Overnight – Stocks higher as Trump does a deal on Automaker tariffs…. with himself

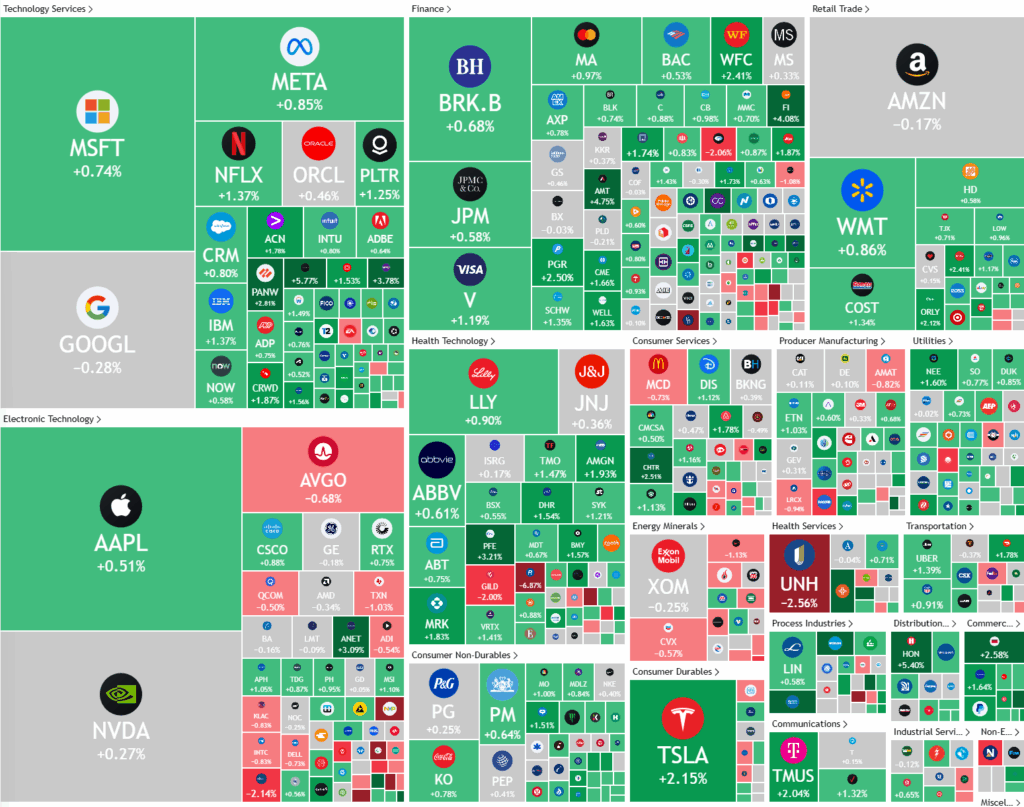

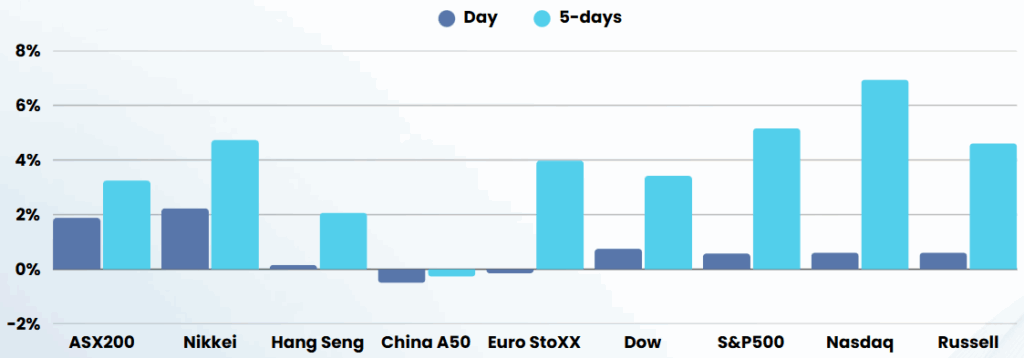

Stocks closed sharply higher for the sixth-straight day, after Trump effectively did a deal with himself to show flexibility on tariffs, underpinned by falling Treasury yields due to falling consumer sentiment ahead of earnings from Microsoft and Meta

U.S. President Donald Trump, signed an order on after the bell, easing some of his own tariffs on cars and car parts, said the reprieve will offer automakers short term help. “We just wanted to help [automakers] enjoy this little transition, short-term. If they can’t get parts, you know, it has to do with a very small percentage. If they can’t get parts, we didn’t want to penalize them,” Trump said.

In another positive note on the trade front, Commerce Secretary Howard Lutnick told CNBC that the U.S. was close to announcing a major trade deal. The move comes a day after Secretary Bessent in an interview with CNBC on Monday, said many countries have offered “very good” tariff proposals to the U.S. However, this positive tone was undermined by the White House slamming Amazon for reportedly planning to display the cost of President Donald Trump’s tariffs next to the total price of products on its site. “This is hostile and political act by Amazon,” White House press secretary Karoline Leavitt said at a press briefing earlier Tuesday.

