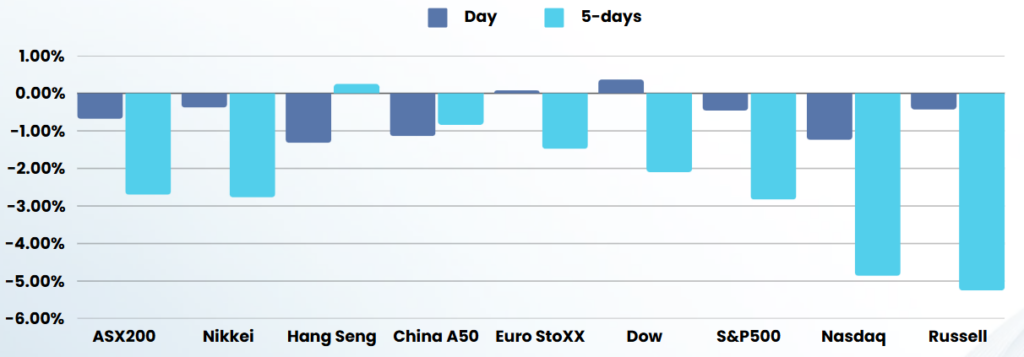

Overnight – Trump Trade becomes Trump Trap as stocks hit 6-week lows

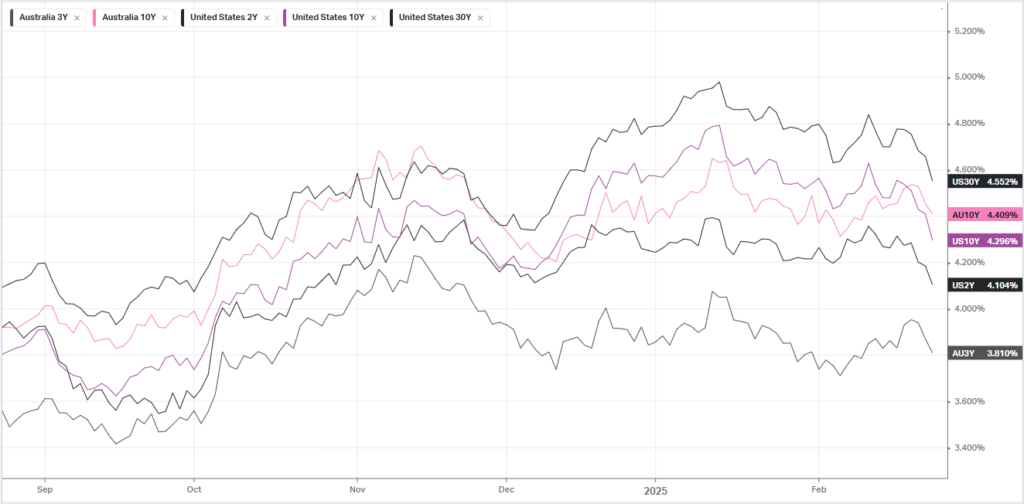

Stocks and Treasury yields tumbled on signs of softening U.S. growth and uncertainty over Trump administration policies.

U.S. consumer confidence deteriorated for a third straight month in February, in the latest sign that American households are fretting over the effect tariffs and inflation could have on the path ahead for the wider economy. Recent data points have suggested that shoppers are worried about lingering inflationary pressures weighing on their purchasing power. Concerns have also surrounded whether it may be too late for consumers to avoid the impact of sweeping tariff plans being pursued by U.S. President Donald Trump.

References to inflation and prices in general continue to rank high in write-in responses, but the focus shifted towards other topics. There was a sharp increase in the mentions of trade and tariffs, back to a level unseen since 2019. Most notably, comments on the current Administration and its policies dominated the responses.

Trump’s planned duties on U.S. imports risk pushing up domestic inflation, while his mass firings of government employees could impact the labor market, just when the Federal Reserve needs room to cut interest rates.

Tension between the U.S. and Europe has also risen over Ukraine and how to broker a ceasefire agreement with Russia, three years after Moscow’s full-blown invasion of its neighbour.

