Overnight – Stocks end mixed as investors focus on earnings week ahead

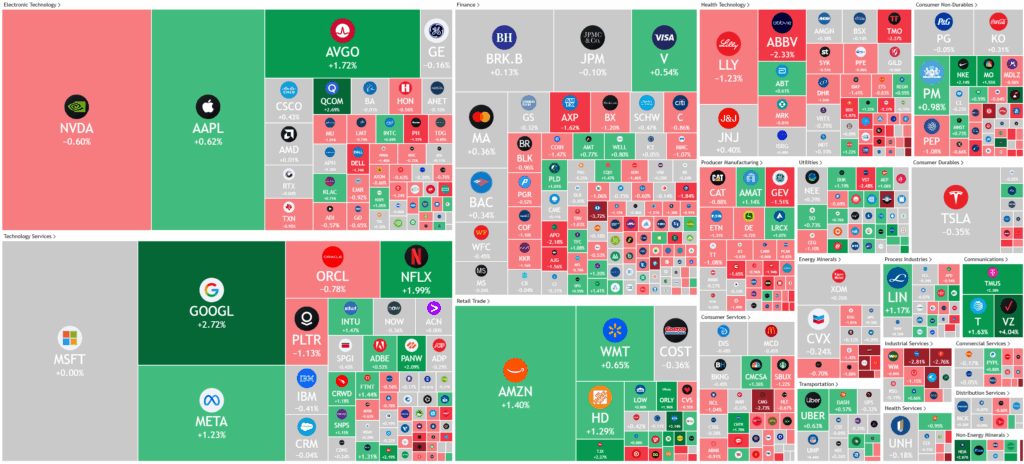

Stocks were mixed overnight as investors were happy to bide their time until earnings from 2 of the MAG7 this week in Google and Tesla

Notable market movers included Verizon, Nike, and Amazon on the upside, and American Express, Travelers, and Caterpillar on the downside. In the cryptocurrency market, bitcoin and ethereum gave back recent gains, swayed by sector regulation news and legislative developments

Communication services and technology momentum stocks drove much of the recent gains in the market as the second-quarter earnings season moved into full swing. Major tech names, particularly Alphabet and Tesla—part of the so-called “Magnificent Seven”—were in the spotlight, with both set to report results alongside other heavyweights like IBM and Intel. Investors closely watched these earnings, especially as sentiment remained buoyed by optimism around trade and early signs of solid performance from reporting companies. The broader environment was described by portfolio managers as having a “don’t-fight-the-trend” feel, with upside leadership coming from tech-adjacent stocks despite ongoing macro uncertainties.

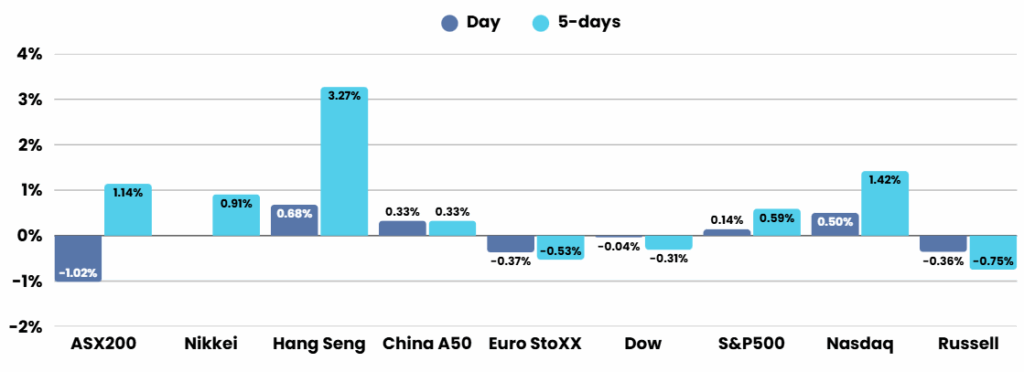

Meanwhile, global trade negotiations remained unresolved, especially with the U.S. administration’s looming August 1 tariff deadline. President Trump’s moves to impose extensive tariffs—30% on imports from the European Union and Mexico, among others—sparked warnings of potential retaliation and market turbulence. Although U.S. investors seemed increasingly numb to the constant trade headlines, the volatility was more apparent overseas. These unresolved trade tensions added to the complex backdrop, leaving investors eyeing both corporate earnings and global policy developments for direction.

