Overnight – Stocks drift lower on weaker jobs data

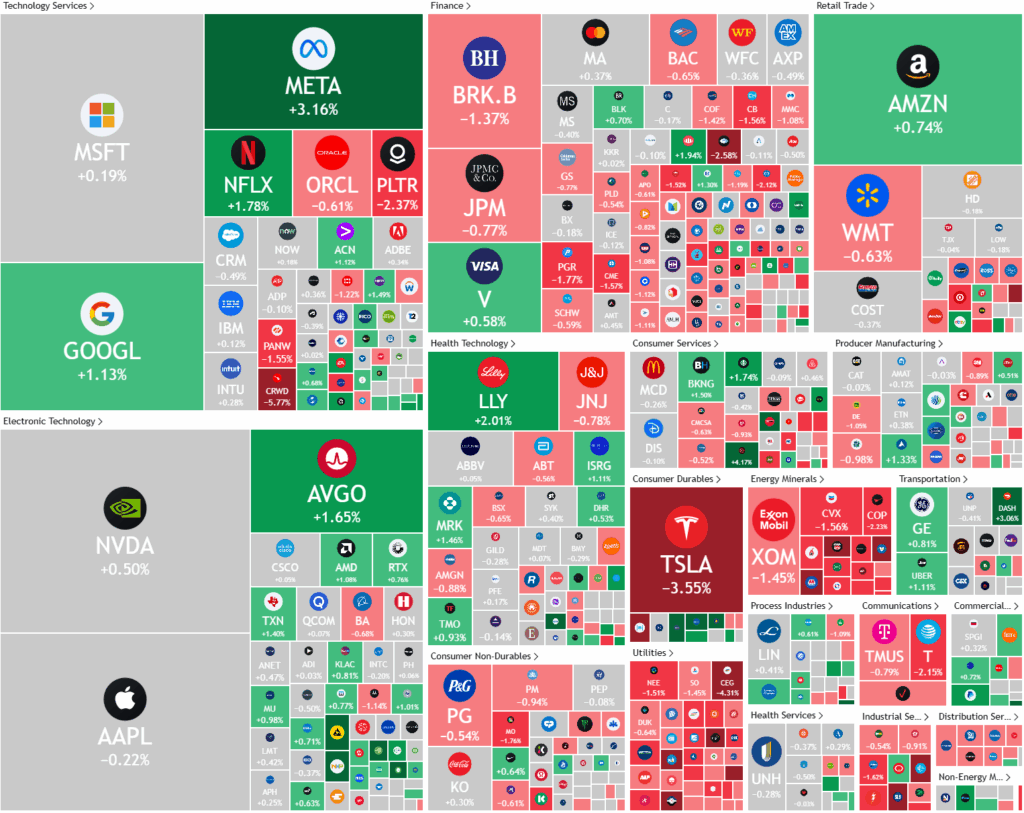

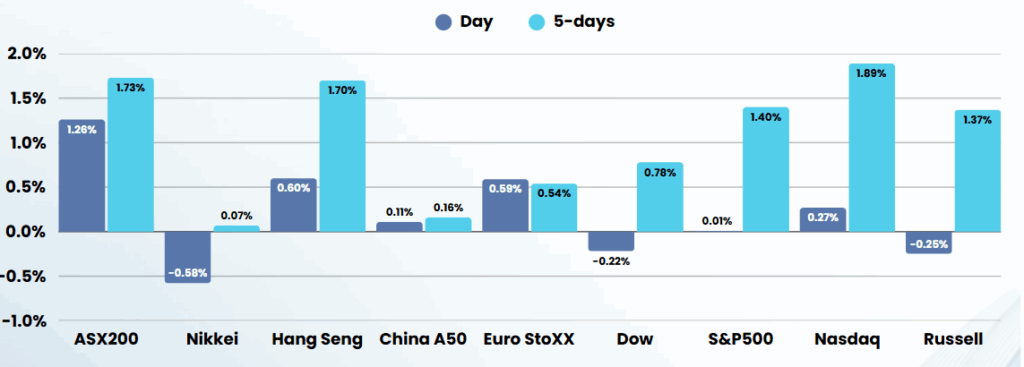

Stocks drifted lower overnight as weaker labor data stoked concerns about the economy just as US/China trade relations continued to sour ahead of talks expected this week between President Donald Trump and Chinese President Xi Jinping.

