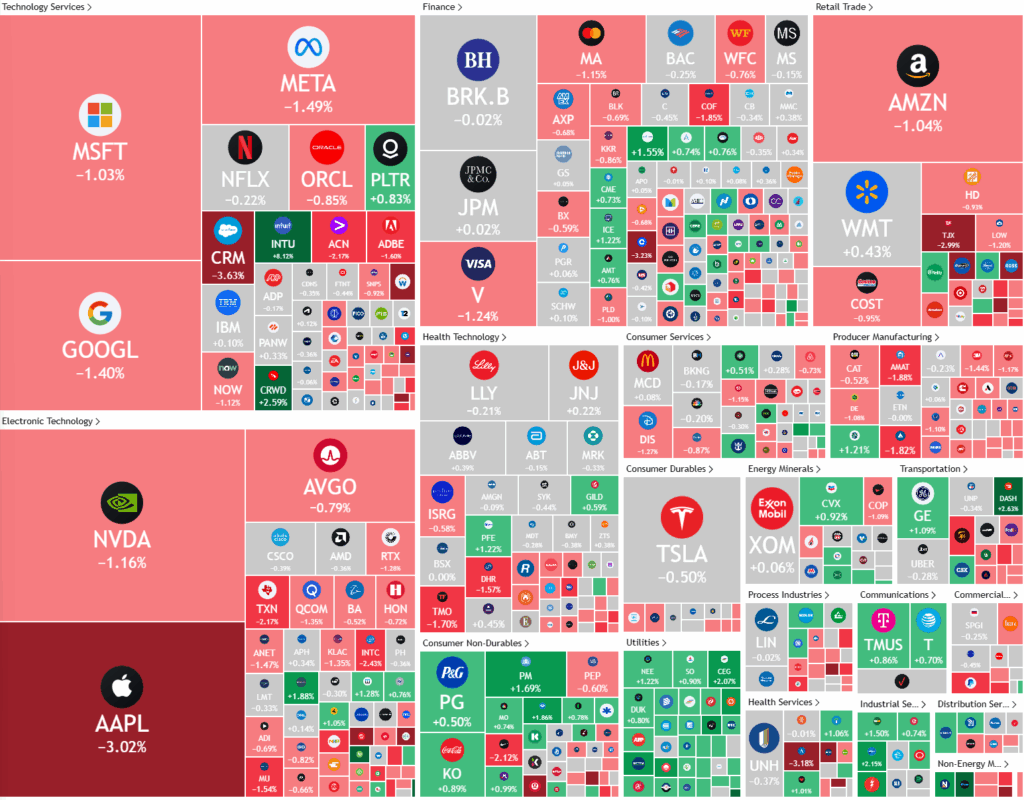

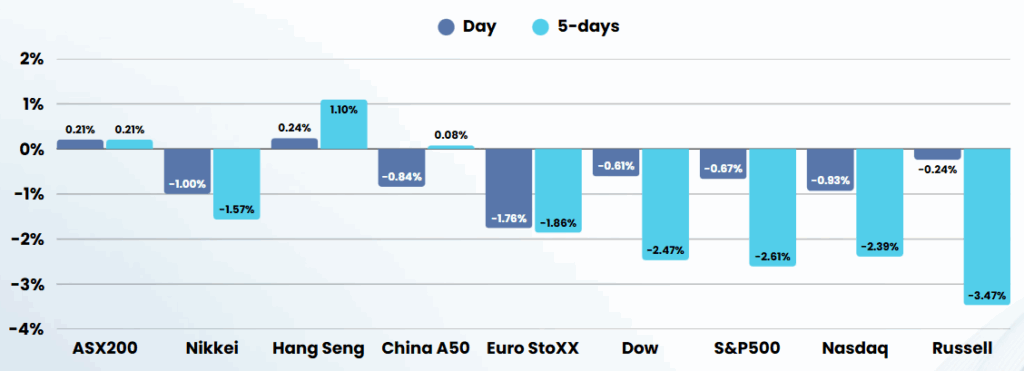

Overnight – Stocks ends week lower as fresh trade war fears bite

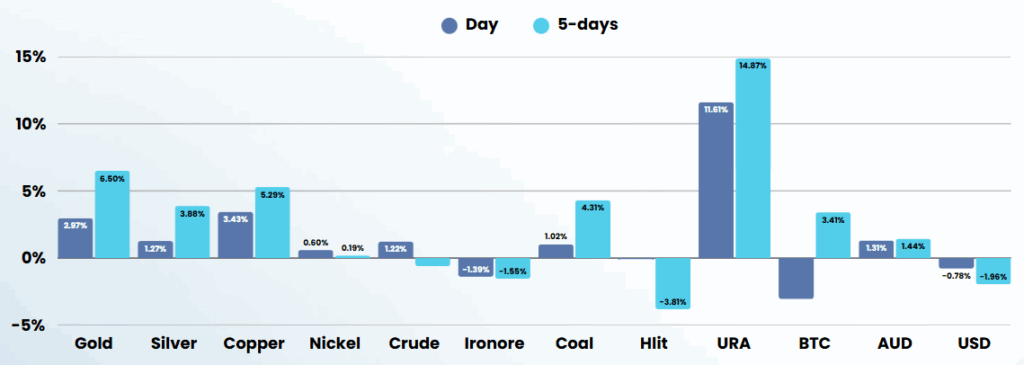

Stocks ended the week lower as President Trump reignites threats of tariffs against the EU and Apple, while the uranium sector bounced on an executive order on Nuclear power

Shares of nuclear power companies surged after President Donald Trump signed executive orders aimed at revitalizing the U.S. nuclear industry by cutting regulations and fast-tracking new reactor licenses. These actions come as U.S. electricity demand is projected to hit record highs in 2025 and 2026, largely driven by energy-intensive data centers for artificial intelligence and crypto mining. The orders also seek to boost domestic uranium production and preserve tax credits for nuclear energy, fueling significant gains in uranium and nuclear technology stocks, as investors and analysts increasingly view nuclear power as a crucial, reliable, and cleaner energy source for meeting future demand

President Donald Trump has sharply escalated trade tensions with the European Union by announcing a proposed 50% tariff on all EU goods entering the United States, effective June 1. Trump justified the move by accusing the EU of being difficult in trade negotiations and maintaining unfair trade barriers, VAT taxes, and penalties against American companies, which he claims have resulted in a significant trade deficit for the U.S. The EU, which had previously offered a zero-tariff agreement for industrial goods, has responded by emphasizing the need for mutual respect in trade relations and warning of possible countermeasures if the tariffs are imposed.

