Overnight – Stocks give up gains as Trump talks tough to world leaders

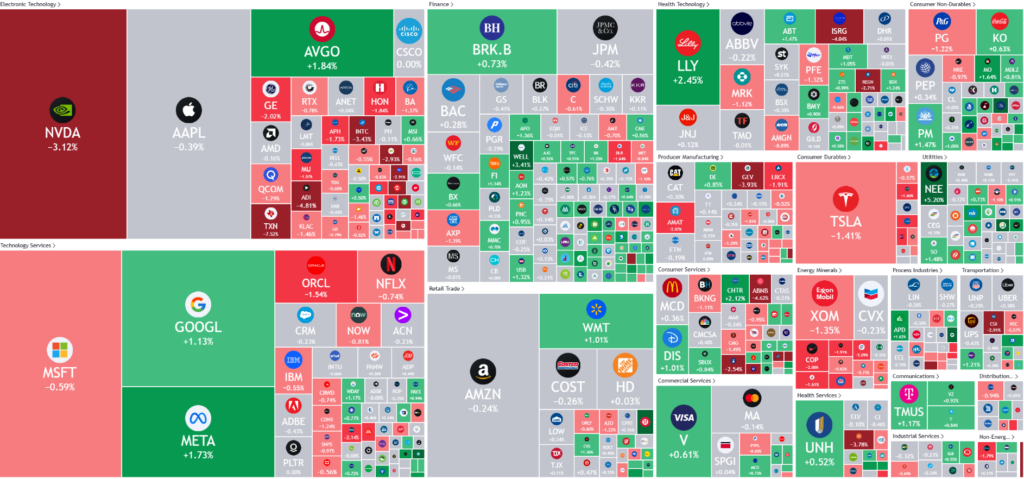

Stocks hit another fresh record high before giving up some gains Friday as investors digested more corporate earnings and economic data.

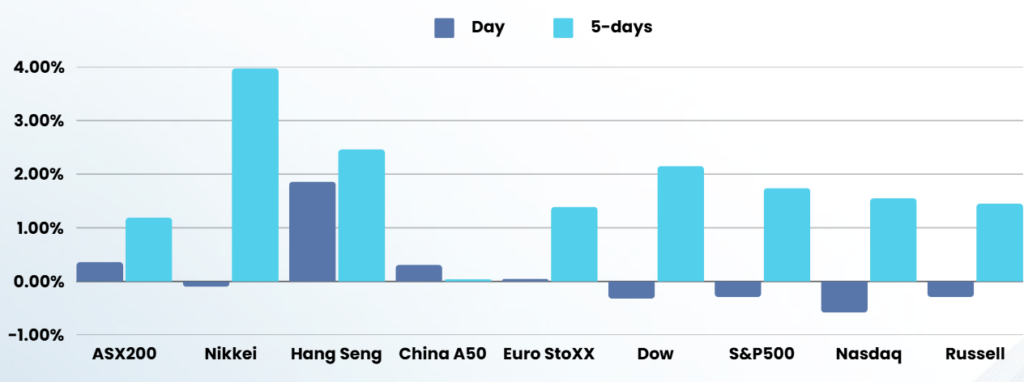

All three major averages are on track to post their second positive week, with the S&P 500 posting a record high, after President Donald Trump said he would “demand that interest rates drop immediately” as he addressed world leaders in Davos, Switzerland.

Earlier Friday, the Bank of Japan raised interest rates by 25 basis points, marking the third hike by the central bank since it began scaling back its ultra-loose monetary policy in early-2024.

The Michigan Consumer Sentiment Index, fell to 71.1 in January, down from 74.0 a month earlier, marking the decline in six months. The data comes ahead of next week’s Federal Reserve policy-setting meeting, and the future path of interest rates.

The US central bank is widely expected to hold interest rates unchanged on Wednesday, with Fed officials expected to largely disregard any inflationary effects stemming from tariffs under Donald Trump’s administration, as such impacts are viewed as one-time price level increases rather than persistent inflationary pressures, Goldman Sachs analysts said in a research note.

Meta hit a record high on Friday after unveiling spending plans to invest about $60 billion to $65 billion in capital expenditure this year as it builds out its AI infrastructure.

Corporate Earnings

- Intuitive Surgical – despite beating analysts estimates by 23% the stock fell 4%, a sign that the stock is over heated. JP Morgan and RBC maintained their “outperform” rating post the results

- Verizon Communications – stock rose more than 1% after the telecom major reported its best quarterly wireless subscriber growth in five years.

- American Express – stock fell 2.4% despite the financial giant reporting a 12% jump in fourth-quarter profit, as more consumers swiped cards during the holiday season for travel and online shopping.

- Boeing – stock fell 1.2% after the aircraft manufacturer said it will post a bigger-than-anticipated loss of around $4 billion in its most recent quarter, as it grappled with a prolonged strike, charges related to US government projects and expenses linked to a slew of job cuts.

- Texas Instruments – stock dropped 7% after the analog chipmaker forecast first-quarter profit below estimates, as it grapples with an inventory buildup in its key automotive and industrial markets.

- Twilio – stock soared 21% after the cloud communications software maker announced that it expects adjusted earnings to come in at the top range of guidance for the fourth quarter and unveiled positive guidance for the next couple of years through 2027.

ASX SPI 8403 (+0.01%)

With the newly inaugurated President stealing all of the headlines, with a steady supply of soundbites, investors are increasingly being distracted by the noise. Its likely that we will have little reason to move until earnings season rolls around in a couple of weeks

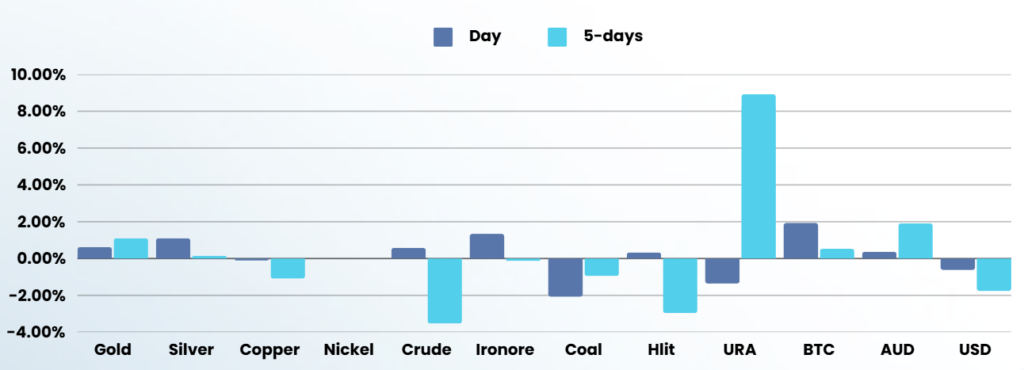

The drop in the USD will be good for commodities stocks, but otherwise it looks like it will be quiet until the “shiny new” President loses lustre