U.S. private sector hiring slowed dramatically in May, with employers adding just 37,000 jobs—the weakest monthly gain in over two years and far below economists’ expectations of 110,000. This sharp slowdown, highlighted in the latest ADP National Employment Report, signals a labor market losing momentum amid ongoing economic uncertainty and the impact of tariffs. The disappointing data prompted former President Donald Trump to publicly pressure Federal Reserve Chairman Jerome Powell to cut interest rates, arguing that monetary easing is now overdue as signs of economic softness mount.

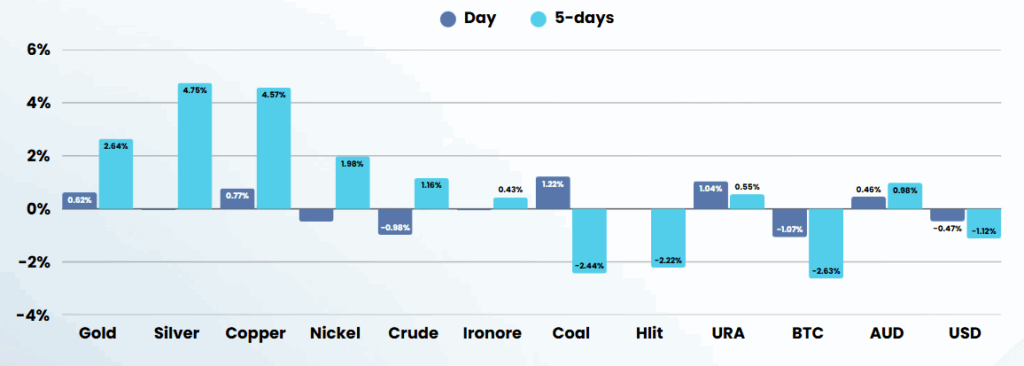

Trade tensions remain elevated, with Trump doubling tariffs on steel and aluminum imports from 25% to 50% in a bid to protect U.S. industries, while sparing the United Kingdom due to ongoing negotiations. As the deadline for U.S. trading partners to submit their “best offer” to avoid further tariffs approached, only Britain had reached a preliminary agreement. Meanwhile, Trump is seeking a direct call with Chinese President Xi Jinping to break the deadlock in trade talks, though skepticism remains about whether such leader-to-leader engagement will yield a breakthrough. Both sides have exchanged accusations of violating previous agreements, and the U.S. is pressing for faster action on critical minerals and other trade issues.

In the corporate sector, earnings results were mixed. CrowdStrike shares fell after the cybersecurity firm issued cautious revenue guidance despite beating earnings estimates, while Dollar Tree stock dropped as the retailer declined to raise its full-year outlook, even though it reported better-than-expected sales. In contrast, Hewlett Packard Enterprise posted strong quarterly results, driven by demand for AI servers and hybrid cloud solutions. Asana reported its first quarter of non-GAAP profitability, but its stock slipped on guidance concerns. Tesla shares also declined as U.S. and European sales continued to weaken, with China-made vehicle sales dropping 15% year-over-year in May, underscoring ongoing challenges for the EV maker in a competitive global market

ASX SPI 8564 (-0.00%)

Australian shares are set to open slightly lower, tracking a tepid session on Wall Street where early gains faded after weak US economic data. Traders reinforced expectations for Fed rate cuts amid ongoing uncertainty and new tariffs. Locally, attention turns to new ABS spending data and the April trade balance, but overall the outlook is for a subdued start to the day.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.