In addition to targeting the EU, Trump also singled out Apple, declaring that iPhones sold in the U.S. must be manufactured domestically or face a minimum 25% tariff. This announcement caused Apple’s stock to drop sharply, with analysts warning that shifting iPhone production to the U.S. would dramatically raise prices for consumers. These aggressive tariff threats come as part of a broader pattern of economic nationalism, with the administration previously imposing and adjusting tariffs on EU cars, steel, and aluminum, while also seeking to pressure allies and rivals alike through trade policy.

Meanwhile, the U.S. House of Representatives narrowly passed a sweeping tax and spending bill aligned with Trump’s policy agenda, including tax breaks and increased military spending. However, the Congressional Budget Office estimates the legislation will add about $3.8 trillion to the national debt over the next decade, exacerbating concerns about the country’s fiscal health amid a recent credit rating downgrade by Moody’s. Financial markets have reacted with higher Treasury yields and volatility, while Federal Reserve Governor Christopher Waller suggested that interest rate cuts could be possible later in the year—provided tariff levels are moderated and economic uncertainty eases. A Supreme Court ruling also clarified that while Trump can fire many regulatory agency heads, he cannot remove Federal Reserve Chair Jerome Powell, preserving some stability at the central bank during this turbulent period

ASX SPI 8330 (-0.35%)

It will be a soft day for the AU market with the bright spot being uranium stocks

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.