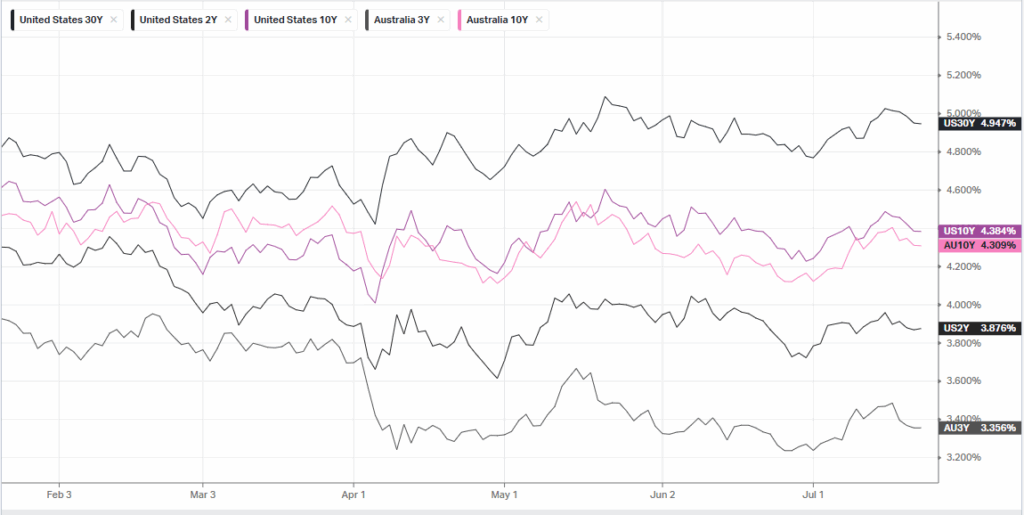

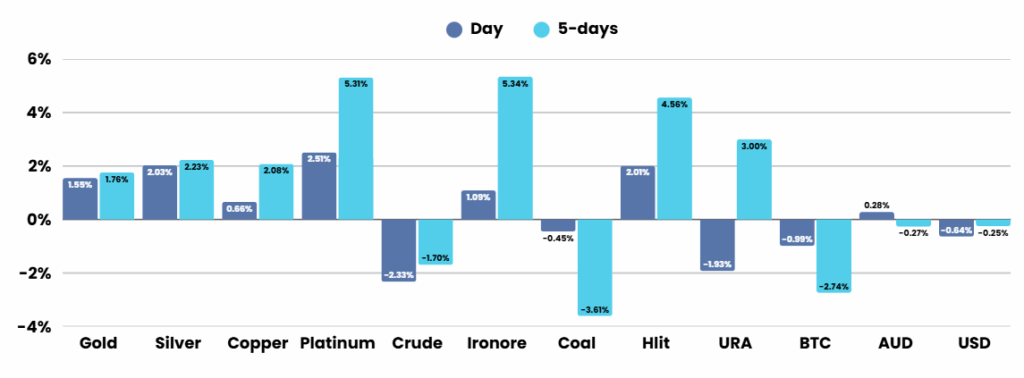

On the commodities and bond front, gold and Silver prices soared to a recent highs, reflective of a softening U.S. dollar and easing Treasury yields. Notably, the dollar weakened against the euro and yen, influenced by political shifts in Japan and global currency trends.

Corporate Earnings

- Verizon +4.04% – S. wireless carrier raised the lower end of its annual profit forecast, riding on strong demand for its premium plans and benefits from the Trump administration’s new tax law. Shares of the company rose 3.5% on Monday as it also surpassed Wall Street estimates for June-quarter sales and profit, thanks to a 2.2% rise in wireless service revenue.

Roper Technologies +2.26% – delivered robust second-quarter 2025 results, surpassing market expectations with earnings per share of $4.87 and revenue of $1.94 billion, both modestly exceeding forecasts. The company achieved a 13% year-over-year revenue increase, attributed to strong software bookings, AI-driven innovations, and successful integration of acquisitions such as Subsplash and Central Reach

ASX SPI 8660 (+0.13%)

The continued rise of Iron ore, along with gold, silver and copper, should again see the materials sector supported, helping the local index higher.

1130 will see the release of the RBA minutes, a key insight into the outlook on interest rates.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.