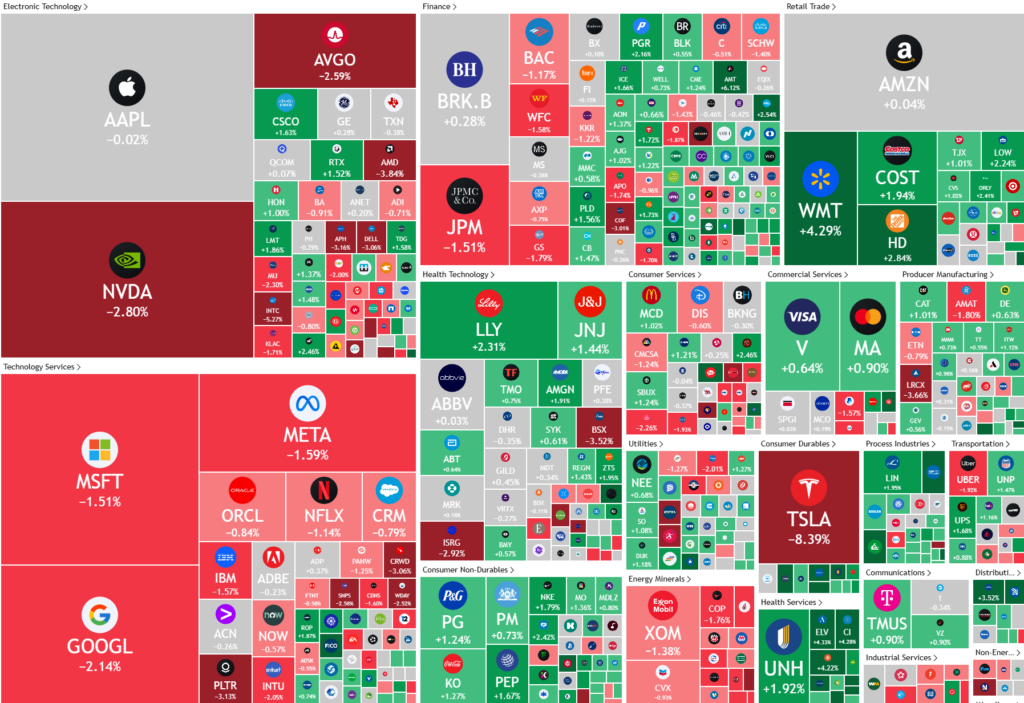

Talk of copper tariffs and a large power outage struck vast swaths of Chile on Tuesday, interrupting mining operations in the world’s biggest copper producer and leaving residents of Santiago without electricity Apple however, sidestepped the selloff to end slightly higher after announcing plans to invest $500 billion in the U.S. over the next four years to boost AI, silicon engineering, and advanced manufacturing.

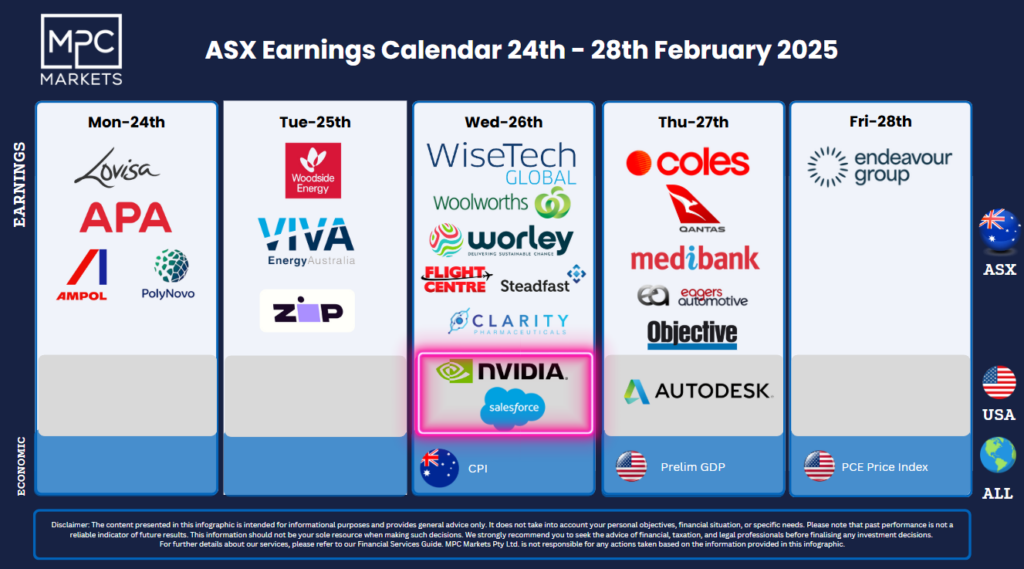

Corporate Earnings

- Tesla – meanwhile, fell more than 8%, taking its market cap below $1 trillion as the EV maker saw a 45% drop in sales in Europe, according to data from the European Automobile Manufacturers’ Association.

- Hims & Hers – warned that it may stop selling legal copies of a popular weight-loss drug made by Denmark’s Novo Nordisk, sending shares in the U.S. telehealth firm down by 22.5%.

- Zoom Communications – stock price also fell more than 8% the video conferencing group unveiled first-quarter and full-year revenue guidance that missed analysts’ estimates.

ASX SPI 8196 (-0.03%)

The focus will remain on earnings again today as the softness in the US market is focused in the MAG7 and largely unrelated to the ASX200

Company Specific

- Meridian Energy posted a net loss of $121 million in the first half as a significant fall in inflows hit the cost of hedge contracts.

- Steadfast Group’s net profit rose 19 per cent in the first half, owing to new acquisitions and growth in gross written premiums.

- Platinumsaid it was on target to cut $25 million of costs from the business but has struggled to stem outflows. The firm’s assets under management has fallen from $16.2 billion in December 2023 to $11 billion last month.

- Kelsian’s interim net profit declined 7.9 per cent to $39.7 million in the first half, as the transport network’s capital investment program peaked.

- Lynas Rare Earths’ net profit collapsed 85 per cent to $5.9 million in the first half of fiscal 2025, from a year ago, despite higher output.

- Tyro Payments doubled its net statutory profit to $10.3 million in the first half of fiscal 2025 driven by higher transaction volumes and cost control, and reaffirmed earnings guidance.