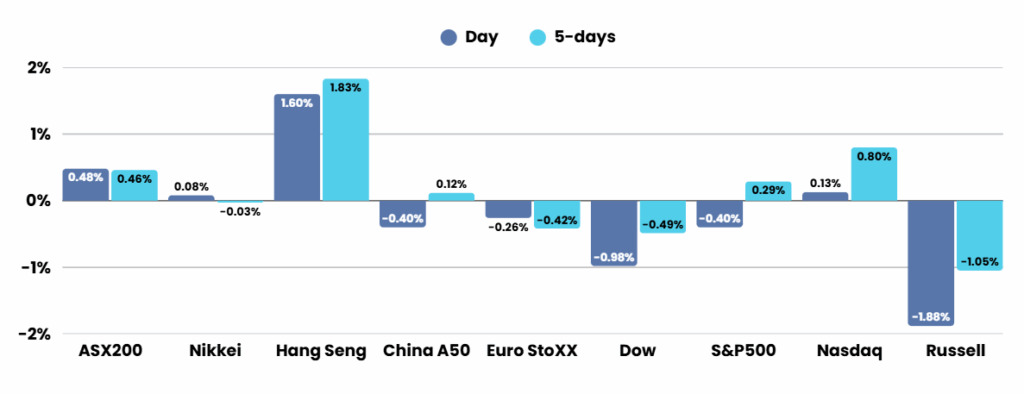

Stocks closed lower overnight, as a Nvidia-led surge in tech wasn’t enough to offset a slump in financials as the banks delivered mixed quarterly earnings.

The only bright spot on the night was Nvidia surging over 4% after announcing the resumption of H20 chip sales to China, a move enabled by loosening U.S. export restrictions, signalling a tentative improvement in U.S.-China tech relations.

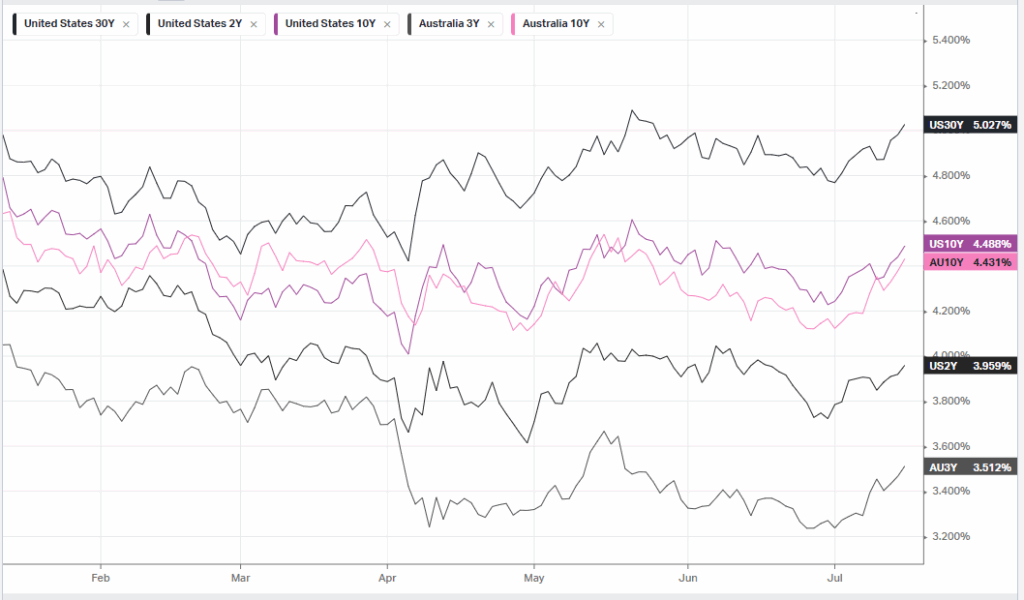

U.S. inflation data for June presented a mixed picture, with headline CPI rising by 2.7% year-over-year, slightly above expectations and up from May’s 2.4%. On a monthly basis, prices increased by 0.3%. However, the core CPI, which excludes food and energy, rose by a more modest 2.9%, below forecast, suggesting that underlying inflationary pressures might be easing slightly. Analysts noted that while businesses have so far absorbed some tariff-related costs due to stockpiled inventories, these reserves are dwindling, potentially paving the way for higher prices ahead. The Federal Reserve remains cautious, likely holding off on interest rate cuts amid signs of “sticky” inflation.

On the international trade front, former President Donald Trump announced a preliminary trade agreement with Indonesia, which includes a 19% tariff on Indonesian exports to the U.S. The deal is part of a broader effort to rebalance trade between the two nations and includes Indonesian commitments to purchase U.S. goods such as agricultural products, energy, and aircraft. Though this deal may ease tensions temporarily, it also reflects the growing complexity of U.S. trade policy as tariffs continue to serve as leverage in negotiations.

Despite generally beating estimates, the banks fells overnight as investors weren’t impressed by the results. Markets are also closely watching results from Bank of America, Goldman Sachs, Microsoft, and Netflix this week.

Corporate Earnings

- JPMorgan Chase-0.74% – reported strong trading revenue but still saw its profit drop compared to the prior year due to a one-time gain in 2024.

- Wells Fargo -5.48% – beat last quarters estimates, but lowered its forecast for annual interest income

- BlackRock -5.88% – despite beating on top and bottom lines, shares fell despite hitting a record $12.53 trillion in assets under management.

ASX SPI 8544 (-0.77%)

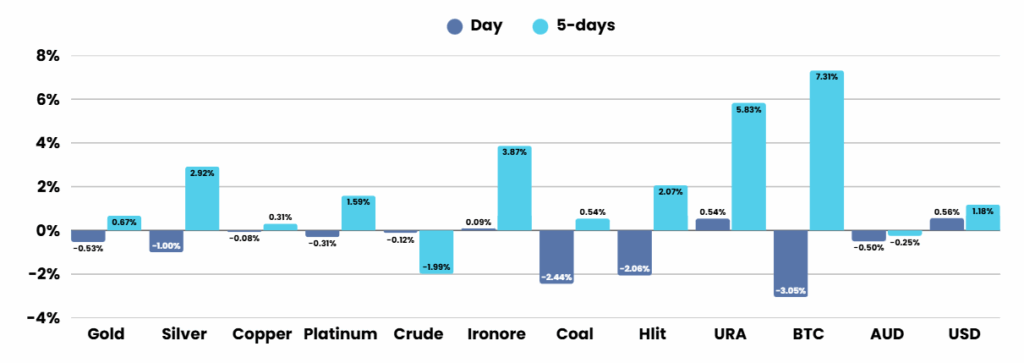

The ASX will look to head lower as the banking sectors and commodities both headed lower overnight, not a good lead for our biggest sectors. While last nights CPI data pushed back rate cut expectations globally, yet another dent in the case for the current bull market to be sustained.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.