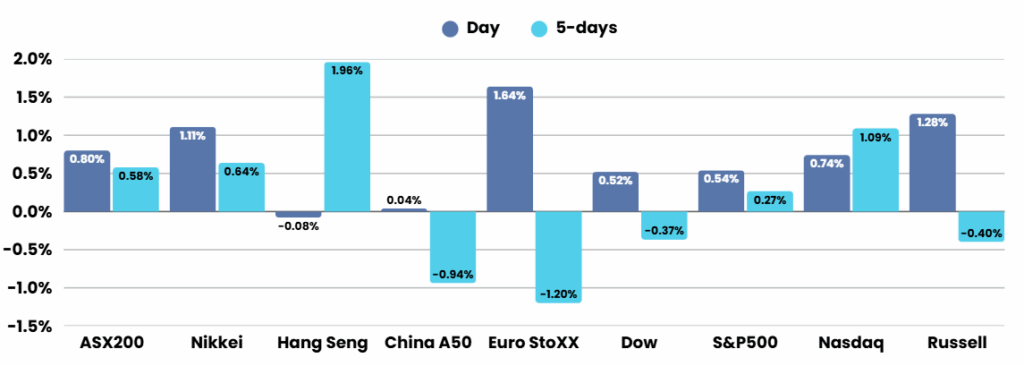

Overnight – Stocks notch new record high on resilient consumer and earnings

US Indices clinched a closing record high overnight, as surging retail sales underscored the strength in the economy just as corporate earnings continued to mostly surprise to the upside.

US retail sales demonstrated a strong rebound in June, increasing by 0.6% month-over-month and reversing the 0.9% decline seen in May. This outpaced economists’ forecasts of just a 0.1% increase and suggested strengthened consumer spending momentum as reported by the U.S. Commerce Department’s Census Bureau. Other indicators also pointed to improving economic conditions, with the Philadelphia Fed Manufacturing Index returning to positive territory and initial jobless claims dipping slightly to 221,000.

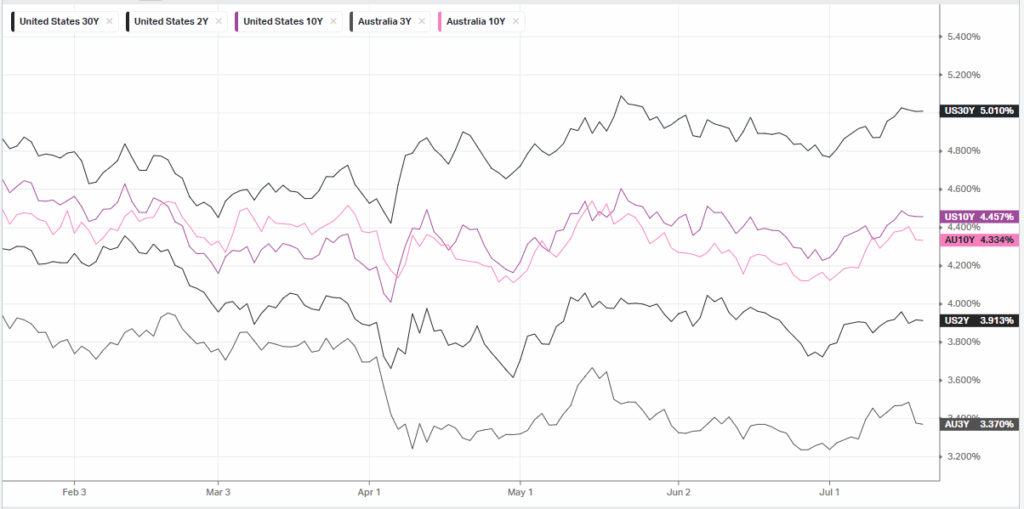

Despite the encouraging data, policymakers remain cautious. At the Federal Reserve’s June meeting, central bank officials projected two interest rate cuts before the end of the year, and financial markets anticipate that rate reductions could begin as soon as September. However, New York Federal Reserve President John Williams recently emphasized that it was still premature to lower rates, citing inflationary pressures driven by tariffs and persistent economic uncertainty.

Separately, political tensions influenced financial markets when reports circulated that President Trump might fire Federal Reserve Chair Jerome Powell, raising alarms about the Fed’s independence and causing volatility on Wall Street. Although Trump denied these plans, he expressed a preference for Powell to step down. In parallel, Trump signaled progress toward a trade deal with India following a recent agreement with Indonesia, while negotiations with the European Union continued despite the EU’s strong opposition to a 30% tariff and threats of retaliation. The president reiterated that he may not extend the August 1 deadline for these negotiations.

Corporate Earnings

- Netflix -1% (post earnings) – the streaming company lifted its annual revenue and operating margin guidance, reporting second-quarter results that topped Wall Street estimates, underpinned by subscription price hikes, membership growth, and a weaker dollar.

- PepsiCo +7.5% – delivered better-than-expected second-quarter results, on top and bottom lines. The company credited resilient global demand for sodas and snacks, particularly in major markets like the U.S. and Europe, as well as continued growth in its international business, which now comprises about 40% of revenue. PepsiCo improved its outlook, despite ongoing headwinds from tariffs and cautious consumer spending.

- GE Aerospace -2.2% – stock initially rose after the aerospace giant posted second-quarter results that exceeded expectations and raised its full-year guidance, driven by robust commercial services performance and improved operational efficiency.

- Taiwan Semiconductor Manufacturing +3.4% – reported record profit in the second quarter, smashing market expectations, as the world’s biggest foundry chipmaker was bolstered by ever-more robust artificial intelligence demand.

ASX SPI 8650 (+0.37%)

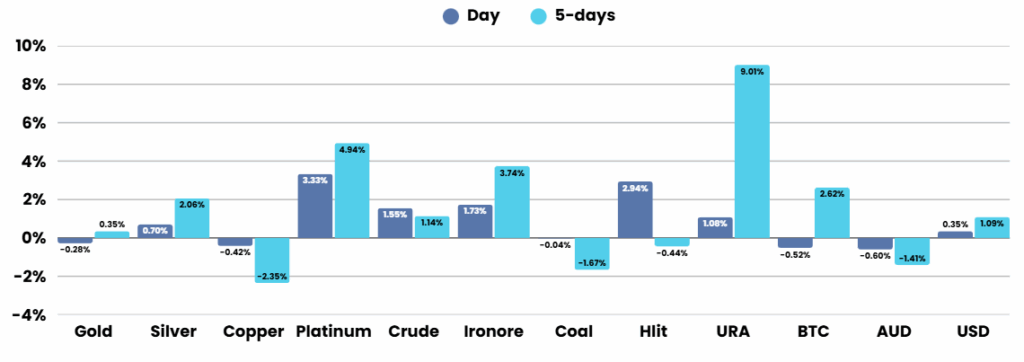

The ASX should almost certainly set a new record today as the buoyancy of US indices and banking sector, coupled with the sustained rally in Iron ore prices, the perfect combination for our index.

BHPs Quarterly is expected before market open, with shares in the mining giant significantly underperforming the underlying commodities it sells over the last month, only up +4.25%, while Iron Ore, Copper, Coal and Uranium are all up 10%-12%

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.