Overnight – Stocks grind higher as Trump distracts media with Fed Chair issue

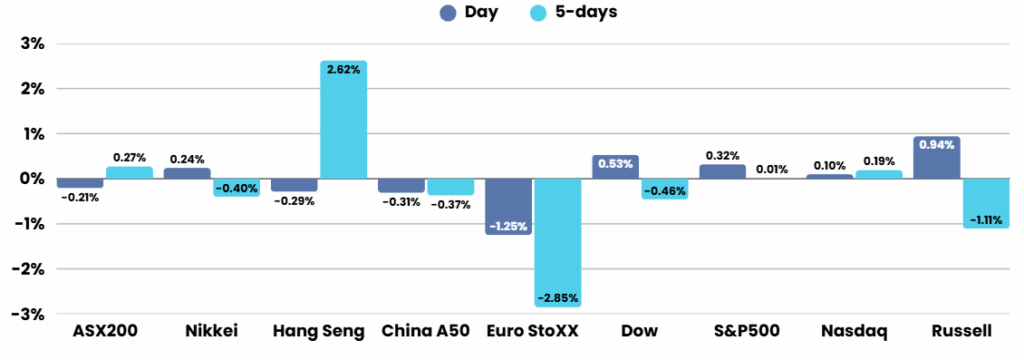

Equities moved higher overnight after President Donald Trump denied reports that he was close to firing Federal Reserve Chairman Jerome Powell.

For context, The President has no legal right to remove the Fed Chair, so in true Trump style, the noise is more about wishes than it is reality and a brilliant distraction from the lack of trade deals, the US debt and inflation from tariffs

President Donald Trump has publicly denied reports that he is close to firing Federal Reserve Chairman Jerome Powell, saying he is “not planning anything” related to such a move. However, Trump did not shy away from criticizing Powell, expressing frustration over the central bank’s decision to keep interest rates high and accusing him of mishandling an expensive renovation project at the Federal Reserve’s headquarters.

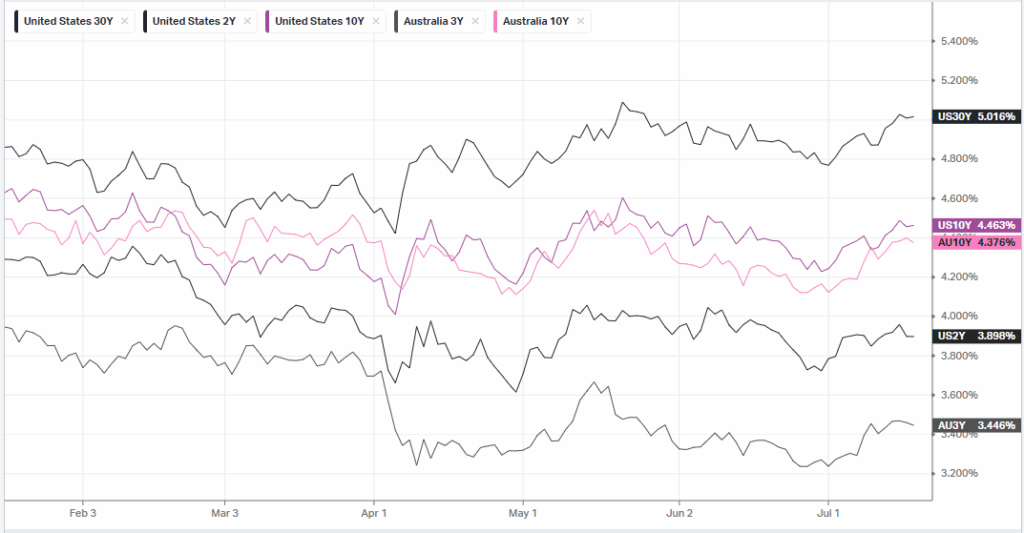

Economic data released this week shows that U.S. wholesale inflation, as measured by the producer price index (PPI), remained unchanged in June, with a 0.0% month-on-month reading—down from 0.3% previously. On an annual basis, PPI growth slowed to 2.3% after hitting 2.7% in May, undershooting economists’ expectations. In contrast, consumer price index (CPI) data for June indicated a faster monthly and annual increase, raising concerns that trade tariffs championed by the administration may be contributing to rising consumer costs.

Ongoing tariff uncertainty remains a central issue. Trump reiterated that planned 200% tariffs on pharmaceutical imports will come into effect by month-end, along with other proposed levies. The U.S. also introduced a 19% tariff on Indonesian goods, part of a new trade agreement, and has signaled additional deals are forthcoming as deadlines for implementing new “reciprocal” tariffs approach. These moves have heightened market anxiety, as previous announcements of tariffs led to significant volatility.

Corporate Earnings

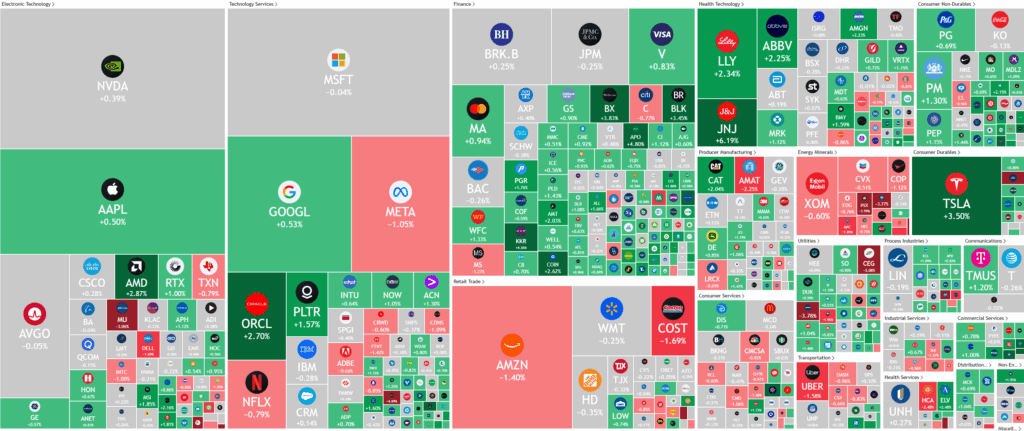

- Goldman Sachs (NYSE:GS) –stock rose after the investment bank’s profit jumped in the second quarter, as turbulent markets lifted equities trading revenue to a record and a pickup in dealmaking boosted investment banking.

- Johnson and Johnson (NYSE:JNJ) +6.19% – commentary focused most-specifically on top-line growth acceleration, with uncertainties about tariffs and other factors confounding operative leverage visibility. The company expects a $200 million tariff impact, down from $400 million previously. The company increased the adjusted operational revenue growth and multiple new product launches are driving their positive outlook confidence

- Bank of America (NYSE:BAC) – gained after the lender’s profit rose in the second quarter as its trading desks brought in more revenue from tumultuous markets in the second three-month period.

- Morgan Stanley (NYSE:MS) – stock fell despite the banking giant’s profit climbing as market volatility buoyed its trading desk.

Tesla Inc (NASDAQ:TSLA) – climbed 3% after the company announced that it would be rolling out a six-seater Model Y starting this fall.

ASX SPI 8588 (+0.62%)

We should see a steep reversal of yesterdays down move as Iron ore shot to 4-month highs and bank earnings in the US were broadly positive. June labour force report is due at 1130, which will heavily influence the RBA’s stance on interest rates. Economists expect employment growth of +20k and for the unemployment rate to remain at 4.1 per cent.

Quarterly reports are expected on Thursday from Santos, Yancoal Australia as well as Alcoa, Gold Road Resources and Genesis Minerals.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.