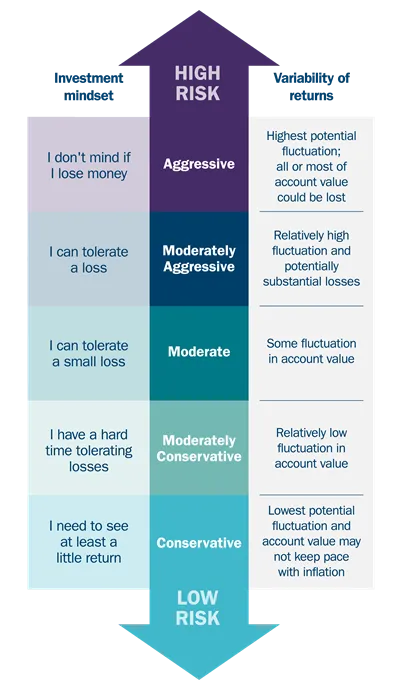

As a new investor, one of the most important concepts to grasp is the investment risk scale. This tool helps you understand the potential risks and rewards associated with different types of investments, allowing you to make informed decisions that align with your financial goals and risk tolerance.

What is the Investment Risk Scale?

The investment risk scale is a way to categorize different asset classes based on their relative riskiness.

It typically ranges from low-risk, stable investments at the bottom to high-risk, volatile investments at the top. Understanding this scale is crucial for building a well-balanced portfolio that matches your risk tolerance and investment objectives.

The Investment Risk Ladder

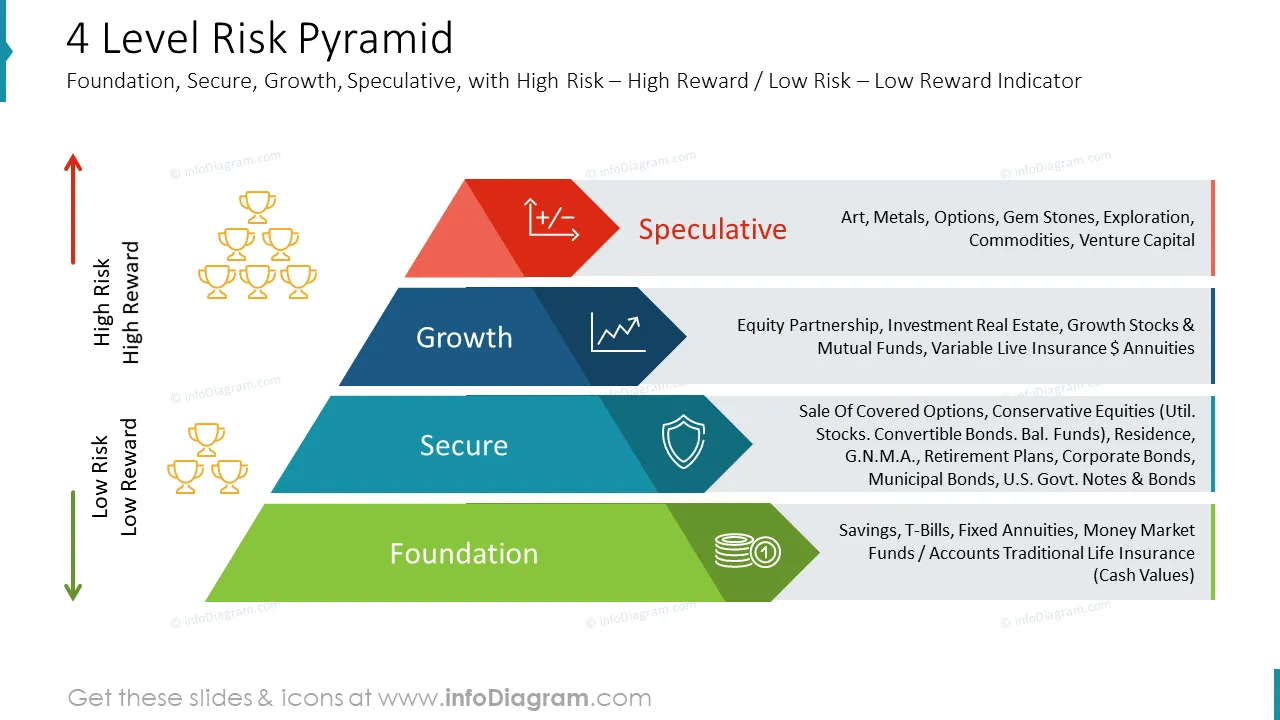

Let’s break down the major asset classes on the investment risk ladder, starting from the least risky to the most volatile:

Cash and Cash Equivalents

At the bottom of the risk ladder, we find cash and cash equivalents, such as savings accounts and certificates of deposit (CDs). These are considered the safest investments, offering guaranteed returns and capital preservation. However, the trade-off is that they typically provide the lowest yields, often failing to keep pace with inflation.

Bonds

Moving up the ladder, we encounter bonds. These are debt instruments issued by governments or corporations. Bonds generally offer higher returns than cash but come with slightly more risk. The risk level can vary depending on the issuer’s creditworthiness, with government bonds typically considered safer than corporate bonds.

Mutual Funds and Exchange-Traded Funds (ETFs)

Mutual funds and ETFs occupy the middle ground on the risk scale. These investment vehicles pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. They offer a balance between risk and reward, with the level of risk depending on the underlying assets.

Stocks

Individual stocks represent ownership in companies and are generally considered riskier than bonds or funds. While they offer the potential for higher returns, they also come with greater volatility and the risk of significant losses.

Speculative Investments

At the top of the risk ladder, we find alternative investments such as derivatives, options, commodities, hedge funds, venture capital, and private equity. These investments often offer the highest potential returns but also come with the highest risk and may be less liquid than traditional investments.

Factors Affecting Risk Tolerance

When determining your position on the investment risk scale, consider the following factors:

- Time Horizon: Generally, the longer your investment timeframe, the more risk you can afford to take.

- Financial Goals: Your specific objectives, whether it’s saving for retirement or a short-term purchase, will influence your risk tolerance.

- Personal Comfort: Your emotional capacity to handle market fluctuations is a crucial factor in determining your risk tolerance.

Building a Balanced Portfolio

For beginner investors, a common strategy is to start with a mix of low to moderate-risk investments and gradually expand as you gain more knowledge and experience.

Many financial advisors recommend a diversified portfolio that includes a mix of different asset classes to balance risk and potential returns.

The Importance of Diversification

Diversification is a key principle in managing investment risk. By spreading your investments across various asset classes, you can potentially reduce the overall risk in your portfolio. This strategy can help protect against significant losses if one particular investment or sector underperforms.

Conclusion

Understanding the investment risk scale is a crucial step for beginner investors. It provides a framework for assessing different investment options and helps you build a portfolio that aligns with your risk tolerance and financial goals. Remember, there’s no one-size-fits-all approach to investing. As you gain more experience and your circumstances change, you may find yourself adjusting your position on the risk scale. The key is to stay informed, regularly review your portfolio, and make adjustments as needed to ensure your investments continue to serve your financial objectives.