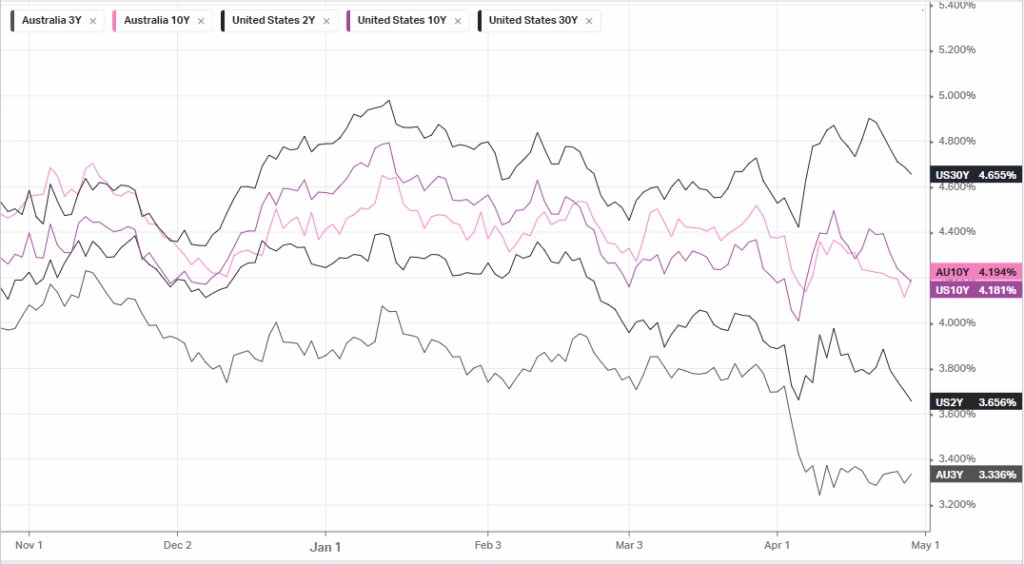

Also helping stocks were falling Treasury yields, after the Conference Board announced consumer confidence fell 7.9 points to 86.0 in April. This was the lowest reading since May 2020 and below the 87.7 expected by economists. The details of the report, showed current conditions slipping 0.9 points to 133.5, a seven-month low, and a gauge of future expectations plunged 12.5 points to 54.4, the lowest reading since 2011

Investors are also bracing for a series of other U.S. economic data releases later this week, including the Federal Reserve’s preferred inflation gauge – the PCE price index, and the monthly U.S. jobs report.

Markets also awaited earnings from the “magnificent seven” megacaps, Microsoft and Meta are set to report on in 24 hours’ time, while Apple and Amazon are scheduled to report their earnings on Thursday (Friday morning AEST)

Company Earnings

- General Motors – stock fell 0.7% despite the auto giant reporting first-quarter earnings and revenue that topped analyst expectations, as it suspended its guidance and froze share buyback program in response to new Trump tariffs.

- Coca-Cola – stock gained 0.8% after the soft drinks giant reported a drop in first-quarter revenue, even after price hikes.

- Spotify – stock fell more than 3% after the streaming music service unveiled a current-quarter guidance for monthly active users that was below expectations.

- United Parcel Service – stock slipped 0.5% lower even after the delivery giant reported better-than-expected first-quarter 2025 results, with adjusted earnings and revenue surpassing analyst estimates.

ASX SPI 8112 (+0.34%)

The local market will be buoyed by the offshore lead, however all eyes will be on domestic CPI numbers today at 1130, with QoQ CPI expected at 0.8% and YoY 2.3% respectively. RBA’s trimmed mean is expected at 0.6% QoQ

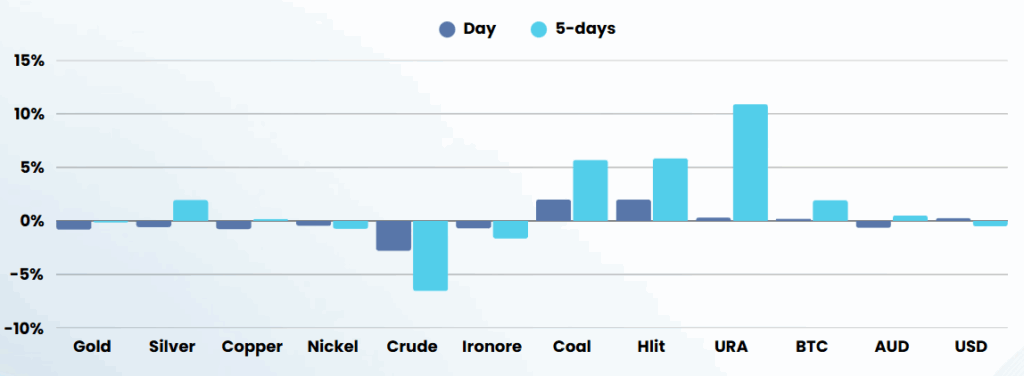

Other economic numbers in focus will be the Chinese manufacturing data, expected to be in slightly contractionary territory at 49.7.